- Oct 09, 2025

JBL Speakers: Global Trade Trends, Major Markets & the Road Ahead

You've likely seen a JBL speaker producing clear, bass-heavy music when hosting a beach party, grilling in your garden, or simply enjoying your favorite song on a solo road trip.

Because of its distinctive fusion of robust construction, potent performance, and affordable price points, JBL has come to represent portable audio for millions of people worldwide. However, as per JBL Import Data by Import Globals, each Flip, Charge, or PartyBox speaker is the result of a complex worldwide commerce network that combines sophisticated electronics, global manufacturing, raw materials, and astute logistics. This blog explores the lesser-known aspects of JBL, such as how its speakers cross international boundaries, which nations serve as the backbone of its supply chain, and what the future holds for this audio behemoth in the ever-growing ecology of international trade.

The JBL Story

JBL was established in Los Angeles in 1946 by James B. Lansing, and its origins are in professional and motion picture sound systems. As a high-fidelity audio enthusiast and engineer, Lansing established the groundwork for a company that would influence future generations' perceptions of movies and music. JBL branched out into portable speakers, automobile sound systems, and consumer audio throughout the years. As per Samsung Export Data by Import Globals, JBL joined Harman International in 1969, and in 2017, Samsung Electronics paid $8 billion to purchase the company. JBL benefited greatly from this transaction since it was able to access Samsung's extensive marketing reach, R&D resources, and global distribution network.

How JBL Speakers Are Produced: Worldwide Production and Supply Chain

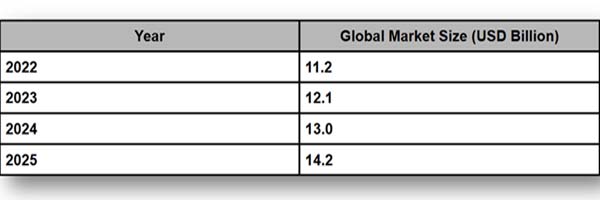

Global Portable Speaker Market Size

JBL has a very global production presence despite its American roots. As per China Import Export Trade Data by Import Globals, the majority of its well-known portable speakers are made in China, which continues to be the world's largest electronics assembly center because of its extensive factory network, highly qualified workforce, and sophisticated logistics. In addition to China, JBL also has manufacturing facilities in Mexico, Hungary, India, and Brazil, all of which were picked to cater to local and regional markets while lowering shipping and tariff expenses. JBL can expand production effectively because of the production model's heavy reliance on OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) relationships.

China, South Korea, and Japan are the main suppliers of necessary parts such as drivers, circuit boards, Bluetooth chips, and rechargeable batteries. JBL's supply chain is resilient due to its integrated network, but as recent global disruptions like COVID-19 and semiconductor shortages have demonstrated, reliance on a small number of core countries can present risks. To mitigate these risks, JBL is expanding its assembly operations in other regions and diversifying its suppliers.

Export and Import Patterns: Worldwide Trade Information

A close examination of the trade figures shows how widespread JBL's global presence is. This may be tracked using HS Code 851821, which pertains to portable or single loudspeakers. For instance, importing shipping records from reliable databases like Zauba and Seair shows that in recent years, India alone imported more than USD 57 million worth of JBL speakers under this category. As per China Import Data by Import Globals, China was the source of nearly all of these exports, highlighting the country's importance as JBL's industrial hub. Globally speaking, the majority of exports of wireless and portable speakers come from China.

