- Jul 31, 2025

Lithium Batteries Global Trade: Market Overview, Analysis, and Forecast

As per Import Data By Import Globals, Lithium-ion batteries are essential to the worldwide transition to sustainability, powering everything from computers and smartphones to electric vehicles (EVs) and renewable energy grids. They are considerably superior to conventional battery technologies because of their small size, high energy density, extended cycle life, and quick charging capabilities. Lithium batteries have become essential in several industries, including automotive, electronics, aerospace, and renewable energy, as demand for environmentally friendly, energy-efficient solutions rises.

Because of its strategic significance in the global economy, lithium batteries are more than just a scientific advancement. Countries are vying to engage in large-scale battery manufacturing, establish a reliable lithium supply chain, and lessen their reliance on fossil fuels. As per Lithium Batteries Export Data by Import Globals, Lithium batteries are not simply a commodity but also a key component of international trade agreements, industrial strategy, and global policy as climate goals become more pressing. Their increasing significance is demonstrated by the battery market's exponential expansion, which is changing the dynamics of commerce and putting battery-producing nations and businesses at the forefront of the energy revolution of the twenty-first century.

Understanding Lithium Batteries: Definition, Types, and Applications

Lithium batteries are rechargeable energy storage devices that use lithium ions to move between the anode and cathode through an electrolyte. This ion movement generates electrical energy during discharge and reverses during charging. Their key advantages over traditional batteries include:

High energy-to-weight and energy-to-volume ratio Low self-discharge rate.

Long cycle life and efficiency

No memory effect (can be charged anytime without losing capacity)

Lightweight and compact design, ideal for portable electronics

There are several types of lithium-ion batteries, each designed for specific applications:

- Lithium Cobalt Oxide (LCO): Commonly used in smartphones, laptops, and cameras.

- Lithium Iron Phosphate (LiFePO?): Known for safety and long life, used in solar storage and electric buses.

- Lithium Nickel Manganese Cobalt Oxide (NMC): Widely used in electric vehicles due to balanced performance.

- Lithium Manganese Oxide (LMO): Used in power tools and medical devices for high thermal stability.

- Lithium Titanate (LTO): Offers fast charging and excellent safety, ideal for aerospace and military use.

Applications:

- Consumer electronics (phones, laptops, cameras)

- Electric vehicles (EVs) and e-bikes

- Renewable energy storage systems (solar and wind)

- Power tools, drones, and wearable tech

- Aerospace, defense, and medical equipment

As per Import Export Trade Data by Import Globals, these features and applications make lithium batteries essential in the global transition toward electric mobility and sustainable energy.

Components and Quality Standards

The performance, safety, and energy capacity of lithium batteries are all influenced by several essential parts. The cathode, which is usually composed of lithium cobalt oxide (LCO), lithium nickel manganese cobalt oxide (NMC), or lithium iron phosphate (LiFePO?), controls the voltage and capacity of the battery. Graphite, which typically makes up the anode, holds lithium ions while it is being charged. The electrolyte, a lithium salt dissolved in an ion-flow-allowing solvent, is located between the anode and cathode. Ion movement is permitted by the separator, a thin porous membrane that blocks direct contact between the anode and cathode. As per Import Custom Data by Import Globals, to guarantee performance and safety, a Battery Management System (BMS) is integrated to track temperature, voltage, and charge levels.

Strict quality requirements and certifications have been put in place to satisfy the expanding demand for dependable and safe lithium batteries worldwide. Thermal stability, cycle life (normally 1000+ charge-discharge cycles), and energy density (generally 150–250 Wh/kg) are important quality factors. International safety and performance requirements like ISO 9001 (quality management), IEC 62133 (portable battery safety), and UN 38.3 (transportation safety) must be followed by manufacturers. Furthermore, certifications such as RoHS (Restriction of Hazardous Substances) and UL (Underwriters Laboratories) guarantee that batteries fulfill local regulatory standards. In addition to ensuring consumer safety, upholding high standards is essential for facilitating global trade and obtaining cross-border regulatory approvals.

