- Jul 16, 2025

Malawi’s Export Engine: Data, Destinations, and Strategic Pathways

According to Import Globals' Malawi Export Data, the country's export profile is largely influenced by agricultural goods, particularly tobacco, tea, and groundnuts, as more than 80% of its population works as subsistence farmers. Malawi is nevertheless actively involved in regional and global trade despite logistical and infrastructure issues, working to diversify its exports and lessen its reliance on a small number of essential goods.

Malawi's export economy has fluctuated between 2020 and 2024 due to internal economic reforms, climate variability, and global market dynamics. Understanding the nation's export performance, key trading partners, and product categories becomes crucial as it navigates through the post-pandemic recovery and changing global trade patterns, according to Malawi Import Data. Malawi's export patterns over the last five years are examined in this blog, along with in-depth data analysis, key products categorized by strategic ramifications, and projections for future trade.

General Economy of Malawi

The majority of Malawi's workforce is employed in agriculture, which accounts for around 80% of the country's GDP. The main agricultural products of Malawi, according to the Malawi Import Export Trade Data from Import Globals, are tobacco, maize, tea, sugarcane, and groundnuts. Because of its landlocked location, Malawi is mostly dependent on its neighbors for access to seaports, which makes trade logistics difficult and expensive. Furthermore, the economy is susceptible to natural disasters like floods and droughts, which frequently impair food security and agricultural production.

With an emphasis on energy, education, and manufacturing, Malawi has made strides in recent years toward infrastructure development and economic diversification. But according to Import Globals' Malawi Import Custom Data, the economy still faces challenges like a large dependency on donor help, a high level of state debt, and a low level of industrial output. The government has been carrying out reforms targeted at macroeconomic stability, inflation control, and fiscal discipline in collaboration with global organizations such as the World Bank and the IMF. Despite these initiatives, structural problems in the transportation, healthcare, and educational sectors continue to limit sustainable growth.

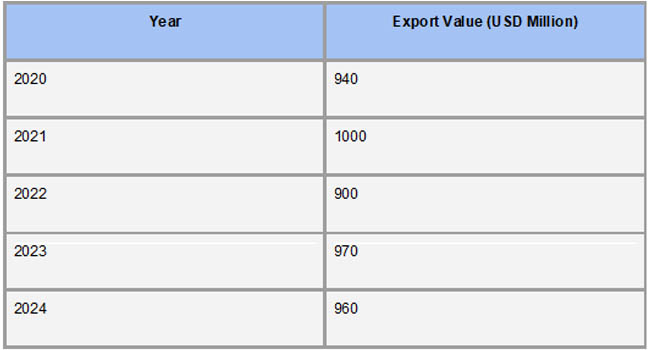

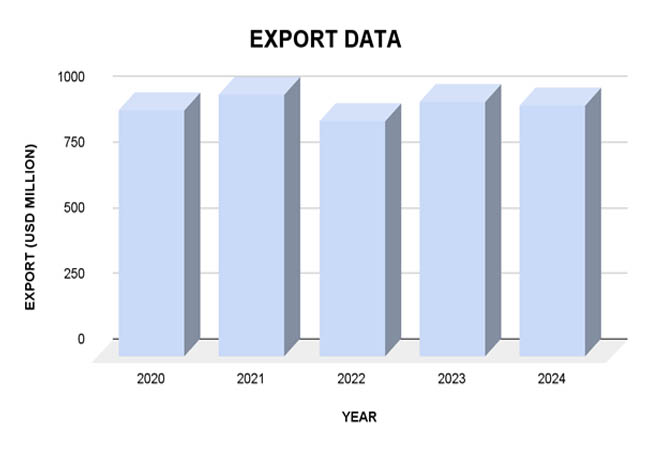

Export Data of Malawi

Malawi's export economy fluctuated between 2020 and 2024 due to changes in domestic economic reforms, climate, and international market dynamics. The value of exports increased from about $782 million in 2020 to $1.02 billion in 2021. But in 2022, it dropped to $941 million, and in 2023, it increased slightly to $965 million. Exports are expected to stay at $960 million in 2024, according to preliminary forecasts. These differences highlight the nation's reliance on agricultural commodities and the influence of outside influences on trade performance, according to Import Globals' Malawi Import Trade Analysis.

With unmanufactured tobacco exports at $447 million in 2023, tobacco continues to be Malawi's top export, making up about 46% of total export value. Other notable exports include tea ($72 million), sugar ($43 million), edible vegetables and some roots and tubers ($100 million), oil seeds and oleaginous fruits ($102 million), and tea. According to Import Globals' Malawi Export Data, these commodities show the nation's emphasis on agriculture and its susceptibility to changes in the price of commodities globally.