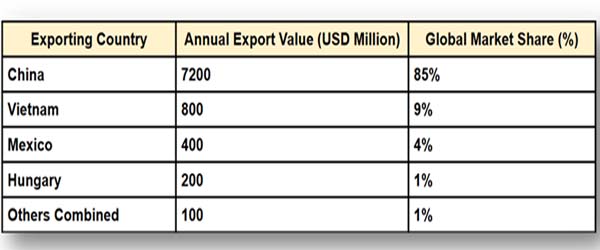

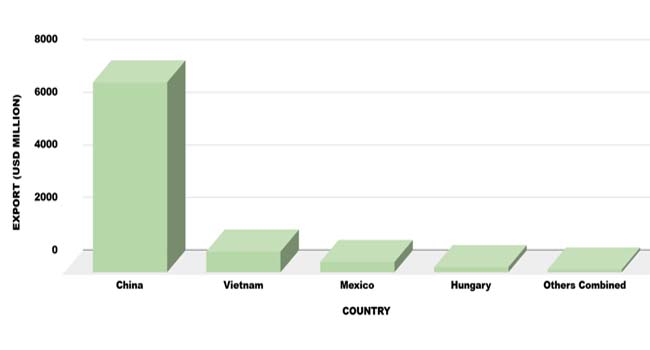

Top Exporting Countries for Portable/Wireless Speakers

As per USA Import Trade Analysis by Import Globals, with tens of thousands of units shipped monthly to the US, Europe, India, Southeast Asia, and Latin America, China leads by a significant margin, according to data from UN Comtrade and Volza. A speaker that is unboxed in Mumbai, London, or São Paulo has probably begun its trip in a Chinese manufacturer, gone through intricate customs processes, and then arrived at shops via local distribution networks, as this flow demonstrates.

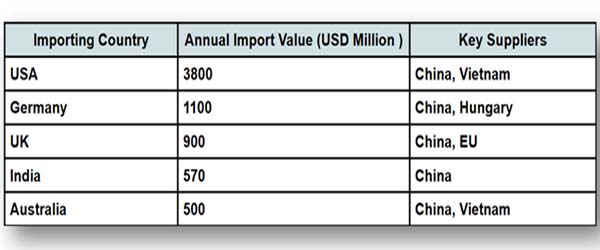

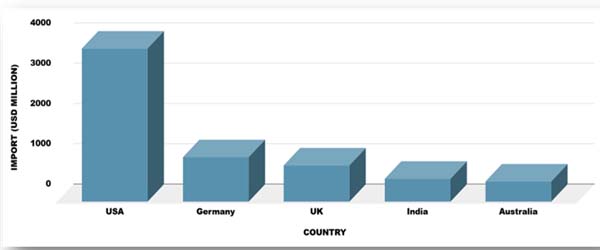

Top Importing Countries for Bluetooth/Wireless Speakers

Top Markets: The Destinations of JBL Speakers

Although JBL has clients on every continent, some areas are particularly important. Due to the strong demand for outdoor and home audio equipment, the US continues to be one of its biggest markets. As per Europe Export Data by Import Globals, a significant portion of JBL's exports comes from Europe, especially Germany, the UK, and France, where customers are lured to the brand's harmony of affordability, robustness, and sound quality. Another major market for JBL sales is India.

JBL's Flip, Go, and Charge models thrive in the nation because of its expanding middle class, youthful, tech-savvy populace, and passion for portable music. The need for durable, battery-operated speakers is fueled by festivals, street parties, and a thriving outdoor culture in Southeast Asia and Latin America, two more potential locations. As per Europe Import Data by Import Globals, the bigger PartyBox series has established a niche in Europe and North America for those who seek concert-level volume at house parties and gatherings, while the Flip and Go series is popular in Asia because of their mobility and cost.

Components and Sourcing: Unprocessed Materials in International Commerce

A standard JBL speaker is much more than just a speaker cone enclosed in a plastic casing. Precision drivers that transform electrical impulses into audible sound, Bluetooth modules that facilitate wireless communication, specialized printed circuit boards (PCBs) that manage signal processing, and large-capacity lithium-ion batteries that sustain music playback for hours are all found behind the grille. As per Asia Import Trade Statistics by Import Globals, the majority of these parts come from the extensive electronics supply chain in Asia.

