- Jul 29, 2025

Global Air Conditioner Export and Trade Analysis

The need for air conditioning systems has increased exponentially as a result of rising global temperatures, growing urbanization, and increased disposable incomes. These days, air conditioners are essential in not only homes and workplaces but also automobiles, shopping malls, medical facilities, data centers, and even distant industrial locations. As per Export Data by Import Globals, strong export markets and regional manufacturing hubs have been fostered by this increase in demand, which has had a direct impact on the dynamics of the global supply chain and trade.

With the backing of favorable trade policies, trained workforce, and competitive industrial advantages, nations like China, Thailand, and Mexico have become major exporters over the last ten years. In the meantime, as per Import Data by Import Globals, climate-sensitive and economically expanding regions like India, the Middle East, and Southeast Asia continue to see a sharp increase in demand for imports. Climate demands and technology advancements, driven by energy-efficient innovations, environmental concerns, and clever integration, are reflected in the worldwide AC market. The main trends, trade statistics, leading exporters, compliance issues, and new prospects in the global air conditioner industry are all examined in this blog.

Product Types and Market Segments

The market for air conditioners is broad and divided into segments according to usage requirements for portable, commercial, residential, and automotive applications. Split air conditioners, window air conditioners, and inverter air conditioners are the most widely utilized systems in the domestic market.

Residential:

Split ACs: Split ACs are ideal for individual rooms and offer quiet, efficient cooling with a separate indoor and outdoor unit.

Window ACs: Window ACs remain popular due to their affordability and compact form.

Inverter ACs: Inverter ACs, however, are quickly becoming the preferred choice among consumers for their energy-saving capabilities and ability to maintain a consistent temperature by varying compressor speed.

Commercial:

Ducted Split Systems: These systems use a central indoor unit connected to multiple air ducts that distribute cooled air throughout different zones or rooms. The indoor unit is typically installed in the ceiling or roof space, making it almost invisible in interiors. Ducted systems offer centralized temperature control and are suitable for buildings that need uniform cooling, like offices, retail stores, or hotels.

VRF (Variable Refrigerant Flow): VRF systems are advanced multi-zone systems that use a single outdoor unit connected to multiple indoor units. What makes VRF unique is its ability to regulate the amount of refrigerant flowing to each indoor unit independently, based on the specific cooling (or heating) needs of each zone.

Packaged Units: Packaged air conditioners are self-contained systems where all components (compressor, condenser, evaporator, and expansion valve) are housed in a single cabinet. These are typically installed on rooftops or outdoor spaces and connected directly to the building's ductwork. Packaged units are easy to install and maintain, and are commonly used in restaurants, small offices, or buildings with space limitations for multiple components.

Automotive:

Integrated AC systems in vehicles (cars, buses, trucks): Integrated AC systems are built into vehicles to provide in-transit comfort.

Portable & Hybrid:

Compact models for temporary or localized cooling needs: Portable and hybrid air conditioners have carved a niche in urban homes and temporary setups, offering compact cooling solutions for small spaces, rentals, or off-grid locations where traditional AC installations are not feasible.

