- Jul 11, 2025

Peru’s Export Economy: An Overview

Peru's economy depends on a diverse export portfolio and is well-known for its extensive mineral reserves, lush agricultural fields, and developing infrastructure. According to Import Globals' Peru Import Custom Data, the nation is essential to meeting global demand for both raw materials and high-quality agricultural goods, from fresh fruits like avocados and grapes to gold and copper. Peru's geographical diversity, which includes coastal plains and Andean highlands, enables it to supply a broad range of commodities to international markets.

Despite political and economic difficulties, Peru has seen a considerable resurgence in commerce in the post-pandemic period (2020–2024). With the help of increased foreign investment, strategic trade agreements, and new infrastructure like the Chancay megaport, the export industry has emerged as a key driver of national development. With China, the United States, and Canada as its top trading partners, Peru's export growth is indicative of both its resource potential and its changing position in the global supply chain, according to Import Globals' Peru Import Trade Analysis.

General Analysis of Peru’s Economy: Resilience and growth over the years

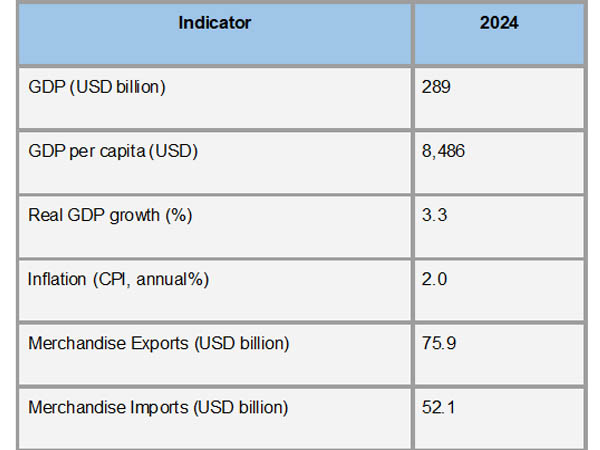

Despite obstacles like the COVID-19 pandemic and political unrest, Peru's economy has proven resilient and growing over the last five years. According to Import Globals' Peru Export Data, the GDP of the nation increased from $206 billion in 2020 to $289 billion in 2024, with a noteworthy 13.4% recovery in 2021 after contracting by -10.9% in 2020. Additionally, GDP per capita grew from $6,329 in 2020 to $8,486 in 2024. Averaging 3.5% in the ten years before 2024, inflation stayed within control and is predicted to level off at about 2% in 2025. In 2024, the unemployment rate dropped from 13.8% in 2020 to 5.5%.

According to Import Globals' Peru Import Data, the budget deficit was 3.6% of GDP in 2024, over the 2.8% fiscal rule limit. However, it is anticipated to drop to 2.5% in 2025 and 1.8% in 2026. At about 34%, the debt-to-GDP ratio did not change. The monetary policy rate in Peru increased from 3.50% to 5.00% at the end of 2024. Between the end of 2014 and the end of 2024, the Peruvian sol fell 21.1% versus the US dollar.

Export Data of Peru

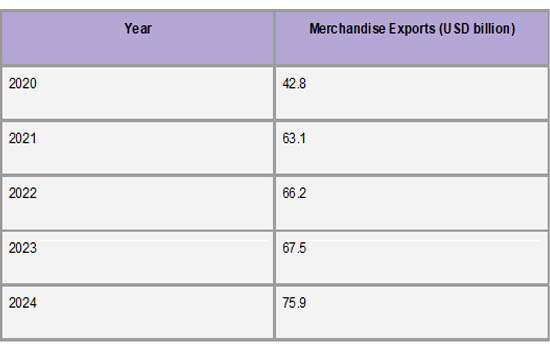

Peru's abundant mineral resources and growing agricultural output have propelled the country's export industry's notable expansion between 2020 and 2024. Exports recovered from the global decline brought on by the COVID-19 pandemic in 2020, reaching USD 42.8 billion. The demand for commodities like copper and gold soared, causing exports to soar to USD 63.1 billion by 2021. This upward trend persisted, with exports hitting USD 66.2 billion in 2022 and USD 67.5 billion in 2023, according to Import Globals' Peru Import Trade Statistics. Peru's exports hit a record high of USD 75.9 billion in 2024, which was a major turning point in its history of commerce.

Peru's key position in international trade, particularly in supplying vital minerals and agricultural products, is shown by the steady development in exports. According to Import Globals' Peru Import Shipment Data, this upward trend has been facilitated by export commodity diversification and market expansion. Peru is now more competitive internationally thanks to trade agreements and infrastructure expenditures that have also made exporting easier.

Peru's key position in international trade, particularly in supplying vital minerals and agricultural products, is shown by the steady development in exports. According to Import Globals' Peru Import Shipment Data, this upward trend has been facilitated by export commodity diversification and market expansion. Peru is now more competitive internationally thanks to trade agreements and infrastructure expenditures that have also made exporting easier.