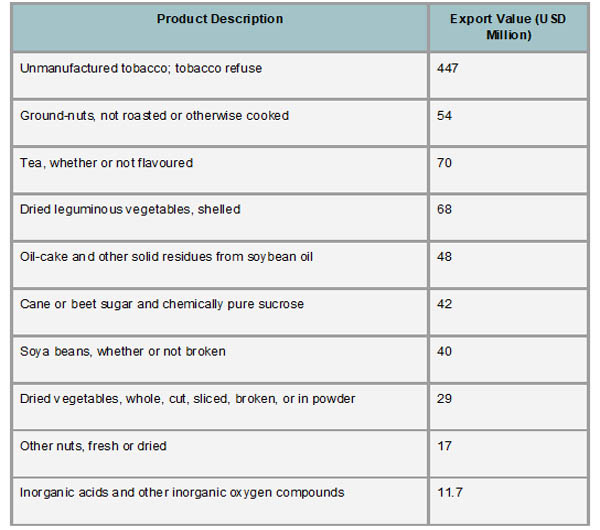

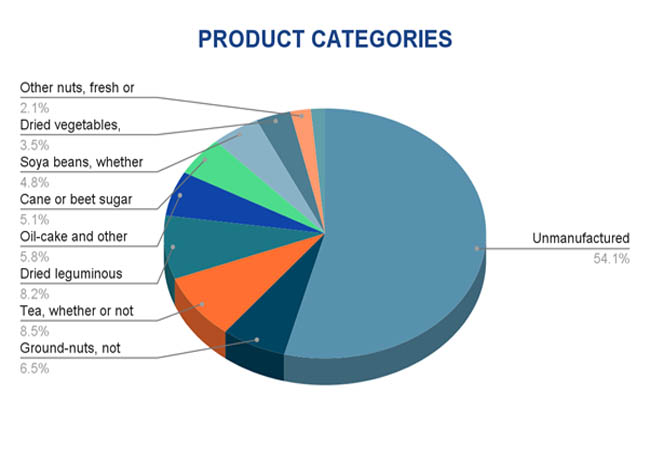

Malawi Export Product Categories

The majority of Malawi's export economy is based on agriculture, and it is heavily dependent on a small number of important agricultural products. Unmanufactured tobacco (HS Code 2401) continued to be the most important export in 2023, making for about 46% of the overall export value, or $447 million. Tea (HS Code 0902), dried leguminous vegetables (HS Code 0713), and groundnuts (HS Code 1202) are other noteworthy agricultural exports, with $70 million, $68 million, and $54 million, respectively. These numbers highlight the nation's reliance on primary agricultural products for foreign exchange revenues, according to Malawi Import Data From Import Globals.

In addition, Malawi exports soybeans (HS Code 1201) for $40 million, sugar (HS Code 1701) worth $42 million, and oil-cake from soybean oil extraction (HS Code 2304) worth $48 million. Additional exports include inorganic compounds (HS Code 2811) at $11.7 million, different nuts (HS Code 0802) at $17 million, and dried vegetables (HS Code 0712) at $29 million. According to Import Globals' Malawi Import Trade Statistics, these goods together significantly contribute to Malawi's export portfolio diversification, even if they each make up a lower amount.

