- Jul 23, 2025

Leading Corn Exporters in 2024–2025: The United States Retakes the Lead

Corn is essential to contemporary life, from feeding millions of cattle to powering the ethanol blend in your automobile. However, as per USA Import Data by Import Globals, the tale of who produces, sells, and purchases it is more dramatic than you may imagine. That plot revolves around record harvests, limited supplies, and a fierce competition between two agricultural giants, Brazil and the United States, for the top slot in 2024–2025.

Why is corn still the Most Popular?

In addition to being a food grain, corn is the world's largest feed grain. In order to feed billions of chickens, pigs, and cattle, the livestock industries in North America, Asia, and Europe depend on inexpensive, abundant maize. In the meanwhile, more than 30% of the U.S. crop is converted into ethanol, which powers automobiles across the Americas.

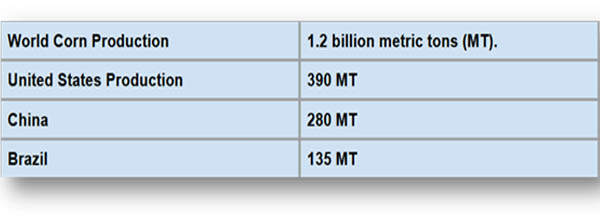

As per USA Export Data by Import Globals, this marketing year, more than 1.2 billion metric tons of maize are anticipated to be produced worldwide by farmers. However, not all exporters do so. For instance, China, the second-largest producer in the world, preserves almost all of its crop to feed its people and animals. Therefore, a small group of powerful exporters accounts for a large portion of the global grain trade balance.

Global Corn Production Snapshot

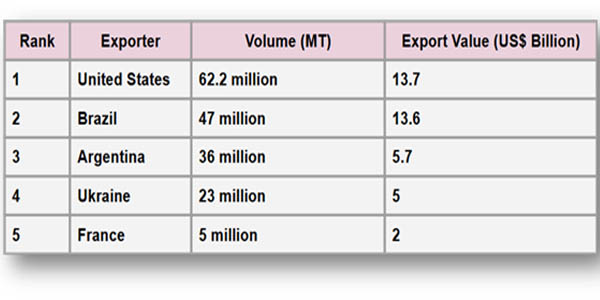

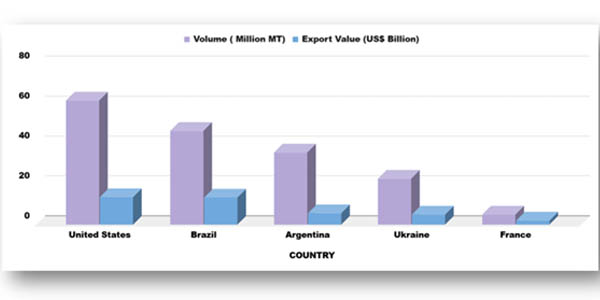

The Five Nations That Provide Corn for the World

Top 5 Corn Exporters

Currently, about 80% of the grain that crosses borders annually is sent out of five nations. At the top is the United States, which is predicted to export over 62 million metric tons in the 2024–2025 season, regaining its position as the largest provider in the world. Following closely after is Brazil, as per USA Import Export Trade Data by Import Globals, which has increased production significantly over the last ten years as a result of its "little harvest," or "safrinha," a second crop that farmers grow immediately after soybeans.

Argentina continues to occupy its customary third position. Argentina continues to be a vital supply for Asian feedlots despite economic difficulties and export tariffs that irritate its farmers. Ukraine continues to outshine itself by sending maize over the Black Sea whenever it can, even in the face of the continuous conflict. France, the main exporter of grain in Europe, completes the top five. France supplies the EU's enormous animal industry.

Inside the Corn Empire in America

Why, therefore, does the US continuously dominate this international trade? It all boils down to logistics, science, and scalability. As per USA Import Custom Data by Import Globals, America's Corn Belt, which consists of a large area of Iowa, Illinois, Nebraska, and nearby states where enormous fields consistently provide bumper harvests, is the most productive region in the world.

According to a July 2025 assessment by the Import Globals on USA Import Trade Analysis, the country would produce over 15.7 billion bushels of corn overall, which is still enormous by any measure but somewhat less than initial projections because of dry spells in several Midwestern regions. Approximately 99% of this season's export obligations were already booked by early July, and around a sixth of that yield will be exported abroad.

Another major factor contributing to American corn's dominance is infrastructure. In the fall, farmers gather corn, store it in hundreds of silos throughout the Midwest, and then transport it to major ports like New Orleans via highways, railroads, and rivers. Grain is loaded into ocean vessels headed for Mexico, Japan, South Korea, and other destinations after barges with yellow kernels float down the Mississippi.

