- Nov 13, 2025

India, US to Hold Trade Talks: Breakthrough Expected in Free Trade Agreement Amid Trump’s Tariffs

The negotiations come after the U.S. placed hefty tariffs in place last summer, including oil-linked penalties that President Donald Trump suggested as a punishment. These tariffs have raised the stakes for both sides in terms of politics and economics. There is a lot of political pressure on negotiators at home to get things done. India wants to defend its export markets and economic growth, while the U.S. wants to protect its own manufacturers and use trade to reach its geopolitical interests.

1. Why are the talks Necessary Right Now

Officials from both capitals have said they are open to talking about trade again. The quick trip of the country's ambassador to New Delhi and statements from American trade officials show that Washington wants to chill things down enough to make real assurances on access to markets and norms. As per India Global Import Export Data, India has to talk about these things since the USA is one of its biggest export markets. The tariffs that are in place right now might damage export income and alter supply chains.

2. The tariff shock: what Happened and Why it Matters

In late August, the U.S. announced harsh steps that raised duties on certain Indian goods by as much as 50%. There was also an additional 25% levy that was alleged to be related to India's ongoing imports of Russian oil. Officials in the U.S. indicated the choice was made because of particular strategic actions, but it had a wider effect on the economy: Large tariffs unexpectedly raise prices for Indian exporters.

According to India Customs Data by Import Globals, this might make it easier for multinational clients to decide to relocate manufacturing back to their own nations, change channels, or create goods locally. Before the penalties took effect, Indian exporters hurried to send items early, which made trade flows swing up and down swiftly over the course of a month.

3. The main issues of contention in the Conversation

Both sides have declared they want to engage again, but there are still certain hard challenges that will make any possible breakthrough harder:

Tariffs and other Solutions for Trade: The extra duties that are designed to penalize are the major cause of the problems and a crucial bargaining tool. Washington wants each side to commit to behaving and to open up their markets to the other. New Delhi wants something in return for getting rid of them or rolling them back slowly.

Farmers and dairy producers want it to be simpler for them to get high-value farm goods like dairy, certain cereals, and ready-made meals. In the past, India has been politically protective of its farming economy and would search for carefully managed deregulation or carve-outs.

India's tariffs on manufacturing and industry are a significant concern. The USA wants lower tariffs on all manufactured goods, while India wants to safeguard critical sectors and not remove sensitive lines as much.

Digital Commerce, Services, and Data Flows: IT, business process outsourcing, and digital services are politically charged yet tremendously crucial for business. The USA wants strong protocols for data and intellectual property. India wants to be able to maintain its own digital economy and keep its data in its own country.

Non-tariff Measures and Standards: Even if the major tariffs stay the same, harmonizing standards, conformity assessment, and customs processes can still have a big impact on the ground.

4. Economic Effects that are Already clear in the Short Run

Market reactions and responses at the company level reveal that tariffs have immediate consequences in the real world:

Putting things in front and then Pushing them Back: A lot of Indian exporters ramped up shipments to the U.S. in the month before tariffs went into force. Customers and suppliers had to make changes, which led to short spikes and then declines.

Reshoring and Transferring Production to the U.S.: Multinational corporations and Indian enterprises that do business in the U.S. are thinking about or currently making things in the U.S. to avoid tariffs.

Price and Competitiveness Pressures: New tariffs can lower the profitability of exporters or force them to raise prices, which might lower demand. If these things keep happening, exporters could never get their market share back.

5. What would a true "Breakthrough" be Like?

There will undoubtedly be big adjustments since there are political limits on both sides. India will let certain U.S. companies do business there if the oil tax goes down slowly or is put on hold for a brief period.

As per USA Import Data, quick deals on customs cooperation, sanitary and phytosanitary (SPS) rules, and agreeing to recognize each other's conformity assessments to make trade simpler.

Digital and service Pilot: a little addition to digital and service that aims to help some professionals go about, secure visas, and find out whether other people know about their skills. Safeguards and transition aid are ways to keep tariffs in place for a limited period or support industries that suddenly get a lot of imports.

A better FTA terminology might say that lawmakers commit to making a bigger FTA within a certain length of time. They should also check on it from time to time and provide people with options to rectify faults in the meanwhile.

6. Trading isn't only about Generating Money; it's also about Strategy and how it changes the World

Based on USA Customs Data by Import Globals, the U.S. wants to conduct more business with India because it fits with its bigger goals in the world, like pushing supply chains away from China, making stronger strategic allies in Indo-Pacific security, and using its economic power to affect behavior. India can acquire more foreign investment, join advanced tech supply chains, and balance its dependency on other countries by having a closer economic relationship with the U.S. But using tariffs to compel others to do what you want makes people doubt long-term trust. Negotiators need to find a way to reconcile their demand for short-term dominance with their need for long-term cooperation based on rules.

7. A Quick overview of who Won and Lost in each Area

If the deal goes through, high-end U.S. agricultural exports, pharmaceuticals and healthcare services, IT and high-value engineering services, and high-end U.S. agribusiness exports will all go up. The Indian Textiles and garment industry, as well as the USA agriculture, will compete with imports if India opens its markets.

