- Jul 19, 2025

Historic U.s.– Indonesia Trade Pact: 19% Export Tariff & Billion-dollar Boeing Jets, Energy, Agri Deals

One of the most significant bilateral trade agreements in recent ASEAN history was signed in mid-July 2025 between the United States and Indonesia.

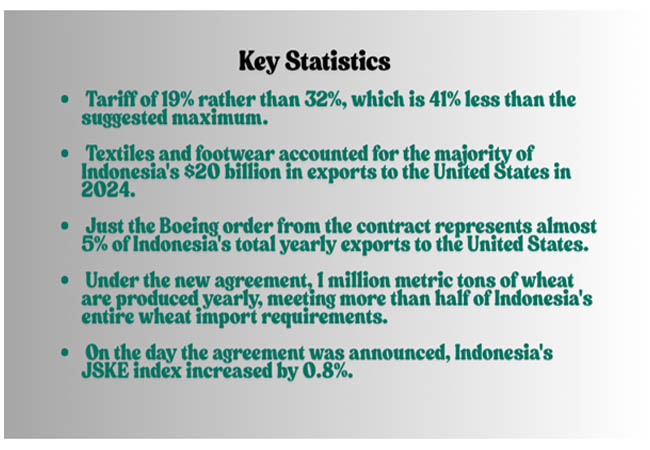

As per Indonesia Import Data by Import Globals, the agreement replaces the previously threatened 32% duty that alarmed the biggest economy in Southeast Asia with a uniform 19% tariff on all Indonesian exports to the United States. With billions of dollars in cross-border transactions and more regular trade flows, this new agreement heralds a new era of economic cooperation.

The Import Reduction: Why 19% Is Important?

The Trump administration's first "Liberation Day" plan called for slapping a hefty 32% tax on a few countries, including Indonesia, to reduce trade deficits. As per Indonesia Export Data by Import Globals, companies and decision-makers cautioned that such a rate may destroy Indonesia's competitive export industries, which include electronics, palm oil, textiles, and footwear.

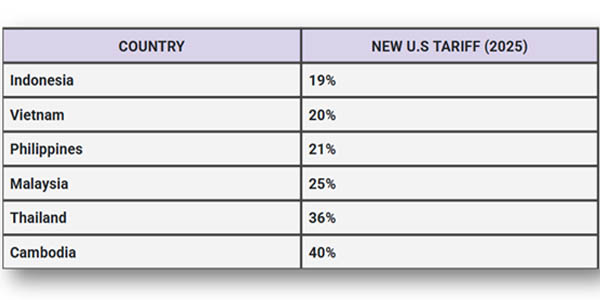

There is a great deal of comfort from the new 19% rate. Despite being higher than it was before 2020, Indonesia today has the lowest tariff rate the US imposes on any ASEAN nation, outperforming Vietnam and the Philippines in terms of cost competitiveness. Exporters gain from more confidence when planning prices, contracts, and supply chain activities, but they still have to manage this additional expense.

USA Tariff Rates

Among Southeast Asian economies impacted by the Liberation Day tariffs, Indonesia has the lowest U.S. tariff rate as of July 2025. According to Indonesia Import Export Trade Data by Import Globals, the acceptable rates in Vietnam, the Philippines, and Malaysia range from 20 to 25 percent, while Thailand and Cambodia, which have not reached any agreements, are subject to even higher rates. The regional standard for preferential treatment is Indonesia's 19%.

Indonesia has a competitive export advantage because of this differentiation, especially in labor-intensive industries like electronics, textiles, and footwear. Additionally, it makes the nation more appealing to international corporations looking to relocate manufacturing from China to stable ASEAN centers.

The concessions that Indonesia made!

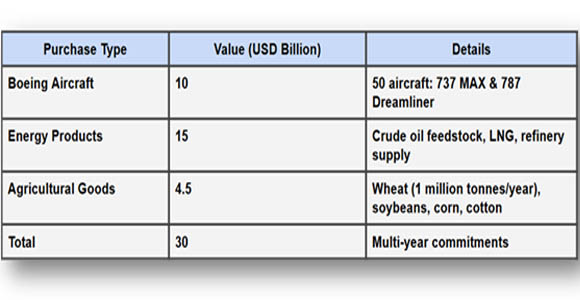

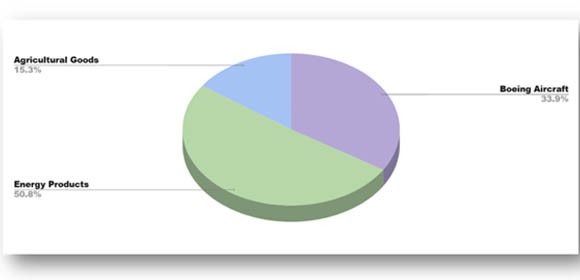

Indonesia’s Purchase Commitments

This advantageous tariff rate wasn't given to them for free. According to USA Import Custom Data by Import Globals, to meet the economic and security objectives of the United States, Indonesia has agreed to a set of multi-year purchases and compliance measures.

50 Boeing Aircraft

50 Boeing aircraft, primarily 737 MAX and 787 Dreamliners, will be acquired by private airlines and Indonesia's flag carrier, Garuda Indonesia. This significant purchase will guarantee job stability in Boeing's supply chain and boost the US aerospace industry.

15 billion US dollars in energy imports

According to USA Import Export Global Data, Indonesia will purchase $15 billion worth of U.S. energy goods, such as natural gas and crude oil feedstock, through new Memoranda of Understanding with ExxonMobil and Chevron. In addition to supporting Indonesia's expanding refinery and petrochemical industries, this lets the United States access a wider audience in the global energy market.

