- Apr 10, 2025

Brief Overview of the Newly Implemented Reciprocal Tariff Strategies of Trump in 2025

In contrast to the growing global trade competition in the international market, President Donald Trump has come up with a set of tariffs over the traded goods on 2nd April 2025: to take a revolutionary movement in the trade sector of the United States. Donald Trump has introduced tariff rates above 26% discounted tariffs over the goods supplied from India due to India's tariff implementation over the U.S. exported goods in its domestic trade sector. The tariff rates introduced by the President over the imported goods from different central regions across the globe are expected to record fluctuations in the recent trade rates based on different factors like increasing competition, supply chains, and the increasing demand for domestic acquisitions.

The set of tariff rates implemented by former President Donald Trump is mainly for a sturdy spike in the recent consumer-based imports of the United States, countering its annual export valuation and the annual revenue generation in a significant manner. The countries with closer geographical proximity to the United States like Mexico and Canada are also having a trade implementation of 25% and 10% over the exports for a feasible trade exchange accompanied by India.

How the Latest Reciprocal Tariff by Donald Trump Has Affected the Global Market?

The latest tariff implemented by President Donald Trump on April 2, 2025, includes a baseline 10% duty on all imports with higher rates for specific countries, notably a 104% tariff on Chinese goods. The latest information on the United States trade data has clarified the fact that these administrative decisions are justified for the necessary actions to address the substantial trade deficits of the United States.

The announcement to this 10% duty on all imports in the United States has ultimately resulted into a severe decline in the stock market. The significant volatility in the global financial markets, including the S&P 500, has declined by a rate of 1.5%, representing the growing concern of the potential investors in the trade wars and economic instability.

The international responses are also increasing in a significant manner as a result of Donald Trump's imposed tariff. China imposed reciprocal tariff measures of 34% on the American goods in its trading regions, following which the European Union has also implemented 20% tariffs on its exports to the U.S., seeking diplomatic solutions to mitigate the disruptions due to the sudden reciprocal tariffs by the United States of America. Rather than this, supply chain disruptions accompanied by geopolitical tensions are some of the potential concerns that have come forward in the international trade market due to the imposition of a 10% duty on all imports in the United States trading regions.

The Top Targeted Countries of the President Trump’s Newly Introduced Tariffs

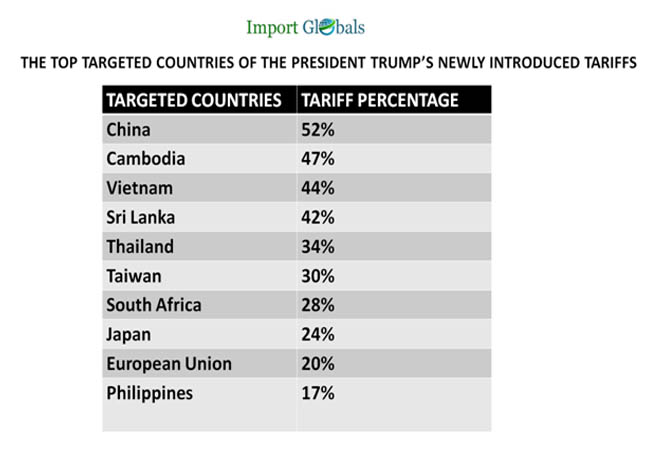

The recent projections on the USA Customs Data have reported that the tariff rate fluctuations are implemented all over the trading regions with closer geographical proximity and are mostly dependent on the trade barriers and political stability within the trading regions. According to the latest trade sheet availed, the top 10 targeted destinations of President Trump's newly launched complementary tariffs are,

1. China - The implemented tariff rate over the goods imported from China is 52%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Automotive goods

B. Textiles

C. Electronics

D. Machinery

E. Steel articles

2. Cambodia - The implemented tariff rate over the goods imported from Cambodia is 47%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Agricultural products

B. Iron and steel

C. Textiles

D. Construction machinery

E. Medicines

3. Vietnam - The implemented tariff rate over the goods imported from Vietnam is 44%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Pharmaceuticals

B. Organic chemicals

C. Textiles

D. Iron and steel

E. Plastic

4. Sri Lanka - The implemented tariff rate over the goods imported from Sri Lanka is 42%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Plastic articles

