- Jul 24, 2025

Naphtha Exports: The Quiet Foundation of the World's Petrochemical Industry

However, as per Global Import Data by Import Globals, naphtha, an essential industrial workhorse, subtly powers our contemporary lives daily. It is the unseen force behind thousands of commonplace items, such as synthetic textiles, automobile bumpers, and plastic packaging. As 2025 approaches, the naphtha trade is in the news due to factors including changing geopolitics, rising Asian demand, and the intensifying competition between conventional oil products and alternative feedstocks like ethane and propane.

This comprehensive analysis looks at naphtha imports and exports, price-setting variables, and prospects in this vital but sometimes disregarded industry.

Why Does Naphtha Matter and What Is It?

A light, flammable liquid combination known as naphtha is distilled during the processing of natural gas or crude oil. It is a bridge that connects gasoline and crude oil. It is a crucial part of the gasoline blending process used by refiners. More significantly, naphtha is broken down by massive petrochemical companies into lighter olefins, particularly ethylene and propylene, which are used as the raw materials for synthetic rubber, plastics, and resins.

The world's plastics industry would come to a complete stop without naphtha. As per Export Data by Import Globals, more than 40% of the feedstock for petrochemicals in Asia, where steam crackers are common, is naphtha, which is significantly more versatile and volumetrically superior to ethane and propane.

Trade Data Snapshot

Who Are the Leading Exporters of Naphtha in the World?

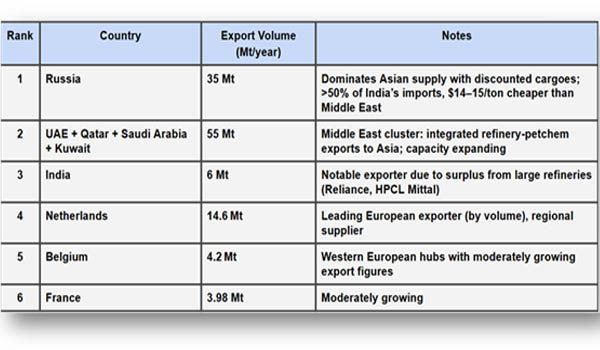

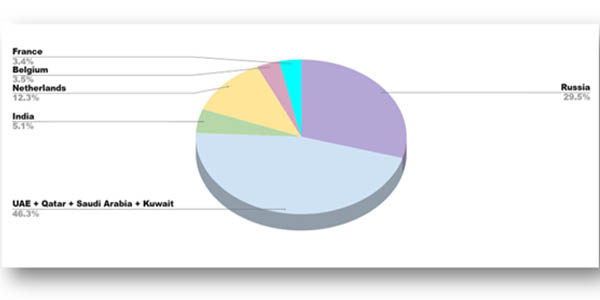

Currently, Russia is the world's top exporter of naphtha. As per Russia Import Export Trade Data by Import Globals, a sanctions problem has been transformed into an export opportunity by Russian refiners in 2024–2025. Russia has strengthened its relations with Asia, while European consumers have reduced their direct purchases of Russian crude and oil products. It now exports cheap naphtha cargoes to South Korea, China, Japan, and India, all of which need feedstock at reasonable prices.

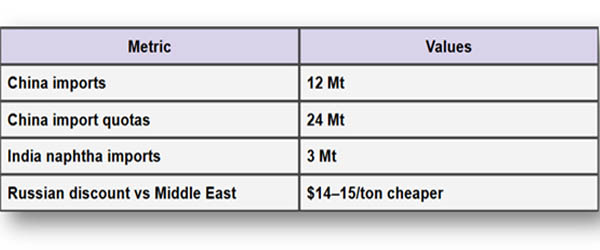

According to recent trade statistics, Russia supplies more than 30 to 35 million tons of naphtha a year, accounting for over one-fifth of the world market. With more than 50% of India's imports last year, Russia has finally surpassed the United Arab Emirates as the country's biggest naphtha supplier, according to Import Globals.