Top Exporting Countries of Air Conditioners

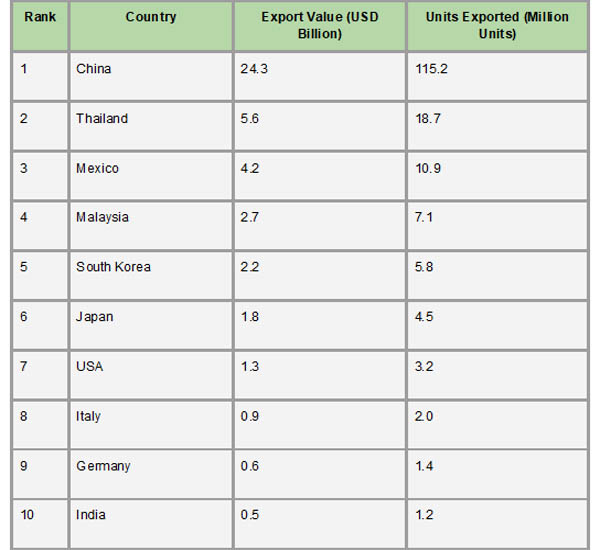

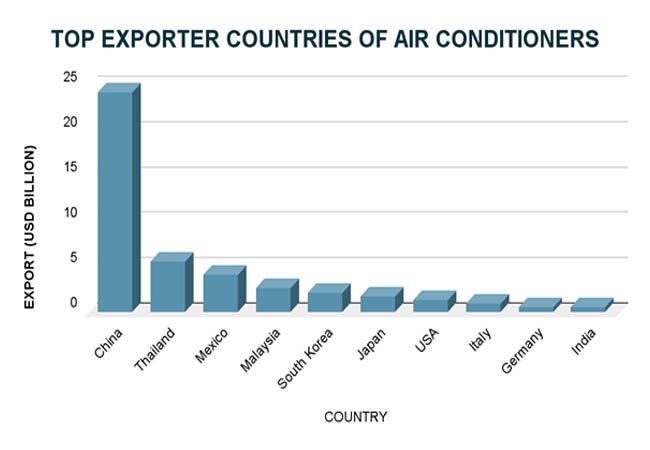

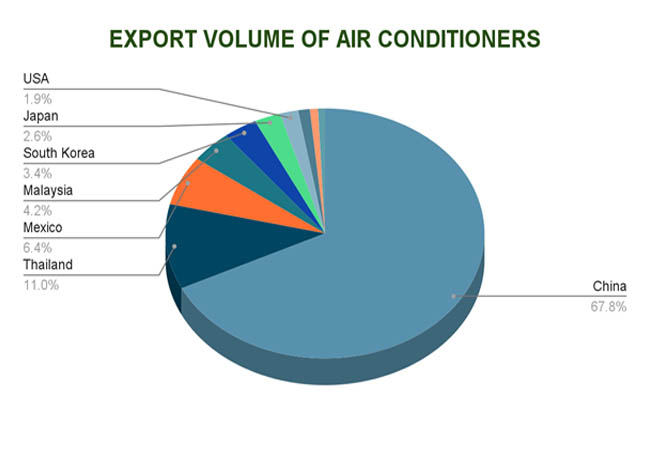

China is without a doubt the market leader for air conditioner exports worldwide, with East Asian nations controlling the majority of the industry. Over 115 million AC units were sold by China in 2023, bringing in about USD 24.3 billion in export revenue. Its established manufacturing ecosystem, cheap labor costs, and the existence of well-known international companies like Gree, Midea, and Haier are all factors in its domination. As per a report by Import Globals on Import Export Trade Data, it serves as a regional base for global brands like Daikin and Mitsubishi. Thailand ranks as the second-largest exporter with a value of USD 5.6 billion. Third-ranked Mexico is a major exporter with over USD 4.2 billion in AC shipments, due to its advantageous trade terms under the USMCA and its proximity to the US.

With their emphasis on component quality and innovation, South Korea, Japan, and Malaysia are other noteworthy exporters that make substantial contributions to the global supply chain. Particularly well-known for their cutting-edge and energy-efficient systems are South Korea and Japan, which sell products under the LG and Panasonic names. As per Import Custom Data by Import Globals, despite being a large importer, the US exports a sizable amount of ACs, particularly to emerging and adjacent nations. The top ten is completed by Italy, Germany, and India, with India gradually gaining ground thanks to its growing industrial capacity and encouraging government programs like the PLI scheme. These nations collectively make up the core of the world's air conditioning commerce network.

With their emphasis on component quality and innovation, South Korea, Japan, and Malaysia are other noteworthy exporters that make substantial contributions to the global supply chain. Particularly well-known for their cutting-edge and energy-efficient systems are South Korea and Japan, which sell products under the LG and Panasonic names. As per Import Custom Data by Import Globals, despite being a large importer, the US exports a sizable amount of ACs, particularly to emerging and adjacent nations. The top ten is completed by Italy, Germany, and India, with India gradually gaining ground thanks to its growing industrial capacity and encouraging government programs like the PLI scheme. These nations collectively make up the core of the world's air conditioning commerce network.

Air Conditioner Manufacturing Hubs and Supply Chain

As the world's largest production hub, China is at the forefront of the highly centralized Asian air conditioner manufacturing industry. China's supply chain is vertically integrated, meaning that all essential parts, such as compressors, copper coils, motors, and electronic control boards, are produced there or can be readily sourced, which accounts for its dominance. This guarantees scalability, quick manufacturing cycles, and cost effectiveness. As per Import Trade Analysis by Import Globals, because of its highly qualified workforce, welcoming investment environment, and proximity to ASEAN markets, Thailand also plays a significant role as a regional base for well-known Japanese brands like Daikin, Mitsubishi, and Panasonic. These nations serve as OEM (Original Equipment Manufacturer) bases for multinational corporations in addition to producing goods under their names.

Mexico has become a major industrial hub outside of Asia, particularly for the North American market. Mexico offers lower shipping costs and quicker market access to companies like Carrier, Trane, and Lennox by utilizing its advantageous position and trade agreements like the USMCA. As per Export Data by Import Globals, with the help of the Production-Linked Incentive (PLI) program, India is establishing itself as a developing manufacturing hub, in the meantime, boosting domestic value addition and lowering reliance on imports. The global supply chain is a complicated network that sources plastics, sheet metal, electronic components, and refrigerants from different nations. As such, it is extremely vulnerable to changes in raw material prices, shipping delays, and geopolitical concerns. Resilience and efficiency in this supply chain are essential for satisfying demand worldwide and preserving competitiveness.