Export Product Categories of Peru

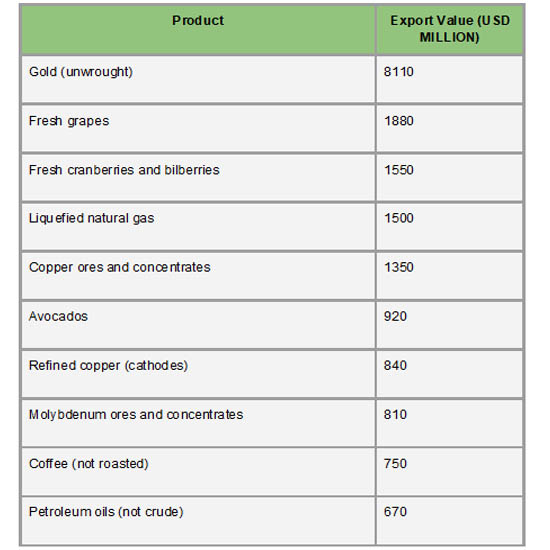

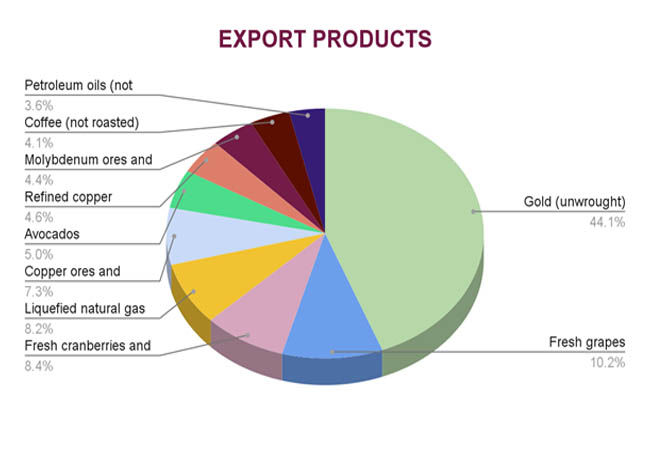

With ores, slag, and ash (HS Code 26) leading at $26.9 billion in 2023, or 41.9% of total exports, Peru's mining industry dominates the country's export portfolio. According to Import Globals' Peru Import Export Trade Analysis, gold and other precious metals and stones (HS Code 71) came in second at $8.7 billion (13.5%). With coffee, tea, and spices (HS Code 09) at $1.14 billion (1.8%) and edible fruits and nuts (HS Code 08) at $5.5 billion (8.5%), agricultural products have experienced a notable increase. Fish and other aquatic invertebrates (HS Code 03) provided $1.4 billion (2.1%) to the export mix, while mineral fuels and oils (HS Code 27) contributed $4.4 billion (6.8%).

The inclusion of petroleum oils (HS Code 2710) at $2.06 billion and refined copper (HS Code 7403) at $2.79 billion further demonstrates the variety of Peru's exports. At about $1.99 billion and $1.76 billion, respectively, fresh grapes (HS Code 0806) and other fruits (HS Code 0810) have also grown in importance. This diversification is a reflection of Peru's strategic attempts to grow its agricultural sector, with a target of $40 billion in agricultural exports by 2040, according to research by Import Globals on Peru Export Import Global Trade Data.

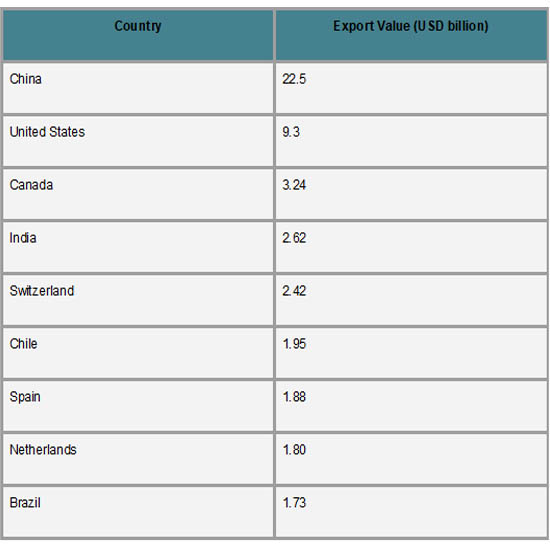

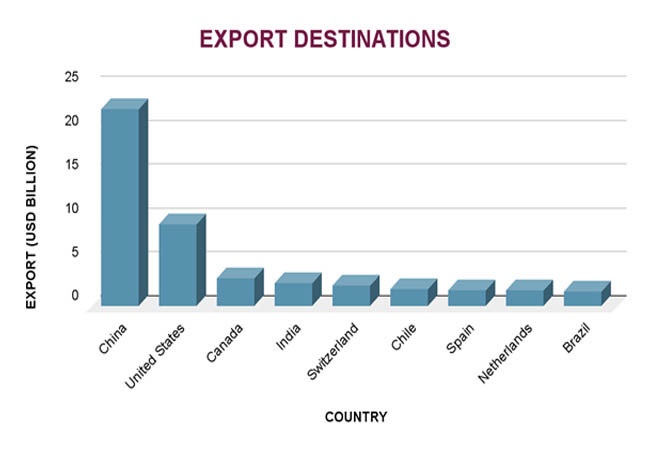

Major Export Destinations Of Peru

Peru's economic contacts with important international partners have a big impact on its export environment. China became the top market for Peruvian exports in 2023, receiving 35% of the country's total export value, or over USD 23 billion. Canada came in second with 4.64% (USD 2.98 billion) and the US with 14.2% (USD 9.18 billion). Other noteworthy destinations included India (3.92%), South Korea (3.64%), Japan (3.44%), Chile (2.02%), Spain (2.92%), the Netherlands (2.79%), and Brazil (2.68%), according to Import Globals' Peru Import Export Global Data.

