Africa Trade Data

AFRICA MARKET SURGE: RISING INTRA-CONTINENTAL TRADE AND LANDSCAPE: MARKET INSIGHT OF AFRICA TRADE DATA

With significant advancements in market expansion, trade dynamics, and structural changes, Africa TRADE DATA showed resiliency in the face of global problems in 2024. Africa's GDP is expected to grow by 3.7% in 2024, up from 3.1% in 2023, making it the second-fastest-growing area in the world behind emerging Asia. By 2025, it is expected to grow by 4.3%. According to an IMPORT GLOBALS research on AFRICA IMPORT EXPORT DATA, infrastructure development and regional integration propel East Africa's growth to 4.9%, while West Africa's rise to 4.2% is bolstered by robust performances in nations like Ghana and Côte d'Ivoire.

Africa Trade Data shows, Chad and the Democratic Republic of the Congo are expected to positively contribute to Central Africa's 4.1% estimate, while Egypt and Morocco's difficulties cause North Africa to lag slightly to 3.6%. Due to pressures from tariffs, South Africa's economy is growing at a slower rate than the rest, at 2.2%. According to Africa Trade Data provided by IMPORT GLOBALS' shows, trade in Africa shrank by 6.3% in 2023 following a robust 15.9% growth in 2022, which was a result of global economic challenges. Despite outside challenges, intra-African trade defied the trend and increased by 3.2%, demonstrating the AFCFTA's increasing influence in fostering regional integration and commerce stated in Africa Customs Data analysis.

Africa's Geographic Setting and Changing Trade and Supply Chain Relationships

Africa is the second-largest continent in the world, covering an area of more than 30 million square kilometers. It is bounded to the north by the Mediterranean Sea, to the east by the Red Sea and Indian Ocean, and to the west by the Atlantic Ocean. Much of its trade dynamics is influenced by its closeness to Europe, the Middle East, and Asia. According to IMPORT GLOBALS' AFRICA IMPORT DATA, Africa's varied topography, from the Sahara Desert and Sahel in the north to tropical rainforests and savannas in the center and south, affects its internal supply chains, which are frequently hampered by inadequate transportation systems and infrastructure deficiencies.

Notwithstanding these obstacles, Africa continues to have robust trade ties with neighboring regions: China has emerged as a major trading and investment partner, especially in the areas of manufacturing, mining, and infrastructure as per Africa Export Data, while the European Union continues to be Africa's largest trading partner, importing a large portion of its energy resources, minerals, and agricultural products as per Africa Import Data. Imports of food and agriculture are increasingly coming from the Middle East, particularly the Gulf nations, while intra-African commerce is increasing rapidly under the African Continental Free Trade Area (AfCFTA), which aims to lower obstacles and fortify regional supply chains. Africa's geographic location makes it an essential bridge between continents, but achieving its full trade potential mostly hinges on enhancing cross-border coordination, port efficiency, and logistics, according to a report from IMPORT GLOBALS on AFRICA IMPORT EXPORT DATA.

Africa's Contribution to International Trade

Despite deliberate attempts to improve commercial integration throughout the continent, Africa's contribution to global trade, as reported in the AFRICA IMPORTERS DATA by IMPORT GLOBALS, has remained below 3% as of 2024. The main causes of this stagnation are the continent's persistent reliance on exporting raw materials and the low level of intra-African trade, which has not increased as expected even after the African Continental Free Trade Area (AfCFTA) was established in 2021.

In order to facilitate the flow of people and capital and set the groundwork for a continental customs union, the AfCFTA seeks to establish a single market for products and services. However, according to the AFRICA EXPORTERS DATA, intra-African commerce as a percentage of total trade on the continent fell from 14.5% in 2021 to 13.7% in 2022. African nations continue to trade more with outside partners than with one another, as evidenced by the minor declines in intra-African imports and exports.

Africa must solve these issues by coordinating trade policy, investing in infrastructural development, and encouraging industrialization to advance up the value chain to increase its share of the world economy. Strengthening intra-African trade through the successful implementation of the AfCFTA may act as a stimulus for economic growth and greater participation in international trade, according to a study conducted by Import Globals on Africa Import Export Trade Data.

Africa's Trade Contributions Are Illuminated by Exclusive Import Globals Data

A unique and thorough perspective on the economic activities and international trade contributions of major African countries, such as Nigeria, Ethiopia, Uganda, Kenya, Ghana, Tanzania, Zimbabwe, Namibia, Mozambique, Angola, Botswana, Ivory Coast, Lesotho, Malawi, Cameroon, São Tomé, Liberia, and the Democratic Republic of the Congo, can be found in Import Globals' most exclusive and comprehensive trade data on Africa SHIPMENT DATA and AFRICA TRADE DATA.