Air Conditioner Manufacturing Process

As per Import Data by Import Globals, an air conditioner is manufactured using a series of carefully planned procedures to guarantee energy efficiency, performance, and safety. Engineers start by designing and prototyping models depending on target markets and climate requirements. Manufacturers then acquire parts, including eco-friendly refrigerants, fans, control panels, copper tubing, compressors, and condensers. After that, specialists assemble these components on production lines by integrating the structural casing, electrical wiring, and cooling system. Every device is placed through quality control testing to check for energy efficiency, cooling output, and refrigerant leaks. Following clearance, the air conditioners are transported to either domestic or foreign markets, barcoded for traceability, and bundled with user manuals and accessories.

Top AC Brands in Global Trade

As per Import Trade Statistics by Import Globals, a combination of Asian and Western brands, renowned for their inventiveness, size, and global presence, dominate the global air conditioning market. With the biggest market share in the world, Daikin (Japan) is well-known for its highly efficient systems and robust presence in both the residential and commercial sectors. Following closely after are the Chinese behemoths Midea and Gree, who provide a vast array of goods and are significant OEM suppliers for other companies. A leader in contemporary air conditioning, Carrier (USA) is still a major force, particularly in North America. Other well-known brands with a wide range of products and a significant global presence are Haier (China), Panasonic (Japan), and LG (South Korea).

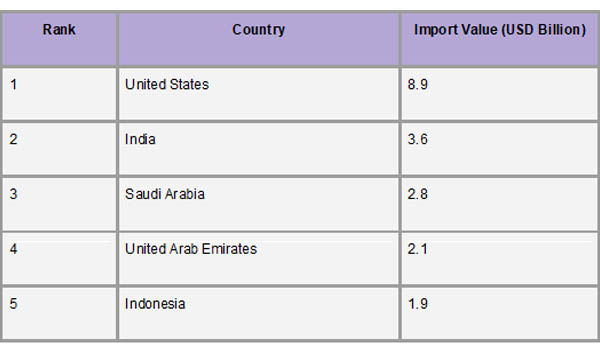

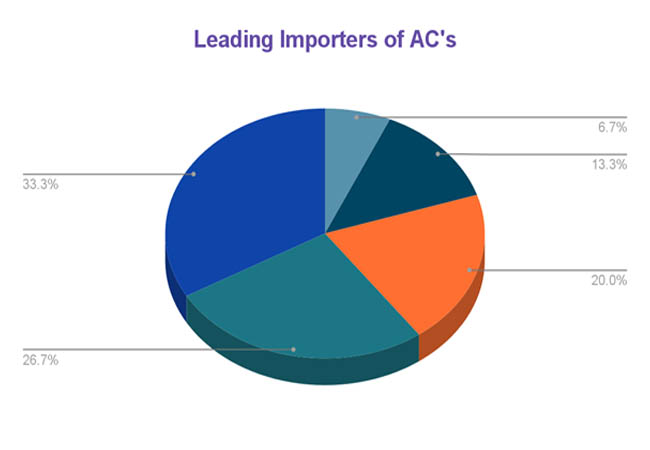

Top Importing Countries of Air Conditioners

The United States dominated the world market for air conditioner imports in 2023, with imports totaling over $14.2 billion. The nation's sizable residential and commercial sectors, along with an increasing focus on intelligent and energy-efficient cooling systems, are the main drivers of this significant demand. Japan and Germany came next, each bringing in over $2.49 billion worth of air conditioners, demonstrating their dedication to sustainable technologies and sophisticated infrastructure. As per Import Shipments Data by Import Globals, with imports of $2.49 billion and $2.38 billion, respectively, France and Canada also stood out, demonstrating strong demand in several industries in these countries.

As per Import Export Trade Analysis by Import Globals, beyond these, nations like Vietnam, Indonesia, and India have become major importers due to factors including rising temperatures, growing urbanization, and rising disposable incomes. For example, the demand for air conditioners has increased significantly in India, especially in metropolitan areas, which has resulted in a noticeable rise in imports. Similar increases in import volumes have been seen in Vietnam and Indonesia, which can be attributed to growing middle classes and infrastructure advancements. These patterns highlight how the demand for air conditioners is changing globally, with rising economies becoming a more significant player in the market.

Export Compliance & Certification Requirements

Strict adherence to several certifications and legal requirements is necessary when exporting air conditioners to foreign markets to guarantee product safety, energy efficiency, and environmental sustainability. For example, as per Export Import Global Trade Data by Import Globals, exports to the European Union must bear the CE mark, which denotes compliance with safety and health regulations. In addition to meeting Energy Star efficiency standards, air conditioners in the US can also need to be certified by Underwriters Laboratories (UL). RoHS (Restriction of Hazardous Substances) compliance is required in many markets, especially to restrict the use of hazardous materials in electrical equipment. Exporters also need to adhere to ISO 9001 for quality management and ISO 14001 for environmental standards. Country-specific requirements like BIS certification in India must also be met, making it essential for manufacturers and exporters to stay updated with evolving regulations in each target market.