Product Analysis

As per Import Trade Analysis by Import Globals, the market for lithium batteries has grown rapidly worldwide as a result of increased demand from industries including consumer electronics, renewable energy storage, and electric vehicles (EVs). With manufacturers concentrating on enhancing energy density, charging speed, and safety, the product landscape is changing quickly. Leading the market are advanced chemistries like NMC (Nickel Manganese Cobalt) and LFP (Lithium Iron Phosphate), each of which has unique advantages: LFP provides cost-effectiveness and thermal stability in grid storage, while NMC offers great performance in EVs. Large-scale deployment is now more feasible due to the average cost of lithium-ion battery packs decreasing from over $1,100 per kWh in 2010 to about $137 per kWh in 2024.

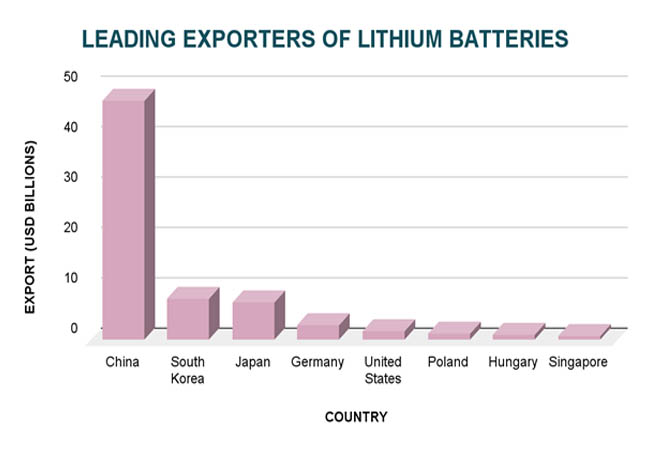

Top Exporter Countries of Lithium Batteries

Because of its enormous manufacturing capacity, strong supply chain, and government support for battery technology, China has the lion's share of the worldwide lithium battery export market. China vastly outpaced other nations in 2023, exporting lithium batteries valued at almost $47.5 billion. With $8.2 billion and $7.6 billion in exports, respectively, South Korea and Japan come in second and third, powered by big businesses like Panasonic, Samsung SDI, and LG Energy Solution. With the help of local gigafactory projects and the expansion of the electric car industry, European nations like Germany and Poland are also becoming important exporters. As per Export Data by Import Globals, the increase in exports is a result of both deliberate attempts to meet the expanding demand worldwide, particularly from North America and Europe, and technological leadership.