Peru's strategic place in the global market is highlighted by these trade patterns, especially concerning the export of agricultural and mineral products. The United States' position emphasizes varied trade, including agricultural products, while China's sizeable portion reflects its thirst for Peru's mineral resources. Peru's growing influence in the international export market is further demonstrated by the presence of nations like Canada and India.

Peru's Principal Producing Regions

Peru's varied topography, which includes Amazonian rainforest, Andean highlands, and coastal plains, supports a wide range of economic activities in all of its areas. Producing cotton, avocados, grapes, and other commodities, the coastal regions, especially Ica, Piura, and Lima, are major export destinations for agriculture. Because of their abundance of mineral resources, the Andean highlands, which include areas like Arequipa, Cusco, and Puno, are essential to Peru's mining sector. Despite being less developed, the Amazonian region has the potential for sustainable development because of its contributions to forestry and agriculture. This regional specialization highlights Peru's economic diversity and the significance of customized development strategies for each region, according to Peru Export Data.

Peru's varied production sectors are a result of its diversified topography.

Mining Areas:

- The Yanacocha mine: It is the biggest gold mine in South America, and is located in Cajamarca.

- Pataz (La Libertad): As per Peru Export Data by Import Globals, it has prominent gold production, despite illicit mining operations.

- The Antamina mine, a significant supplier of copper and zinc, is located in Ancash.

Agricultural Areas:

- Ica: Known for producing asparagus and grapes.

- Piura: Grows lemons and mangoes.

- La Libertad: Prominent blueberry farm.

Strategic Implications

Peru's export performance has important strategic ramifications for its stance in international trade as well as its home economy. Due to its significant reliance on mineral exports, especially to China, the nation is susceptible to changes in the price of commodities globally as well as external demand shocks. Peru is actively attempting to reduce this risk, though, by diversifying its exports, particularly in the manufacturing and agricultural sectors. Chinese-backed infrastructure initiatives like the Chancay megaport are intended to provide access to Asian markets and solidify Peru's position as a Pacific logistical center. Furthermore, its involvement in significant trade agreements like the Pacific Alliance and the CPTPP strengthens its integration into global value chains, drawing in foreign capital and fostering long-term economic stability.

- Mining Sector: According to Import Globals' Peru Import Data, mining generates export income, but there are also serious risks associated with issues like illegal mining and environmental concerns, particularly in areas like Pataz.

- Agricultural Exports: Diversification is demonstrated by the rise in agricultural exports, such as avocados and grapes. Climate change and water scarcity are still issues, though.

- Infrastructure Development: While enhancing trade routes is the goal of projects like China's $3.6 billion megaport in Chancay, geopolitical concerns are also brought up.

Forecast Trend

- Commodity Prices: Peru's export earnings are anticipated to be supported by the continued strong demand for minerals such as copper and gold on a worldwide scale.

- Agricultural Products: According to Import Globals' Peru Import Export Trade Data, the demand for superfoods and healthful produce around the world points to the sustained increase in exports of goods like avocados and blueberries.

- Economic Outlook: In 2025, Peru's GDP is expected to rise by 4%, with stable inflation of about 2%, suggesting that trade conditions are positive.

Final Thoughts

With important exports like minerals and agricultural goods propelling expansion, Peru's export industry is vital to the nation's economic success. Despite obstacles like political unrest and fluctuations in commodity prices, the nation is well-positioned for long-term prosperity in the global economy thanks to its strategic infrastructure investments and diversification initiatives. Peru is well on its way to solidifying its position as a significant international exporter by concentrating on growing agricultural exports, strengthening trade ties, and advancing logistics. Long-term trade success for Peru will depend on its ability to continue adapting to market demands and global trends.

If you are looking for detailed and up-to-date Peru Export Data, You Can Contact Import Globals.

FAQs

Que: What are the main exports from Peru?

Ans: Gold, copper, avocados, natural gas, and fresh grapes are among Peru's top exports.

Que: To whom do Peru's exports primarily go?

Ans: China, the US, Canada, India, and Switzerland are the main export markets.

Que: Which Peruvian regions are essential for mining operations?

Ans: Three important mining areas are Ancash (Antamina mine), Pataz (La Libertad), and Cajamarca (Yanacocha mine).

Que: How does Peru's economy look in 2025?

Ans: In 2025, Peru's GDP is anticipated to expand by 4% while inflation levels out at about 2%.

Que: Where can to obtain detailed Peru Export Data?

Ans: Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Peru Export Data.