Top Naptha Exporters

As a whole, the Middle East is not far behind. The market has traditionally been controlled by the United Arab Emirates, Qatar, Saudi Arabia, and Kuwait. These nations manufacture excess naphtha for export by utilizing large integrated refinery-petrochemical hubs, such as Saudi Arabia's Yanbu complex and Qatar's Ras Laffan. As per Import Custom Data by Import Globals, the production of the area is being further increased by the expansion of refineries in Kuwait (al-Zour) and Oman (Duqm). As additional cargoes compete for customers, analysts at Argus Media predict that the Middle East's new capacity would probably limit naphtha premiums in Asia.

It's noteworthy to see that India plays both sides. It is becoming a tiny but significant exporter, even though it imports a lot to fulfill the need for petrochemicals at home. When local demand declines or profits overseas rise, major refiners like Reliance Industries and HPCL Mittal frequently send excess naphtha cargoes to Southeast Asia and Europe.

Europe makes a more specialized but steady contribution. Re-export centers include nations like the Netherlands and Belgium, which send refined naphtha to neighboring markets or inside Europe, where short-haul supply outperforms long-distance rivalry.

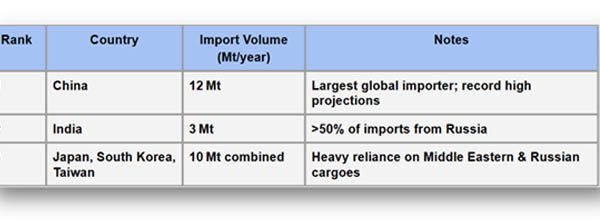

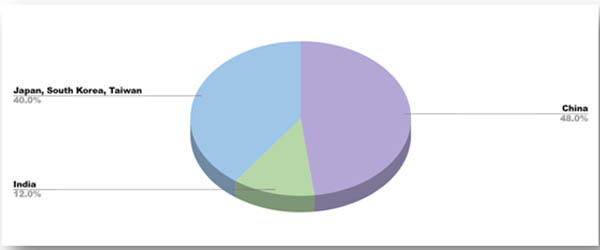

Who Purchases This Much Naphtha?

China is without a doubt the primary source of the world's naphtha imports. It has a huge appetite that is just getting bigger. As new mega steam crackers come online, analysts predict that China's naphtha imports will reach a record 16–17 million tonnes in 2025, up from around 12 million tonnes in 2024. Giants like Sinopec, PetroChina, and international joint ventures like Ineos are in charge of massive projects in Tianjin, Longkou, and Zhenhai that are all intended to support the nation's unrelenting plastics and chemicals sector.

Additionally, there is a geopolitical twist. As per USA Import Trade Analysis by Import Globals, the lingering effects of the trade war between the United States and China are contributing to China's diversification of its feedstock sources. For Chinese petrochemical manufacturers, naphtha is a more reliable alternative due to higher taxes and uncertainty surrounding American propane and ethane.

Top Naptha Importers

In contrast, India continues to be the second-largest importer of naphtha in Asia. In the most recent fiscal year alone, it hauled in over 3 million tonnes. It's remarkable how India's purchasing habits have changed: a few years ago, just 15% of its imports were Russian cargoes; today, they account for over half. The fact that Russian barrels are typically $14–15 per tonne less expensive than comparable Middle Eastern imports is a prime example of cost advantage.

Other significant purchasers include industrial superpowers Taiwan, South Korea, and Japan, which have no domestic crude reserves but a massive capability for steam cracking. As per Global Import Export Data by Import Globals, to keep their petrochemical factories operating efficiently, they mostly depend on regular naphtha supplies from Russia and the Middle East.

Southeast Asia is also involved. Although it doesn't generate much naphtha directly, Singapore serves as a key center for regional storage and re-export. Through Singapore's top-notch bunkering and terminal facilities, traders mix, store, and reroute goods.

What Affects Naphtha Costs?

Naphtha prices follow benchmarks for crude oil, much as those of all other oil products. However, refining margins, supply-demand fluctuations, and feedstock rivalry all provide additional levels of complexity.

Throughout much of 2024 and the first part of 2025, margins in Asia, the largest naphtha market in the world, have remained persistently narrow. S&P Global Commodity Insights reports that naphtha cracking margins were significantly lower than the record levels observed during the post-pandemic boom, ranging from $5 to $17 per tonne above gasoline.

