- Jun 19, 2025

Pharmaceuticals Trade of 2024: A Brief Overview of the Global Import and Export Trade

The growing global interest of different importers and exporters in this specific category has promoted the sector as a hot topic of discussion in the global international trade. The Import Globals Global Pharmaceutical Trade Data represents the overall trade environment of the industry, with crucial import and export trade strategies followed by service investment patterns.

Global Pharmaceutical Trade: A Comprehensive Overview of 2024

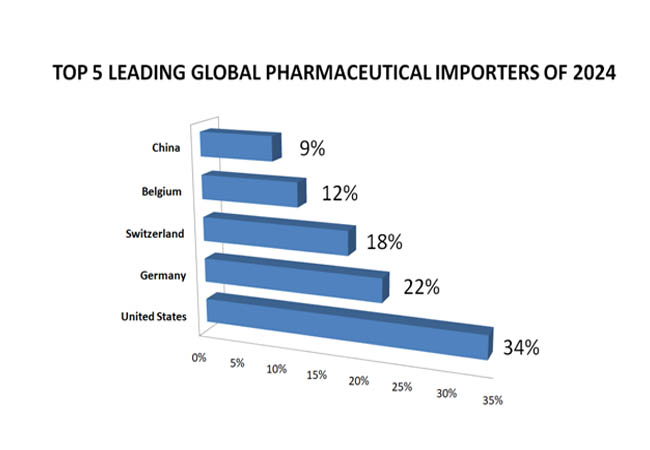

The overall global pharmaceutical industry has recorded significant growth rates in its trade due to increased demand and geopolitical shifts. Amidst the worldwide trade changes, the United States solidified its position as the largest importer of pharmaceuticals with an increase in import rate of 47% year-over-year. The growing demand for ready-to-use medicinal products and the neurological therapies from nations like Ireland have facilitated the US pharmaceutical import surpassing China.

The globally growing aging population and the prevalence of chronic diseases such as diabetes, cancer, and cardiovascular conditions top the list of growing consumer-based demands of medications in a global manner. The innovations in biotechnology, MRA vaccines, and monoclonal antibodies are fostering the expanded treatment options investment of the government authorities through actively importing and exporting the crucial necessities.

India stated itself as a role player in the global pharmaceutical landscape with exports of around 65 billion US dollars in 2024, representing a static 9.6% increase from the previous year. The strong demand for generic formulations and APIs in the United States, the European Union, and Africa promotes the country. India is expected to boost the valuation by around 85 billion US dollars in 2025 and 130 billion US dollars by 2030.

Pharmaceuticals Export Data (2024)