B. Paper products

C. Textiles

D. Agricultural machinery

E. Textile equipments

5. Thailand - The implemented tariff rate over the goods imported from Thailand is 34%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Wooden products

B. Textiles

C. Iron and its articles

D. Beverages

E. Food products

6. Taiwan - The implemented tariff rate over the goods imported from Taiwan is 30%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Iron and steel

B. Textiles

C. Medicines

D. Paper products

E. Fabrics

7. South Africa - The implemented tariff rate over the goods imported from South Africa is 28%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Paper pulp

B. Electronic machinery

C. Mechanical appliances

D. Textile equipments

E. Household appliances

8. Japan - The implemented tariff rate over the goods imported from Japan is 24%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Iron and steel articles

B. Agricultural products

c. Food products

D. Textiles

E. Machineries

9. European Union - The implemented tariff rate over the goods imported from the EU is 20%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Electrical machinery

B. Energy Essentials

C. Mineral fuels

D. Technological equipments

E. Beverages

10. Philippines - The implemented tariff rate over the goods imported from the Philippines is 17%.

MAJOR IMPACTED GOODS BY THE TARIFF RATES

A. Paper articles

B. Food products

C. Machineries

D. Mechanical appliances

E. Textiles

The Crucial Insights of Trump’s Tariff Impacts on Different Sectors

The newly launched complementary tariff rates over the traded goods of the United Kingdom had a significant impact on various sectors, both domestically and globally. According to the United States Customs Data, the top five sectors that are affected crucially by the latest implemented tariff rates by Donald Trump in 2025 are,

• Automotive Industry - One of the most crucial trade sectors that have been significantly impacted by the new tariffs imposed by former President Donald Trump is the automobile industry. The United States has been majorly depending on the import of vehicles from countries like Japan, South Korea, and Germany. Due to the severe implementation of complementary tariffs, the trade rates now with these nations are expected to face higher duties on their favorable exports to the U.S. market. The imposition of approximately 25% tariffs on this region has led to disruptions in the integrated build-up of supply chains, countering the annual valuations.

• Steel and Aluminum Industry - Following the automobile industry, the steel and aluminum industry, mainly the manufacturing unit, has faced severe fluctuations in its trade rates due to the newly introduced tariff by President Donald Trump. The hefty rate of taxes on imports of this crucial metal from China and other countries was a matter of retaliation from targeted nations, which can cause a disruption in the pricing strategies for raw materials within the U.S. market.

• Technology Sector - The recent statistics of the U.S. import data have reported that the nation relies heavily on the import duties of Chinese goods regarding the technological sector due to the high-tech production capability of the Chinese industries for efficient production. At present, the companies within this sector are facing higher transportation costs for their manufacturing processes, leading to a potential increase in consumer purchases for electronic devices in the U.S. market.

• Agricultural Sector - The agriculture sector has also been severely affected by the newly implemented tariffs of President Donald Trump. The implementation of approximately 30% tariffs on traded goods with closer geographical proximity to trade destinations like Bangladesh has caused severe additional changes in U.S. farmer’s trade practices due to retaliatory tariffs from affected countries.

• Energy Sector - The recently implemented tariff has affected Canadian oil and energy imports by a considerable impact. The proposed 10% tariff on Canadian energy has projected severe disruptions in the increase in gasoline prices in the United States, especially in the regions that are heavily reliant on Canadian oil for domestic needs. This can lead to higher energy costs for consumers and can also result in severe challenges for the U.S. refineries that depend on Canadian crude oil.

FAQ's

Que. What is the top inspected sector of Trump's newly launched tariff?

Ans. The automotive industry was severely affected by Trump's newly launched tariff rates in 2025.

Que. Who is the top-targeted trade firm of President Trump's newly-introduced Tariff?

Ans. China leads the top-targeted trade firm of President Trump's newly-introduced Tariffs.

Que. Where can you get a detailed trade analysis of President Trump's newly introduced tariff in 2024?

Ans. By subscribing to Import Globals, you can get a detailed trade analysis of President Trump's newly introduced tariffs in 2024.

Que. What is the total percentage of tariffs implemented over the goods supplied from India?

Ans. The implemented tariff over the goods supplied from India is 26%.