US Agricultural Products Worth US$4.5B

According to Usa Import Trade Analysis by Import Globals, about US$4.5 billion worth of American agricultural products, including wheat, corn, soybeans, and cotton, would be bought in large quantities by Indonesia. Through 2030, the wheat component alone will commit 1 million metric tons annually, giving American farmers access to stable export markets.

What Does America Stand to Gain from U.S. Market Access?

The United States has agreed to let the entry of Indonesian goods under the standard tariff of 19% in exchange. All American products, will be able to enter Indonesia duty-free in the meantime, with better quotas and quicker clearance processes. This guarantees improved market access for American producers, IT firms, and agricultural exporters in the biggest consumer market in Southeast Asia.

Furthermore, as per Indonesia Export Data by Import Globals, Indonesia has consented to relax its regulations on local content for some tech items made in the United States. It is anticipated that this would enable American software and electronics businesses to grow in Indonesia without encountering the typical localization challenges.

Safeguards for Compliance and Transshipment

The agreement includes additional compliance procedures to address long-standing concerns about transshipment, when products from China may be redirected through Indonesia to avoid U.S. duties. Better port monitoring, stricter customs inspections, and sanctions for infractions are all promises made by Indonesia.

To keep an eye on questionable cargoes, major ports like Tanjung Priok and Batam will make investments in cutting-edge cargo-scanning equipment. As per USA Import Data by Import Globals, the purpose of these actions is to ensure that U.S. customs officials understand that the tariff agreement would not be used as a backdoor for goods from foreign countries.

Responses and Economic Effects

On the day the agreement was completed, Jakarta's major stock index (JKSE) increased by around 0.8% as a result of the announcement. In response, Bank Indonesia indicated a somewhat more positive GDP projection and made hints about potential interest rate changes to help exporters adapt to the new cost environment.

Local producers are still wary, though. As per USA Import Trade Statistics by Import Globals, the truth is that a 19% tariff still reduces profit margins for low-cost commodities like clothing and shoes, even while the Boeing, energy, and agriculture deals make headlines.

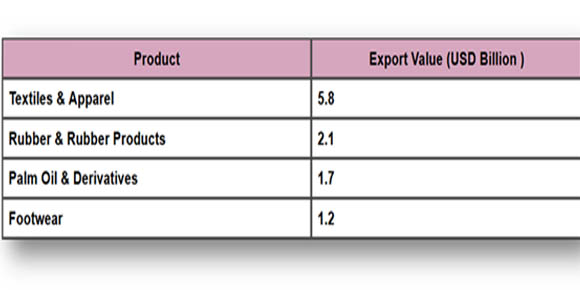

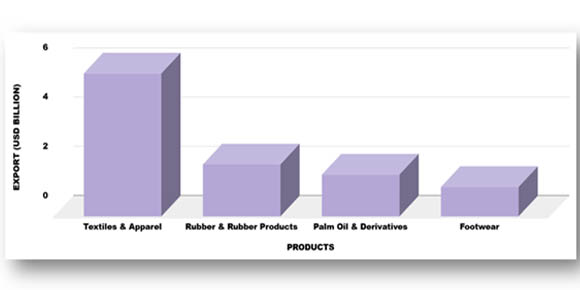

Top Indonesian Exports to the US

Effects of Regional Ripples

The trade dynamics in the ASEAN area may be impacted by Indonesia's recent designation as America's "best tariff partner." Now that their tariff rates are comparatively higher, Vietnam, Malaysia, and the Philippines could be pressured to negotiate comparable deals, most likely in exchange for their pledges to purchase American energy, aircraft, or agricultural products.

Additionally, as per USA Import Shipments Data by Import Globals, trade specialists caution that this agreement may serve as a model for future U.S. agreements with other developing countries. The message is clear: nations may gain better access to the profitable U.S. market if they make significant concessions and adhere to tight regulations.

The Last Obstacles

Some information is still unknown despite the significant news. To partially offset the 19% tax on important exports like palm oil, nickel, cocoa, and rubber industries that support millions of jobs and generate substantial foreign exchange, Indonesia is seeking sector-specific exemptions. As per the Usa Import Export Trade Analysis by Import Globals, follow-up bilateral discussions are anticipated to provide final schedules for grain purchases, energy supplies, and Boeing delivery.

Conclusion

With tariffs as leverage, expensive purchases as negotiating chips, and compliance as a new trade currency, the landmark U.S.–Indonesia trade treaty serves as a practical example of how contemporary trade policy operates. Both nations stand to win if it is implemented properly, but exporters, customs officers, and legislators must remain watchful to make sure the promised advantages reach companies and employees on both sides. Import Globals is a leading data provider of USA Import Export Trade Data. Subscribe to Import Globals to get more details on global trade!

FAQs

Que. Why did Indonesia accept the 19% tariff?

Ans. To avoid the much harsher 32% tariff that would have cost billions in lost export revenue.

Que. What did the U.S. gain?

Ans. Billions in guaranteed aircraft, energy, and farm exports, plus better compliance to close loopholes.

Que. Who benefits most?

Ans. The U.S. aerospace, energy, and agricultural sectors. Indonesia keeps market access but faces costs.

Que. Will other ASEAN nations follow?

Ans. Possibly the deal sets a new benchmark for bilateral trade talks in the region.

Que. Where can you obtain detailed Indonesia Export Import Global Trade Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.