These nations, which are spread over West, East, Central, and Southern Africa, have some of the most vibrant and varied economies on the continent. They all have unique export profiles, ranging from Ghana's gold and cocoa to Kenya's agricultural exports to Nigeria's hegemony in oil and gas. In addition to providing comprehensive statistics on import and export flows, the Import Globals data also identifies important trading partners, growth prospects, and underlying patterns in supply chain movements.

Import Globals’ dataset provides a comprehensive collection of important trade information, allowing for a close examination of the complex elements of Africa IMPORT EXPORT CUSTOMS TRADE DATA.

- Importer company name

- Exporter company name

- FOB (Free on Board) value

- CIF (Cost, Insurance, and Freight) value

- Invoice value

- Port of loading

- Port of unloading

- Destination country

- Origin country

- HS (Harmonized System) code

- Product description and many more

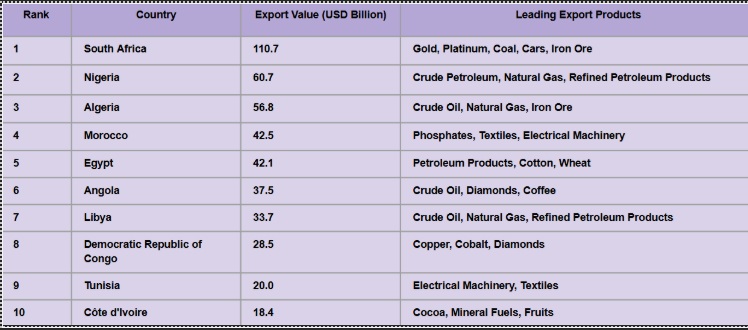

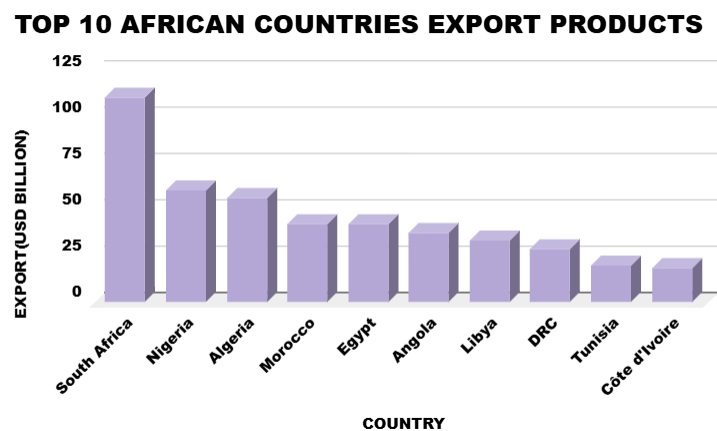

TOP 10 AFRICAN countries Export Products : AFIRCA TRADE DATA

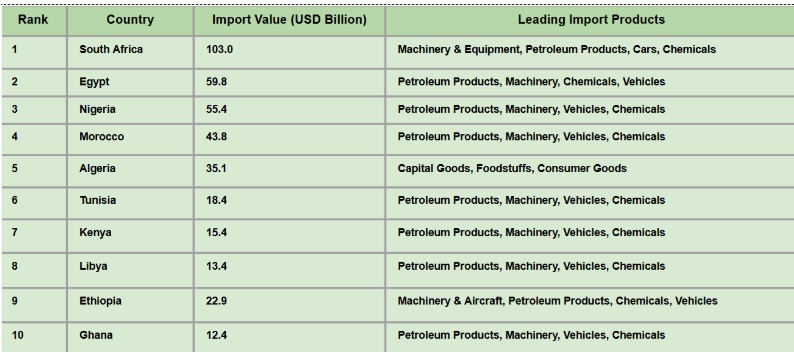

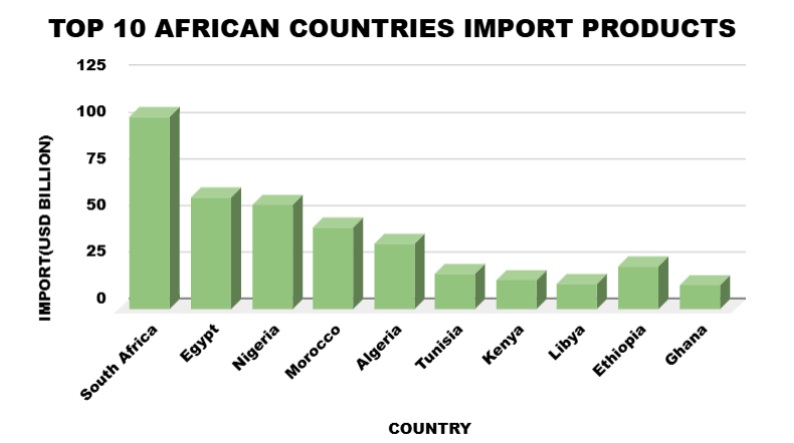

TOP 10 African countries Import Products : AFRICA TRADE DATA

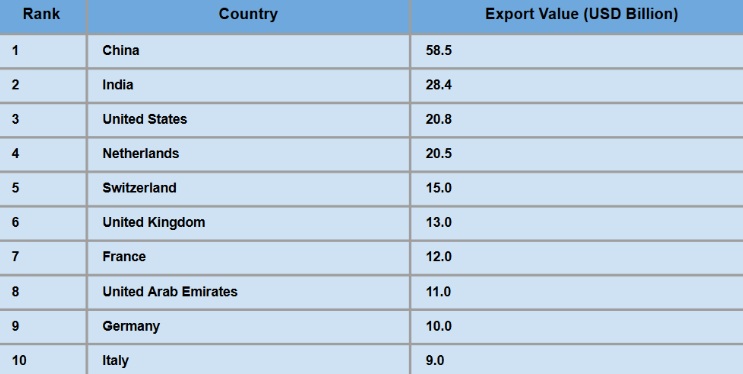

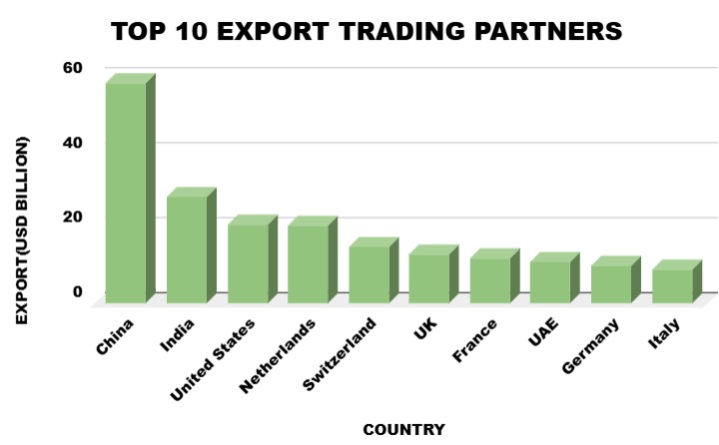

TOP 10 Exporting Trading Partners : AFRICA EXPORT DATA

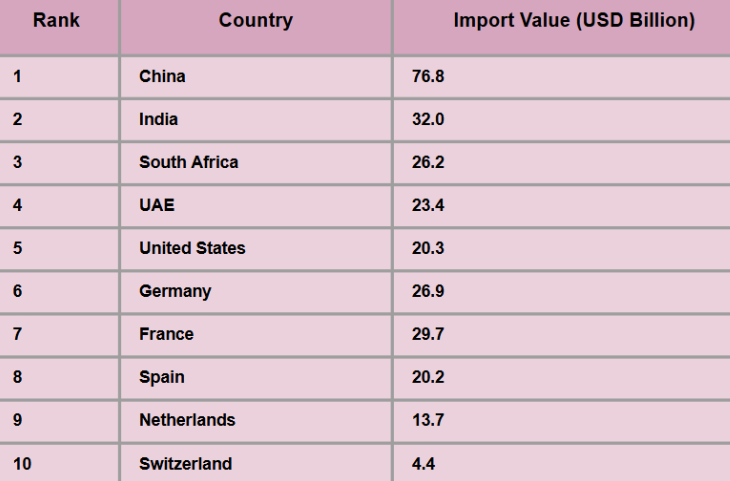

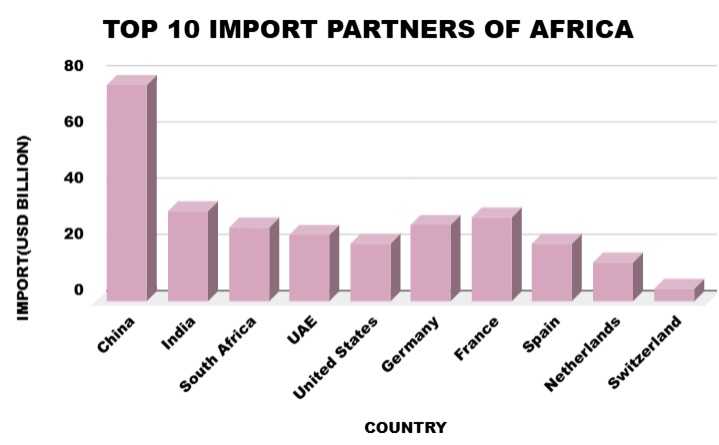

TOP 10 Importing Trading Partners : AFRICA IMPORT DATA

Discover a multitude of information about the import-export patterns of African nations! Get the most recent Africa Import Export Trade Data and market research by subscribing to Import Globals.

UNLOCK COMPREHENSIVE INSIGHT INTO AFRICA TRADE DATA IMPORT EXPORT DATA BY SUBSCRIBING TO IMPORT GLOBALS PLATEFORM!

- Customs Report

- Statistical Report