Why was it squeezed? It's a perfect storm: downstream demand hasn't increased as quickly as anticipated, and new petrochemical factories are coming online. As per Russia Export Data by Import Globals, refineries in Russia and the Middle East have increased their output in the meantime, filling Asia with low-cost cargoes. As a result, dealers' and refiners' profit margins are reduced, supply is abundant, and demand is cautious.

The increasing popularity of alternative feedstocks makes matters more difficult. Asian crackers can shift some capacity away from naphtha when ethane and propane are readily available and reasonably priced, particularly in the United States. However, trade tensions have complicated this delicate balancing act. According to Global Import Export Trade Data by Import Globals, many importers now prefer to lock up secure, multi-year naphtha contracts from the Middle East or Russia because of the impending levies on US LPG shipments to China.

Geopolitics: The Unpredictability

One thing about the naphtha trade that never changes is how quickly geopolitics can change the course of events. As per USA Import Data by Import Globals, traders are on edge due to supply chain vulnerabilities, tit-for-tat tariffs between the U.S. and China, and sanctions on Russia.

One of the best examples is Russia's shift to Asia. Russian producers swiftly courted Indian and Chinese consumers with significant discounts after being rejected by European refiners. Trade routes were altered by that deal, which made it harder for Middle Eastern exporters to compete and pushed the UAE down on India's list of suppliers. In addition, China's restrictions on LPG imports from the United States have unintentionally increased the demand for naphtha as a more dependable alternative.

The naphtha market will continue to fluctuate in the future due to possible new tariffs, refinery expansions in the Middle East, and the slow energy shift to cleaner feedstocks.

What Will Happen to Global Naphtha Next?

Particularly in Asia, the short-term picture calls for moderate demand growth and stable supply. China's enormous new crackers are here to stay, and the demand for naphtha is still strong due to the emergence of new petrochemical zones in Southeast Asia and India.

But there are dangers in the market. As per Import Trade Statistics by Import Globals, Petrochemical profits may decrease if the market for downstream polymers slows down or if recycling regulations become more stringent. Naphtha's share might be squeezed if trade ties between the United States and China improve and feedstock tastes shift back toward propane and ethane.

Both merchants and refiners are keeping a careful eye on the balance. Asian consumers are currently in a stronger position due to cheap pricing and excess supply. However, nothing in the energy markets remains constant for very long. Naphtha's worth might increase rapidly if oil prices rise, geopolitical tensions worsen, or other feedstocks become more expensive.

Important Takeaways

According to Russia Import Shipment Data by Import Globals, Russia has overtaken the Middle East as the world's leading naphtha exporter, regaining market share.

China is still the country that imports naphtha at the quickest rate in the world, thanks to trade changes and massive new cracker capacity.

India has increased its reliance on low-cost Russian cargoes to keep its plastic manufacturers fueled and save money.

Strong Asian demand keeps the floor stable despite the strain on margins from the influx of new supply.

Energy policy and geopolitics will continue to be major factors, which might redraw the trade map in the years to come.

Import Globals is a leading data provider of global import export trade data. Subscribe to Import Globals to get more details on global trade!

FAQs

Que. What is naphtha mainly used for?

Ans. Naphtha is primarily used as a feedstock in steam crackers to produce key petrochemicals like ethylene and propylene, which are then turned into plastics, resins, and synthetic materials. It’s also blended into gasoline to boost octane levels.

Que. Which country exports the most naphtha?

Ans. As of 2024–2025, Russia is the world’s top naphtha exporter, supplying major Asian markets like China, India, Japan, and South Korea, often at discounted prices compared to Middle Eastern suppliers.

Que. Who are the biggest importers of naphtha?

Ans. China is the largest importer, forecast to buy around 16–17 million tonnes in 2025 due to new petrochemical capacity. India, Japan, South Korea, and Taiwan are other major buyers.

Que. Why is the naphtha trade important globally?

Ans. Naphtha trade is crucial because it fuels the global petrochemical supply chain. It links crude oil refining with plastic manufacturing, so shifts in its supply, price, or trade routes directly impact industries worldwide.

Que. Where can you obtain detailed IMPORT EXPORT TRADE ANALYSIS?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.