Neutral/transformative: Electronics and components might aid both countries by making their supply chains more diverse, but this would require harmonizing tariffs and non-tariff obstacles.

8. What will Probably Happen to the Economy in the next 12 to 24 Months

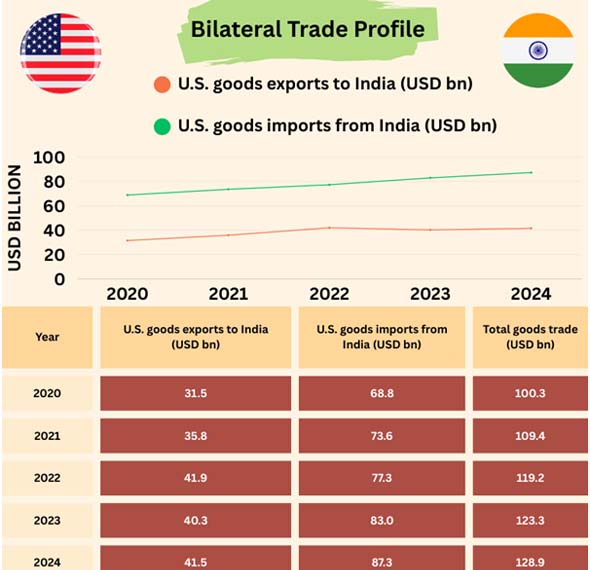

If the U.S. delivers a customized market-access package in exchange for a partial cut or a temporary halt on more tariffs, expect commerce in goods between the two countries to grow again and certain supply chains to get back to normal.

If tariffs continue in place and discussions fail, Indian exporters would undoubtedly keep altering their supply chains. More firms may shift their factories to the U.S. or other nations, which will lower short-term export volumes.

As per USA Trade Data by Import Globals, India has a huge surplus in services trade and investment flows. These flows aren't as directly affected by tariffs on products, but they are still in danger from visa restrictions and other government rules. An accord that includes liberalizing services might boost India's services exports in the medium term.

9. How Negotiators can Quickly Build Confidence

Sequencing and Transparency: Public roadmaps that illustrate the order of delivery and safety measures will make business less unpredictable.

Technical Working Groups: Creating working groups for certain topics, such as agricultural SPS, customs, and service credentials, can lead to quick, real-world results.

Intermediate Monitoring and Conflict Resolution: A middle ground for keeping an eye on promises and dealing with problems helps minimize tactical losses from halting talks.

Joint economic cooperation financing or transition aid for affected industries are examples of domestic adjustment packages that might make it simpler for people to accept changes in their own nations.

10. A one-page action list for Business Leaders

Look at the U.S. tariff lines and think about making or shipping goods to North America as a backup plan. Get in touch with trade organizations to suggest changes to customs and SPS that will make things flow more smoothly right now.

Check the customs figures every month to see whether demand changes fast. Front-loading will cost a lot if tariffs are heavily imposed. Look for services and digital market possibilities that can come with product compromises.

Conclusion

India and the United States are talking about trade again, which has both good and bad facets. This year's high tariffs have made matters more urgent and given both parties more authority to negotiate. As per USA Export Data, a comprehensive, immediate FTA breakthrough is unlikely because of local limits. But it is conceivable to have a progressive, practical package that includes modifications to tariffs (or temporary suspensions), technical fixes (customs, SPS), and a strategy for a greater agreement. This sort of package would protect short-term commercial connections, limit long-term damage to the economy, and let people support working together based on norms on a larger scale. The next several weeks of talks will be highly critical. If politicians can use leverage to make a deal over time, both businesses and consumers will profit. If not, the tariffs might force the partnership to break down into a more costly and fragmented state.

FAQs

Que: Are the tariffs in the U.S. here to stay?

Ans: The new harsh penalties are already in place, but how long they continue will depend on how effectively diplomacy and talks go. The president can alter, halt, or get rid of tariffs on their own or as part of a trade deal.

Que: Will this cost individuals in either nation extra money?

Ans: Yes, tariffs normally raise the pricing of the things they affect, and they can pass those costs on to customers, businesses, or both. Some companies can decide to create items in their own country to avoid tariffs. This can help keep rates low, but it may take some time and money.

Que: Is it possible that this will stop a bigger FTA for good?

Ans: Not all the time. High-profile tariffs might make things worse politically in the near term, but they could also speed up discussions. Political problems need to be solved before a long-lasting, all-encompassing FTA can be thought of. Using incremental or phased methods makes it more likely to happen over time.

Que: What should exporters do next?

Ans: Exporters should find out how much the tariffed lines harm them, look for ways to lower their risk in the short term, and work with industry groups that talk to negotiators to find solutions for their sector. You may avoid short-term costs by keeping an eye on monthly customs releases and quickly changing your logistics.

Que: Where can you obtain detailed USA GLOBAL CUSTOMS DATA?

Ans: Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.