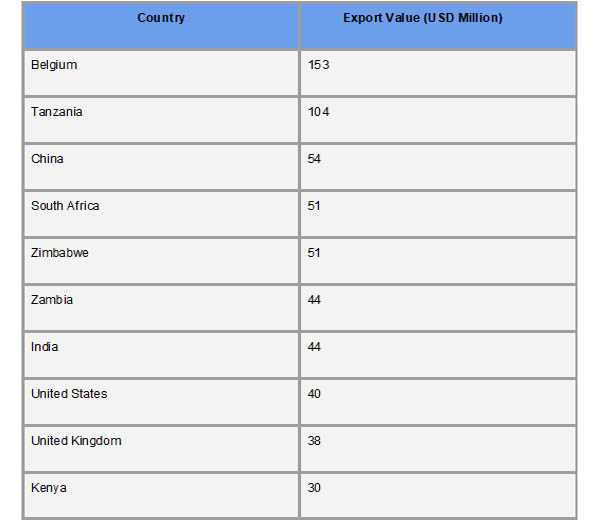

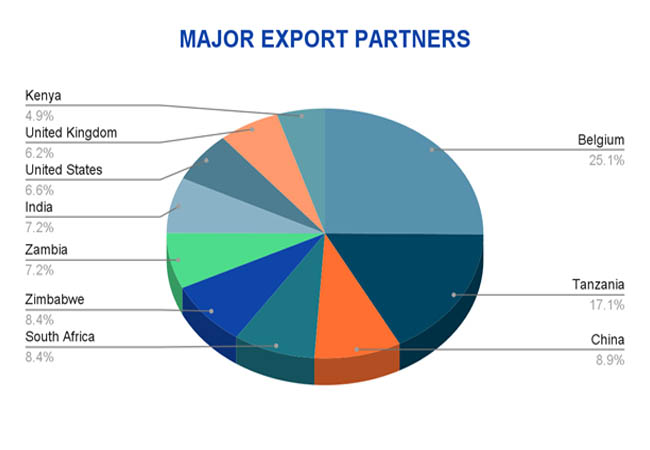

Major Export Destinations

A wide variety of trading partners from Europe, Africa, Asia, and North America defined Malawi's export economy in 2023. With about 15.9% of all exports, or $153 million, going to Belgium, it became the top destination. South Africa came in at 5.4% ($51.7 million), China at 5.6% ($54 million), and Tanzania at 10.8% ($104 million). Other noteworthy partners included Zimbabwe (5.3%), Zambia (4.7%), India (4.6%), the United States (4.2%), the United Kingdom (4%), and Kenya (3.2%), according to Malawi Import Shipment Data From Import Globals.

Agricultural products like tobacco, tea, groundnuts, and legumes make up the majority of the export profile to these nations. For example, Tanzania received enormous amounts of edible vegetables and oilseeds, whereas Malawi supplied Belgium with mostly unmanufactured tobacco. To meet its demand for plant-based protein sources, China imported soybean meal and dried legumes. According to Import Globals' Malawi Import Export Trade Analysis, South Africa imported a range of goods, such as oilseeds, nuts, and edible fruits.

Strategic Implications

Malawi has both strategic and economic dangers due to its over-reliance on a small number of agricultural exports, especially tobacco. Due to this concentration, the nation is susceptible to changes in demand, shifting international rules, particularly those of tobacco, and volatility in worldwide prices. As a result, Malawi's export revenues may fluctuate, which could affect both economic stability and foreign exchange profits. Furthermore, Malawi's landlocked status results in higher transportation and logistics costs, which lowers its competitiveness in international markets and emphasizes the urgent need for better infrastructure and trade facilitation with neighboring countries, according to Malawi Export Import Global Trade Data by Import Globals.

Malawi must seek diversification by entering value-added processing and looking into markets outside of its traditional partners to create a more robust and sustainable export economy. Both domestic job possibilities and the value of exported goods can be increased by investing in agro-processing industries. Additionally, according to Import Globals' Malawi Import Export Global Data, leveraging trade agreements and fortifying regional trade links can improve market access and lessen reliance on a small number of nations. In the upcoming years, strategic infrastructure upgrades, such as electricity supply and transportation corridors, will also be essential to reducing export costs and increasing Malawi's competitiveness in international trade.

Forecast Trend: Trade Predictions

Over the next five years, Malawi's export industry is expected to develop somewhat, assuming favorable agricultural circumstances and well-timed economic changes. A resurgence in agricultural output and rising private consumption are expected to propel real GDP growth to roughly 3.5% in 2025. It is anticipated that this expansion would improve export results, especially for tobacco and other agricultural products.

With ongoing advancements in important industries including mining, services, and agriculture, the economy is expected to grow even more in 2026. Sustained export growth, however, may be threatened by issues like infrastructure deficiencies, climate variability, and global economic concerns. To increase Malawi's export competitiveness and achieve long-term economic stability, strategic investments in market diversification, infrastructure expansion, and value-added processing will be essential.

Conclusion

Malawi’s export economy remains heavily anchored in agriculture, with tobacco and related products dominating its trade landscape. While export values have shown resilience from 2020 to 2024, the country faces significant challenges, including limited product diversification, infrastructure constraints, and vulnerability to external shocks. Strategic efforts focused on value addition, market expansion, and improved logistics are essential for Malawi to strengthen its global trade position. With sustained reforms and investment, Malawi has the potential to achieve more stable and inclusive economic growth through its export sector in the coming years.

If you are looking for detailed and up-to-date Malawi Export Data, You Can Contact Import Globals.

FAQs

Que: What is the primary export from Malawi?

Ans: In 2023, tobacco accounted for over 46% of Malawi's total export earnings, making it the country's top export.

Que: Which nations are Malawi's major export destinations?

Ans: China, South Africa, Tanzania, Belgium, and Zimbabwe were the major export destinations in 2023.

Que: What changes have you seen in Malawi's export performance recently?

Ans: From 2020 to 2024, Malawi's export values ranged from $0.90 billion to $1.00 billion, reflecting both internal difficulties and international market conditions.

Que: How can Malawi strengthen its export-based economy?

Ans: Important tactics for boosting Malawi's export sector include diversifying export goods, making value-added investments, upgrading infrastructure, and investigating new markets.

Que. Where to obtain detailed Malawi Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Malawi Export Data.