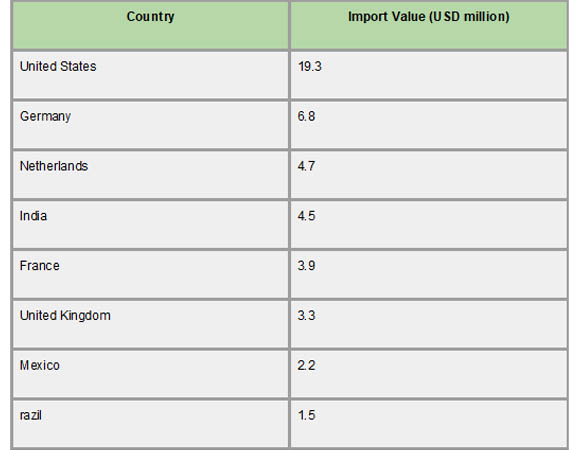

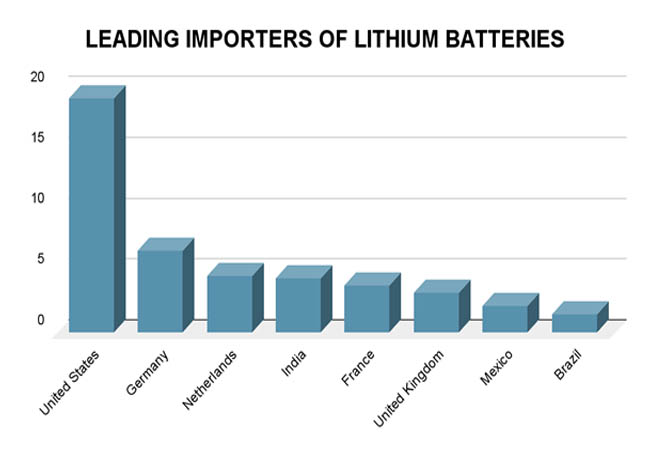

Top Importer Countries of Lithium Batteries

The United States stands as the world's largest importer of lithium-ion batteries, driven by its expanding electric vehicle (EV) market and increasing demand for energy storage solutions. In 2023, the U.S. imported approximately $13.1 billion worth of lithium-ion batteries from China alone, accounting for about 70% of its total imports in this category. As per Import Data by Import Globals, other significant importers include Germany, the Netherlands, and India, each bolstering their energy storage capacities to meet renewable energy targets and support EV adoption. This surge in imports reflects a global trend where nations are striving to secure reliable battery supplies to facilitate their transitions toward sustainable energy and transportation systems.

Major Manufacturing Hubs and Companies

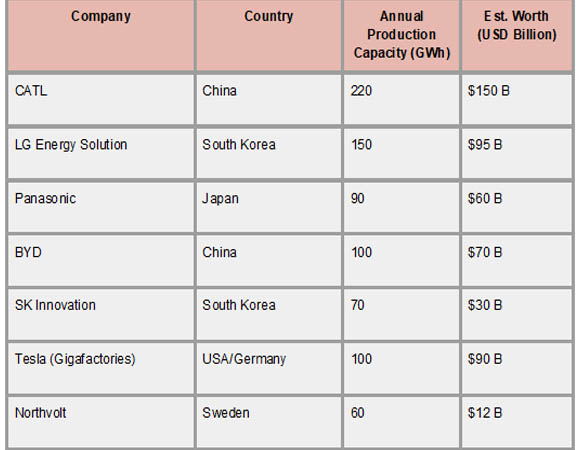

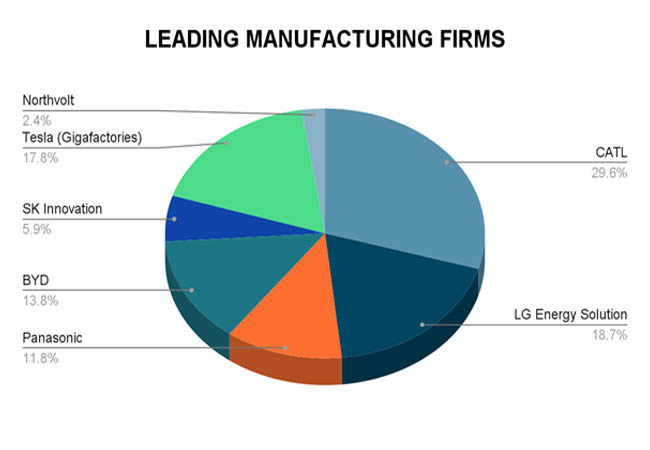

The production of lithium batteries is mostly centered in East Asia, especially in China, South Korea, and Japan, which account for more than 85% of global output. With a massive supply chain, easy access to resources, and substantial government subsidies, China is the clear leader and home to industry titans like CATL (Contemporary Amperex Technology Co. Ltd.) and BYD. As per Import Trade Statistics by Import Globals, major manufacturers like Samsung SDI and LG Energy Solution are based in South Korea, while Panasonic, which is well-known for its alliance with Tesla, is still a competitor in Japan. These businesses promote innovation in battery chemistry, energy density, and safety technologies in addition to controlling manufacturing volume.