Sustainability in AC Manufacturing

As per Import Export Global Data by Import Globals, the industry looks to lessen its environmental impact in response to growing worldwide demand, and sustainability has taken center stage in the production of air conditioners. Since eco-friendly refrigerants like R-32 and R-290 have a lower potential to cause global warming than conventional hydrofluorocarbons (HFCs), manufacturers are increasingly using them. Another important topic is energy efficiency, where businesses build units with greater Energy Efficiency Ratios (EER) and include smart technologies to maximize power consumption. Furthermore, a lot of companies are adopting circular economy principles, such as recycling programs for end-of-life products and recyclable packaging and components. In addition to adhering to more stringent international requirements, these initiatives also satisfy the growing demand from consumers for more sustainable and environmentally friendly cooling options.

Challenges in the AC Export Market

There are several important issues facing the air conditioner export business that affect producers and exporters everywhere. Costs have gone up and supply chains have been disrupted as a result of trade tensions and tariff barriers, especially between big powers like the US and China. Production costs are further made unclear by the fluctuating prices of essential raw materials like copper, aluminum, and semiconductors. Additionally, exporters have to deal with a variety of intricate compliance regulations in other nations, which can raise costs and delay market access. Shipping routes and logistics are impacted by geopolitical instability, which makes on-time delivery even more difficult. Furthermore, the industry has both a challenge and an opportunity as a result of stricter climate laws and regulations of emissions and refrigerants, which necessitate ongoing innovation and investment in greener technology.

Global Demand Drivers

Some significant variables are driving the global demand for air conditioners and influencing the market environment. The need for effective cooling solutions in public, commercial, and residential infrastructure is growing in rapidly urbanizing economies due to the rapid urbanization of these regions. Air conditioning is now necessary for comfort and health due to climate change and rising global temperatures, particularly in tropical and subtropical areas. Energy-efficient technology advancements, like inverters and smart AC systems, appeal to people who care about the environment and lower electricity prices. Furthermore, government incentives and subsidies that support environmentally friendly equipment increase demand by lowering the cost of contemporary air conditioners and opening them up to a wider global market.

Export Trends and Forecast (2025–2030)

Between 2025 and 2030, the worldwide air conditioning industry is expected to increase significantly due to rising temperatures, urbanization, and technological improvements. The market is anticipated to grow at a compound annual growth rate (CAGR) of 6.1% to 9.8%, according to industry estimations. By 2032, the market is estimated to reach a size of between USD 276.7 billion and USD 377.66 billion. This expansion is especially noticeable in the Asia-Pacific area, where the need for residential and commercial air conditioning systems is being fueled by rising disposable incomes and fast urbanization.

Additionally, technological advancements are significantly influencing export patterns. Smart features like IoT connectivity and the use of inverter technology, which provides increased energy efficiency, are becoming commonplace in new models. These developments support worldwide sustainability objectives in addition to meeting the rising demand from consumers for energy-efficient products. The market for air conditioning exports is expected to grow rapidly as long as manufacturers keep coming up with new ideas and adjusting to these trends. Emerging markets in Latin America and Africa will also offer new prospects for growth.

Conclusion

The global air conditioner export market is undergoing rapid transformation, fueled by rising global temperatures, urban growth, and increasing consumer demand for energy-efficient and smart cooling solutions. Dominated by manufacturing hubs in Asia, especially China and Thailand, the industry faces challenges such as trade tensions, regulatory compliance, and sustainability pressures. However, innovations in eco-friendly refrigerants, smart technology, and expanding markets in emerging economies offer significant growth opportunities. To stay competitive, exporters must balance technological advancement with environmental responsibility while navigating complex international trade landscapes.

If you are looking for detailed and up-to-date Air Conditioners Export Data, You Can Contact Import Globals.

FAQs

Que. Which country is the largest exporter of air conditioners?

Ans. China exports over $24 billion worth annually.

Que. What is the HS Code for air conditioners?

Ans. 8415, including window, vehicle, and split-type ACs.

Que. Which countries import the most air conditioners?

Ans. USA, India, Saudi Arabia, UAE, and Indonesia.

Que. What are the latest trends in AC manufacturing?

Ans. IoT-enabled systems, eco-friendly refrigerants, energy-efficient designs.

Que. What challenges do exporters face?

Ans. Tariffs, raw material costs, compliance hurdles, and sustainability pressures.

Que. Where to obtain detailed AC Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Export Data.