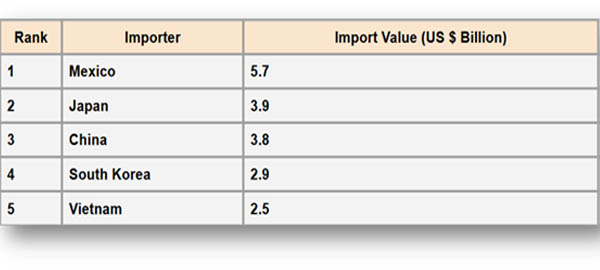

Why and Who Purchases American Corn

Top 5 Corn Importers

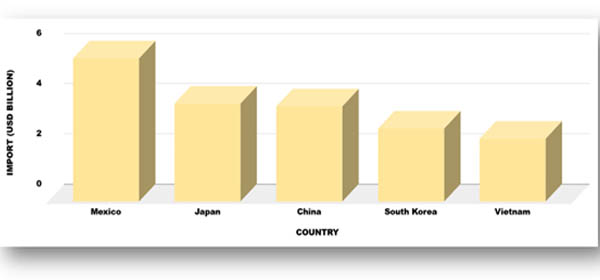

Mexico has a stronger connection to American corn than any other nation. Mexico is anticipated to buy around $5.7 billion worth of U.S. corn this year alone, which accounts for approximately 40% of total U.S. grain exports. South of the border, as per Mexico Export Data by Import Globals, livestock feedlots depend on this consistent supply, which has grown so important that even disagreements over genetically modified maize haven't been able to halt the flow.

Japan comes next after Mexico. The island government purchases billions of dollars' worth of feed grain annually from American farmers because it lacks the area to produce enough for its big pig and poultry industries. As per USA Import Data even when larger consumers like China reduce imports, the United States maintains its position by having Colombia, South Korea, and Canada round out the top five destinations for American maize.

The Green Giant on America's heels is Brazil.

The United States continues to lead, but Brazil is catching up. Double-cropping is a skill that Brazilian farmers have perfected, growing a second crop of corn, known as "safrinha," immediately after soybeans are harvested. As per USA Import Trade Statistics by Import Globals, Brazil's overall maize output is predicted to reach 132 million metric tons this year, with exports estimated to reach 47 million metric tons, a significant increase from ten years ago due to excellent weather and strong worldwide demand.

However, Brazil's infrastructure remains a weakness. Roads in farm-heavy regions like Mato Grosso are generally in bad repair, and port congestion can block shipments during peak export season. This makes it possible for American corn to fill up the gaps, particularly when feed mills in Mexico or Japan require timely delivery.

The Additional Heavyweights

With almost 36 million metric tons shipped outside this season, Argentina is still a significant participant. Although local farmers are frustrated by the nation's high inflation and stringent export levies, as per Argentina Import Shipment Data by Import Globals, Argentina is still among the top three. Farmers in Ukraine are still overcoming obstacles. An estimated 23 million metric tons of maize, a crucial source for Europe's feed markets, have been transported this year despite the dangers of carrying grain over the Black Sea during a period of war.

Additionally, France secretly transports millions of tons annually around the EU, while being frequently eclipsed by its larger neighbors. French and Ukrainian grain are essential to the successful operation of livestock and poultry farms in Europe.

Firm Prices, Tight Stocks: An Analysis

Don't assume that all of this maize will translate into low costs. Except for China's enormous stockpiles, global grain supplies are at their lowest point in almost thirty years. As per USA Import Export Trade Analysis, the stocks-to-use ratio in the United States is currently at its lowest level in years, at about 9.6%. Because of this, maize futures on the Chicago Board of Trade have stabilized, which is good news for American farmers who had to contend with poor prices for a portion of 2023–2024. The stakes are high: purchasers may rush to lock in grain at higher prices if weather-related issues or trade tensions further restrict supplies.

What Does the Corn Trade Have in Store?

The most significant concern for the future is whether Brazil can surpass the United States as the world's top exporter of corn. It's just a matter of time, according to some analysts, if Brazil can repair its ports and roadways. Others contend that America has an incomparable advantage due to its solid trade agreements and dependable infrastructure.

The future of Ukraine depends on the security of the corridor and the war. Additionally, as per USA Export Import Global Trade Data by Import Globals, because limited inventories offer little room for error, price volatility will continue to be the norm for purchasers worldwide. In the meantime, every kernel harvested faces further competition due to the growing demand for corn-based biofuels worldwide.

Conclusion

Environmental expenses associated with high-yield corn cultivation include soil erosion, fertilizer runoff, and GMO controversy, which is driving a drive for more environmentally friendly methods. As per USA Import Export Global Data by Import Globals, to maintain the Corn Belt's productivity for future generations, American farmers are making investments in carbon-smart soil management, precision technologies, and cover crops. Despite not making as much news as lithium or oil, corn is a vital commodity that supports billions of jobs, keeps automobiles running, and feeds animals worldwide. The United States continues to dominate corn exports in 2024–2025, although it's unclear how long it will keep this position.

Import Globals is a leading data provider of United States import export trade data. Subscribe to Import Globals to get more global trade details!

FAQs

Que. What port ships the most U.S. corn?

Ans. Mostly the Gulf Coast, especially New Orleans.

Que. Does Mexico buy the most?

Ans. Yes, Mexico is the top buyer of U.S. corn by far.

Que. Is U.S. corn genetically modified?

Ans. Roughly 90% of U.S. corn acres are GM, designed for high yield and pest resistance.

Que. Who sets corn prices?

Ans. Futures markets like the Chicago Board of Trade influence prices globally.

Que. What’s the biggest risk ahead?

Ans. Weather volatility, Brazil’s expansion, and trade policy shifts- any of these could reshuffle the leaderboard.

Que. Where can you obtain detailed United States Import Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.