In addition to Asia, new production centers in North America and Europe are expanding quickly. As per Import Shipment Data by Import Globals, global movement to localize battery manufacture and lessen dependency on Asian imports includes Tesla's Gigafactories in the United States and Germany, Northvolt in Sweden, and ACC (Automotive Cells Company) in France. These producers are spending billions of dollars on gigafactories, which can produce between 40 and 220 gigawatt hours per year. Their objective is to satisfy the rapidly increasing demand for energy storage devices, industrial applications, and electric automobiles. With an annual production of more than 220 GWh and a market capitalization of more than $150 billion as of 2024, CATL is the industry leader and sets the standard for rivals everywhere.

Manufacturing Process and Sourcing

The sourcing of raw materials such as lithium, cobalt, nickel, graphite, and manganese, mostly mined in nations like Australia (lithium), the Democratic Republic of the Congo (cobalt), and China (graphite), is the first of several complex steps in the production of lithium batteries. As per Import Export Trade Analysis By Import Globals, Cathodes and anodes, the electrode materials, are made from these refined materials. Slurry mixing, electrode coating, drying, calendering, cell assembly, electrolyte filling, formation cycling, and aging/testing are all steps in the production process. Module and pack assembly comes next, where battery management systems are connected with individual cells. Strict humidity regulations, cleanroom conditions, and sophisticated automation are necessary for both quality and safety.

Strategic Implications of Lithium Battery Trade

The international commerce in lithium batteries has significant strategic ramifications since it touches on industrial strategy, geopolitical influence, and energy security. Countries that produce the majority of batteries, especially China, have considerable influence over global supply chains, especially as the demand for digital devices, electric cars, and renewable energy storage surges. As per Export Import Global Trade Data, Policy solutions such as the EU's Battery Regulation and the US's Inflation Reduction Act, which seek to localize battery supply chains and lessen reliance on imports, have been prompted by this industry concentration. Control over the sale of lithium batteries affects not just economic competitiveness but also environmental objectives, military preparedness, and the global switch to clean energy.

Forecast Trends (2025–2030)

The market for lithium-ion batteries is expected to grow significantly between 2025 and 2030 due to the growing popularity of consumer electronics, renewable energy storage systems, and electric vehicles (EVs). Demand is expected to rise at a compound annual growth rate (CAGR) of almost 33%, from about 700 GWh in 2022 to over 4.7 TWh by 2030. The main drivers of this increase include growing consumer preference for greener technologies and regulatory changes that support sustainability, such as the U.S. Inflation Reduction Act and the EU's "Fit for 55" program. As per Import Export Global Data by Import Globals, most of this demand is anticipated to be met by the electric vehicle industry; estimates suggest that by 2030, up to 90% of passenger car sales in some nations may be EVs.

Conclusion

Lithium batteries have become a cornerstone of the modern energy landscape, driving the transition toward cleaner, more sustainable technologies across transportation, consumer electronics, and renewable energy storage. Their complex supply chains, advanced manufacturing processes, and evolving product technologies underscore their strategic and economic importance on a global scale. As demand continues to surge, countries and companies that invest in innovation, sustainable sourcing, and localized production will shape the future of this critical industry. Navigating the challenges of raw material availability, environmental impact, and geopolitical competition will be key to unlocking the full potential of lithium batteries in powering the world’s low-carbon future.

If you are looking for detailed and up-to-date Lithium Batteries Export Data, You Can Contact Import Globals.

FAQs

Que. What is the HS code for lithium batteries?

Ans. The HS code for lithium-ion batteries is 85076000.

Que. Which country exports the most lithium batteries?

Ans. China is the largest exporter, accounting for over $47 billion in 2023.

Que. What is the biggest application of lithium batteries?

Ans. Electric vehicles (EVs) are the largest consumers of lithium batteries.

Que. Are lithium batteries recyclable?

Ans. Yes, but the global recycling infrastructure is still developing and needs improvement.

Que. Which companies lead lithium battery production globally?

Ans. Top producers include CATL, LG Energy Solution, Panasonic, Tesla, and BYD.

Que. Where to obtain detailed Lithium Batteries Import Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Lithium Batteries Import Data.