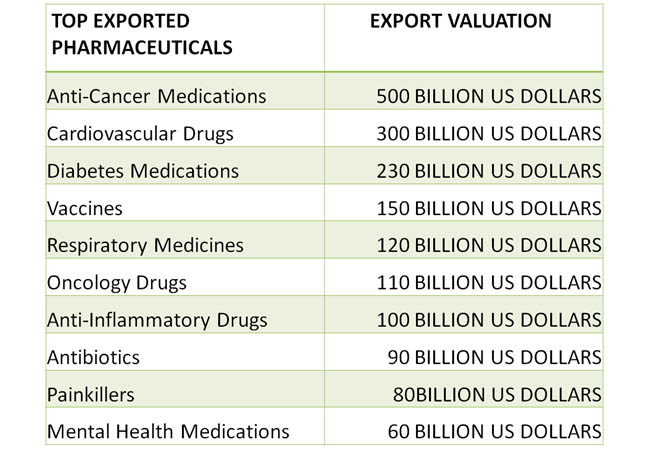

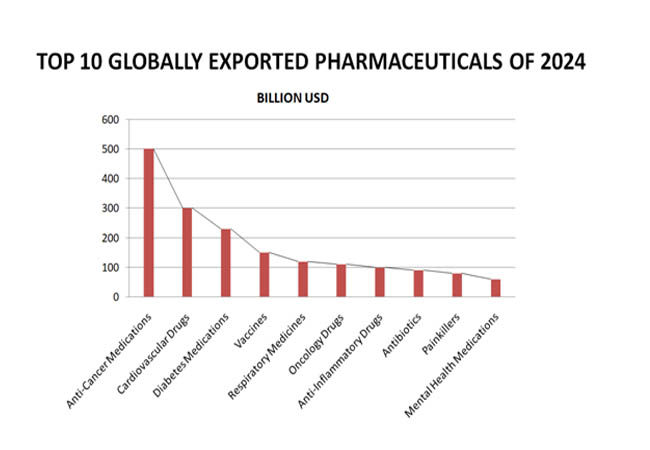

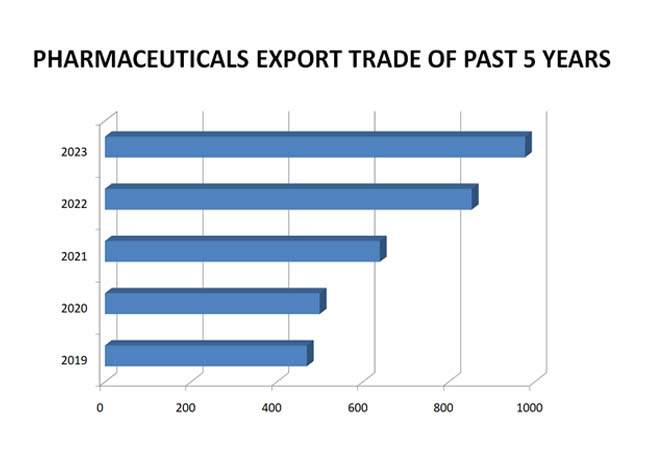

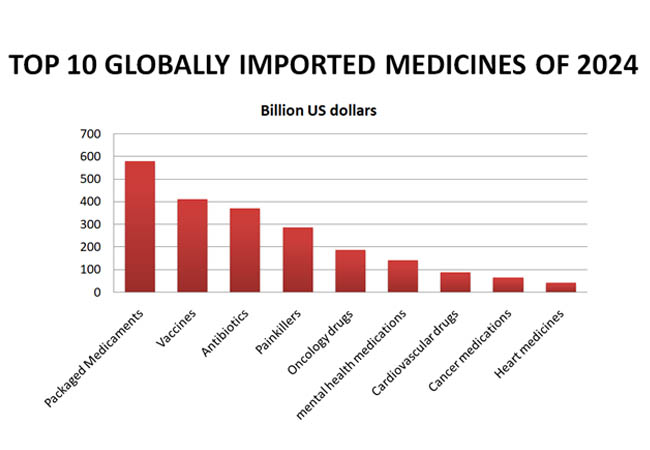

The global pharmaceutical export, driven by increasing demand for medication and advancement in biotechnology, has promoted several industrial sectors as a leading role player in the global economy. The industry has faced challenges due to the U.S. administration's announcement plans to impose tariffs on pharmaceutical imports, but is still on its way to recovering the potential losses, solidifying itself as a leading globally exported commodity worldwide. The export trade of pharmaceuticals reached an annual export valuation worth 1.8 trillion US dollars in 2024, among which vaccines and anti-cancer drugs topped the list by an annual share of 32% and 26% in revenue generation.

The Sturdy Growth of the Global Pharmaceutical Export: Key Players Driving the Surge of 2024

