- May 22, 2025

Democratic Republic of Congo’s Booming Copper Industry

Although the Democratic Republic of the Congo (DRC) has long been recognized for its abundance of natural resources, the copper industry there has been a vital component of the nation's economic expansion in recent years. DRC, one of the biggest producers of copper worldwide, is becoming more and more significant in international supply chains. According to Import Globals on DRC Export Data, the nation is positioned to emerge as one of the most significant participants in the copper market due to its fast-expanding mining sector, smart government efforts, and growing demand for copper in green energy technologies. This blog offers a thorough analysis of the DRC's growing copper exports, along with information on its producing locations, important statistics, and prospects for this rapidly expanding industry.

DRC’s Copper Exports

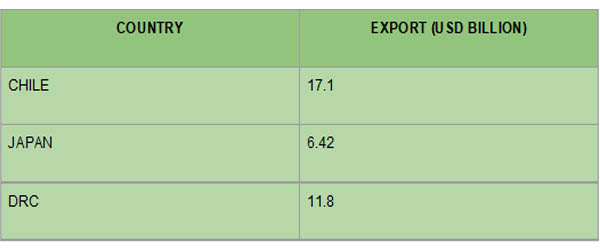

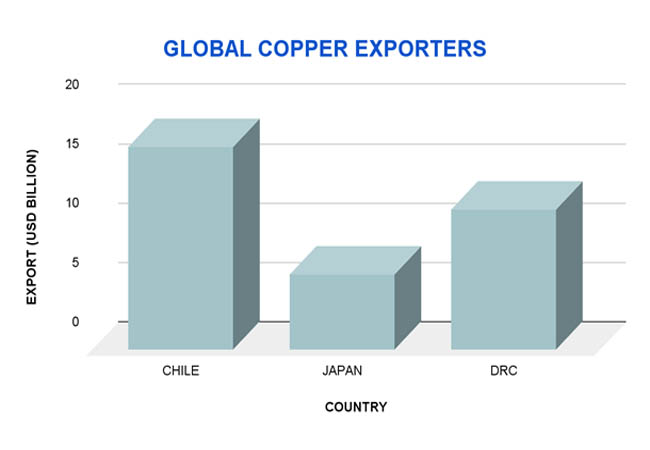

Copper exports from the DRC have increased significantly in recent years. The primary export from the DRC is copper, and it is expected to continue to rank as the world's second-largest exporter of copper, after Chile. The DRC is anticipated to export around 3 million tons of copper in 2024, a 17% increase over 2023 exports, according to DRC Export Import Global Trade Data From Import Globals. This increase is driven by several causes, including the growth of mining activities in the Democratic Republic of the Congo and the rising demand for copper globally, especially in the electric vehicle (EV) and renewable energy sectors.

In 2023, the value of DRC's copper exports reached $11.8 billion, indicating a rise in the metal's demand worldwide. In 2022, copper exports were worth about $17.9 billion. According to a report by Import Globals on Drc Import Export Global Data, the global drive for greener energy and technology is directly associated with the rise in copper exports. Copper is an essential component of solar panels, wind turbines, and batteries for electric vehicles.

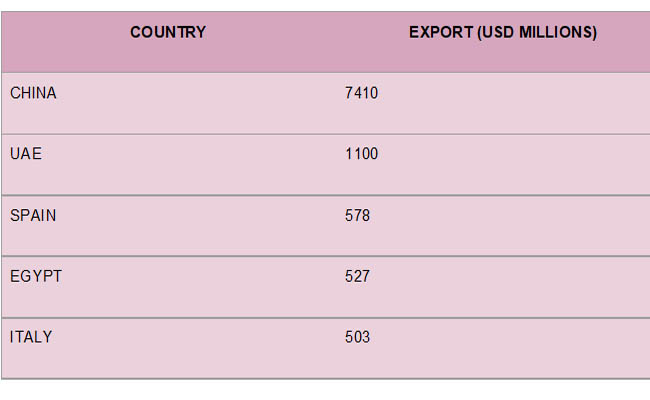

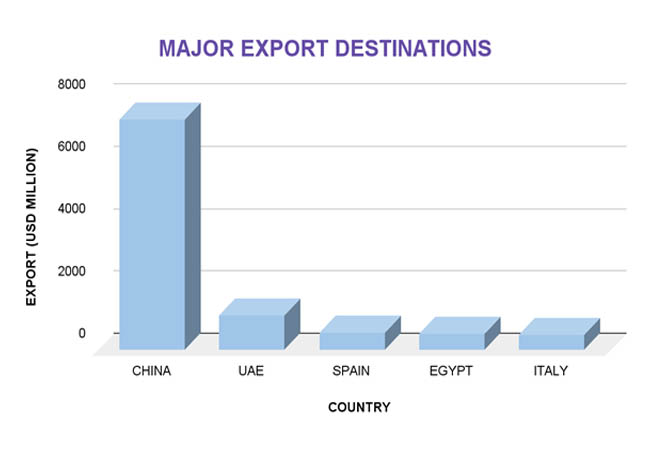

Leading Democratic Republic of Congo Export Destinations

China accounted for roughly 62% of the DRC's copper exports in 2023, however, the country's copper was transported to several other countries as well. China continues to be the world's largest copper consumer, and the wide variety of export markets underscores the global significance of DRC's copper, according to Import Globals' DRC Export Data. These exports have been mostly driven by China's electric car industry's increasing need for copper.