Advanced microchips and battery cells are supplied by South Korea and Japan, but PCB assembly and final assembly are dominated by Chinese providers. This chain of events demonstrates how trade restrictions, taxes, and even the closure of a Shenzhen plant may affect other markets, such as the US or India, and cause delays in shipments. Cost, quality, and supply security are all carefully balanced in JBL's worldwide sourcing strategy, a constant struggle as technological conflicts and environmental issues change the face of international electronics commerce.

The global Speaker market is Competitive

Despite being a leader, JBL competes in a very competitive market. In the portable speaker industry, companies like Marshall, Bose, Sony, and Ultimate Ears (by Logitech) compete for consumers' attention. Every rival has advantages; Bose is known for its superior audio clarity, Sony for its deep bass tuning, and Ultimate Ears for its extreme mobility and robustness. Nonetheless, as per JBL Import Shipment Data by Import Globals, JBL has an advantage because of its extensive product line, affordable prices, and widespread availability. Industry experts like Import Globals predict that the growing desire for wireless entertainment, improved battery technology, and streaming services that keep users connected to their playlists all day long will propel the worldwide wireless speaker industry to a stable 5–8% compound annual growth rate.

Global Trade Patterns and Difficulties

Over the years, JBL has had to deal with fluctuating trade winds, just like any other company with a significant international presence. As per the USA Import Export Trade Analysis by Import Globals, many electronics businesses have been compelled to reconsider their reliance on Chinese production as a result of the US-China tariff issues. To better serve the Americas and Europe, JBL's parent company, Harman International, has responded by diversifying manufacturing through the expansion of facilities in Mexico and Hungary. Another element that has grown is sustainability.

Customers are expecting firms to utilize recyclable materials, cut down on packaging waste, and increase the energy efficiency of their products. This translates into more robust batteries, eco-friendly enclosures, and lighter speaker designs. Customers' preferences are also shifting; they want smart homes with multi-room connections, durable, waterproof models for outdoor use, and stylish accessories like LED party lights and app-controlled music settings. To keep up with these changing demands, JBL has updated its Flip, Charge, and PartyBox lineups.

The Path Ahead: Prognosis & Strategic Perspective

JBL's growth prospects are still bright for the future. As per Vietnam Export Import Global Trade Data by Import Globals, more people switch to wireless audio, emerging economies like Vietnam, Indonesia, India, and portions of Africa offer enormous possibilities. JBL is looking for local assembly agreements that assist in reducing import duties and expedite delivery timeframes to access these markets at a reasonable cost. Also at the forefront is product innovation. Longer battery life, improved Bluetooth range, AI-based sound calibration, and integration with smart assistants are just a few of the ways the company is improving its speakers. Additionally, JBL has access to cutting-edge technology that rivals frequently find difficult to match thanks to Harman's strong parentage under Samsung. These benefits, along with its well-established brand loyalty, put JBL in a strong position to confidently ride the next wave of international audio trade.

Conclusion

There is a complex network of international trade that goes into each JBL speaker that is unwrapped at a party or packed for a camping trip. JBL's success is based on effective supply chains, astute sourcing, and unrelenting product innovation, whether it is in the production hotspots of China or on the busy retail shelves in New York, London, or Mumbai. One beat, one shipment, and one party at a time, JBL's trade narrative is poised to become more widely known as technology develops and the demand for portable wireless audio rises globally. Import Globals is a leading data provider of JBL import export trade data. Subscribe to Import Globals to get more details on global trade!

FAQs

Que. Who owns JBL?

Ans. JBL is owned by Harman International, which is a subsidiary of Samsung Electronics.

Que. Where are JBL speakers made?

Ans. Primarily in China, but also in Mexico, Hungary, India, and Brazil.

Que. Which countries import JBL speakers the most?

Ans. The USA, Germany, India, the UK, and Southeast Asian nations are among the top importers.

Que. What is JBL’s best-selling product line?

Ans. The Flip and PartyBox series are especially popular globally.

Que. Is the wireless speaker market growing?

Ans. Yes, market analysts forecast a steady 5–8% annual growth rate for the global portable speaker segment.

Que. Where can you obtain detailed JBL Import Export Global Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.