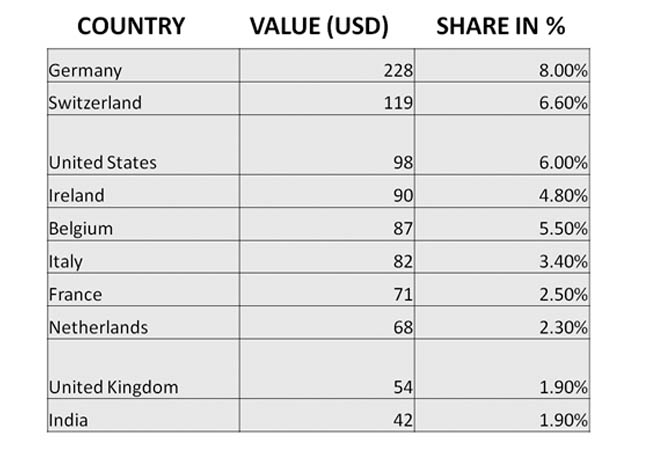

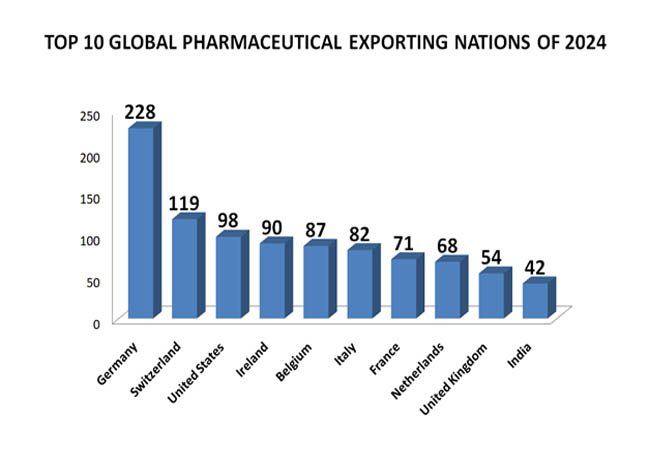

The global pharmaceutical export sector, with a valuation reaching 1.8 trillion US dollars in 2024, has had a significant impact on the international trade market. The exposed vulnerabilities in global pharmaceutical supply chains after the COVID-19 pandemic have encouraged governments to invest in supply chain resilience. This has led to diversity in the manufacturing locations and increased local production capacities for mitigating future disruptions. Germany, the United States, and Switzerland are the resilient impact holders of the global pharmaceutical trade, with an annual share of 42%, 28%, and 22% in 2024. According to the Global Pharmaceutical Trade Data of 2024 by Import Globals, the top 10 role players of the export industry are listed below,

Pharmaceutical Import Data: A Comprehensive Overview of 2024

The pharmaceutical import market of the global international trade has witnessed significant fluctuations in its overall trade valuation, worth a valuation of 1 trillion US dollars in 2024. U.S. pharmaceutical imports surged by 5.8% in 2024, accounting for 20% of all pharmaceutical imports. The spike was mainly driven by imports from Ireland, which overtook China with the largest trade surplus. Germany, Switzerland, and Belgium, like nations, lead the top importing regions. According to the Global Pharmaceutical Import Data, the top 10 leading pharmaceutical importers and imported products of 2024 are,

Opportunities and Challenges of the Global Pharmaceutical Market

The global pharmaceutical industry has faced a mix of challenges and opportunities while shaping its trajectory. The geopolitical tensions and supply chain disruptions, especially due to ongoing conflicts and perfectionist trade policies, are the ones that have created volatility in the movement of active pharmaceutical ingredients.

Intellectual property disputes and approval standards that differ across regions are the ones that continue to hamper the market access and innovation. The high cost of research and development and the scrutiny increased by more than 60% of the drug pricing strategies has made the environment a complexity for the Pharma firms investing in the particular trade.

Despite the hurdles, the pharmaceutical export sector is expected to solidify its position as a leading contributor to global economic growth. With the aging population and the rise in chronic diseases, the biopharmaceutical innovations are still on the road to increasing the employment rate and to counter the annual trade valuation positively.

Conclusion - The Global Pharmaceutical Trade Data by Import Globals demonstrates the strong and resilient impact of the sector on the global economic growth driven by healthcare needs, technological advancement, and expansion of global demand. The geopolitical uncertainties and regulatory challenges are the ones responsible for the increasing exports. Import Globals highlights all the crucial necessities for a sequential trade breakdown of the categorized shipments of pharmaceuticals to help business owners understand the latest strategies for informed decisions based on marketing plans.

FAQ'S

Que. What is the global export trade value of pharmaceuticals in 2024?

Ans. The global export trade value of pharmaceuticals in 2024 is 1.8 trillion US dollars.

Que. What is the top globally exported pharmaceutical of 2024?

Ans. Anticancer medications are the leading exported pharmaceuticals in a global manner of 2024.

Que. What is the import trade value of Global Pharmaceuticals in 2024?

Ans. The global pharmaceutical import trade value stands at 1 trillion US dollars.

Que. Why can we get a detailed trade analysis of the Global Pharmaceuticals Trade of 2024?

Ans. By subscribing to Import Globals, you can get a detailed trade analysis of the global pharmaceutical trade of 2024.