Major Copper Producing Regions of the Democratic Republic of Congo

Some of the biggest copper mines in the world are located in the Democratic Republic of the Congo (DRC), and the country's quick rise as a copper exporter can be attributed to a number of important locations.

Kamoa-Kakula Complex

One of the biggest mining projects in the world is the Kamoa-Kakula Complex, which is situated in the Katanga region. By the end of 2024, this Ivanhoe Mines-operated mine should produce between 425,000 and 450,000 tonnes of copper per year. According to an Import Globals analysis on DRC Export Data, the Kamoa-Kakula Complex is expected to continue to play a significant role in DRC's copper exports and has the potential to overtake all other single-location copper producers in the world in the years to come.

Tenke Fungurume Mine

Another important participant in the DRC's copper output is the Tenke Fungurume Mine. This mine is a joint venture between the DRC government and China Molybdenum Co. (CMOC) and is situated in the country's southeast. Tenke Fungurume is an essential part of the DRC's mining industry, having produced millions of tonnes of copper throughout the years. According to DRC Export Data, it is anticipated to remain a significant contributor to the nation's copper output with plans for future expansion.

Kisanfu Mine (CMOC)

The Kisanfu Mine, likewise run by CMOC, is another noteworthy mine. The mine is a vital component of the nation's copper output and is a part of the larger Tenke Fungurume project. According to an Import Globals study on DRC Import Export Trade Data, CMOC is making significant investments in the mine to double its copper production to one million tonnes per year by 2028.

Leading Exporters of Copper in the World

The Drc is a Vital Component of the Global Copper Market, Impacting Supply Chains and Pricing Trends Due to Its Status as the World's Second-largest Copper Exporter.

Implications for the Strategy of Growing Copper Exports

The DRC's increased copper exports have significant strategic ramifications for the nation and international markets.

Partnerships between the Government and Industry

To maximize the amount of earnings that go to the local economy and obtain more control over its copper trade, the DRC government has been actively negotiating with large multinational mining corporations such as Glencore, CMOC, and Ivanhoe Mines. “This is part of a larger effort to strengthen DRC's position in the global copper market and ensure that mining revenue benefits local communities and infrastructure projects," according to a report by Import Globals on DRC Export Data. The DRC's public treasury received $2.5 billion from mining operations in 2022, demonstrating the sector's significance to the country's economy.

Environmental and Geopolitical Constraints

Even though the DRC is exporting more copper, the nation still has to deal with issues like environmental degradation and geopolitical unrest. While mining-related environmental effects continue to garner worldwide attention, armed conflicts, like those around Bukavu, can impede mining operations. To ensure sustainable development and a consistent supply of copper, the DRC will have to deal with these problems.

Demand for Copper Worldwide

The demand for copper is anticipated to increase as the globe transitions to green energy technologies. A vital component of the global switch to sustainable energy, copper is used in wind turbines, solar panels, and electric cars. Given that copper prices are already rising globally, the DRC stands to gain a great deal from this jump in demand.

Tight supply and rising demand, especially from the EV sector, have caused copper prices on the London Metal Exchange (LME) to rise by 9% since the start of 2025, according to a report by Import Globals on DRC Exporter Data.

Copper Prices and the World's Export Environment

Geopolitical unpredictability, increased demand, and supply limits are some of the factors affecting global copper prices. The pricing trend is anticipated to continue to be optimistic in 2024 as a result of rising demand from important sectors, including renewable energy and electric vehicles.

Conclusion

Growing copper exports from the Democratic Republic of the Congo are making the nation a major force in the world copper market. DRC is well-positioned to hold onto and even improve its position as one of the world's leading producers of copper due to significant production gains, growing export values, and calculated government actions. According to an Import Globals report on DRC Export Import Global Trade Data, the mining industry in the DRC will be essential to supplying the world's growing demand for copper as it moves toward green energy technologies. However, if the nation wants to keep up its copper export momentum, issues including environmental problems and geopolitical instability must be resolved.

FAQs

Que. Why does the world economy need copper?

Ans. Electric vehicles, renewable energy sources, and electrical wiring all require copper. It is essential to shift industries to more environmentally friendly energy sources.

Que. Which DRC regions are the main producers of copper?

Ans. The Kamoa-Kakula Complex, Tenke Fungurume Mine, and Kisanfu Mine are the main copper-producing areas in the Democratic Republic of Congo.

Que. What is the DRC's yearly export of copper?

Ans. The DRC is anticipated to export 3 million tonnes of copper in 2024, maintaining its higher export trend.

Que. Who are the main markets for DRC copper exports?

Ans. China, the United Arab Emirates, Spain, Egypt, and Italy were the biggest export markets for DRC copper in 2023.

Que. How will the DRC's increasing copper exports affect international markets?

Ans. DRC's copper exports are expected to be vital in supplying the world's growing demand for copper, particularly as a result of the switch to electric vehicles and renewable energy sources. This will have an impact on global supply chains and copper prices.

Que. Where to obtain detailed DRC Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date DRC Export Data.