- Jul 25, 2025

Rare Earth Metals: Klein Components, Significant Effect on Global Trade

These 17 elements are not very rare in the Earth's crust, despite their name; rather, their extraction and refinement are expensive, difficult, and strategically delicate. As per rare earth metals import data provided by Import Globals, rare earth elements (REEs) have quietly emerged as one of the world's most important and disputed commodities as countries compete to be the leaders in cutting-edge electronics and green technology.

Rare Earth Elements: What Are They?

The 15 lanthanides, together with scandium and yttrium, are considered rare earth elements. For items like permanent magnets, rechargeable batteries, catalysts, lasers, and advanced military hardware, their distinct magnetic, luminescent, and electrochemical qualities render them indispensable. Since they are necessary for high-performance magnets used in wind turbine generators and electric vehicle (EV) motors, terbium, praseodymium, dysprosium, and neodymium are some of the most traded rare earth elements (REEs).

About 120 million tonnes of rare earth reserves have been found worldwide, with major resources in China, Vietnam, Brazil, Russia, India, Australia, and the US, according to the export data by Import Globals.

What Is the Origin of Rare Earths?

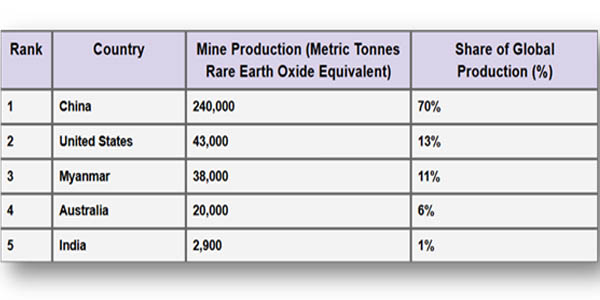

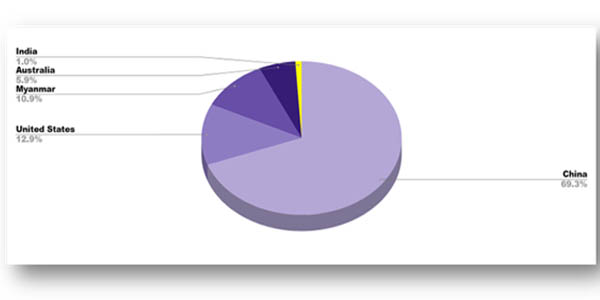

Although reserves are found in numerous nations, China has long controlled the world's supply. According to the Import Export Trade Data by Import Globals, China accounted for about 90% of the world's refining capacity and roughly 70% of the world's mined rare earth output in 2023. The United States is ranked second, mostly due to the production of over 43,000 tonnes of rare earth oxide equivalent in 2023 from MP Materials' Mountain Pass mine in California, which is all sent to China for separation and refinement.

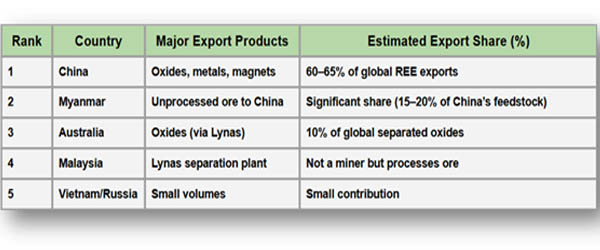

Outside of China, the biggest producer in the world is Lynas Rare Earths Limited, based in Australia. Russia, India, and Myanmar also generate significant amounts, although they have little capability for processing. As per Import Custom Data by Import Globals, China's supremacy is strengthened by the fact that many nations are forced to export raw concentrates to it due to a lack of local separation plants.

Who Buys and Sells in Global Trade Flows?

There is no simple mine-to-market route for rare earth metals. After being mined and partially processed, ore is usually sent, frequently back to China, for ultimate separation into high-purity metals and individual oxides.

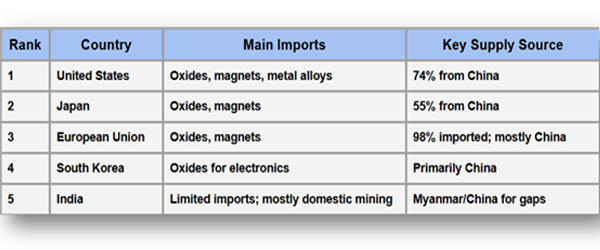

In 2023, as per Import Trade Analysis by Import Globals, China accounted for over 74% of the United States' imports of rare earths, with the other sources coming from Estonia, Malaysia, and Japan. In a similar vein, the European Union imports almost all of its magnets and rare earth metals. China also provides more than half of Japan's supply of rare earth elements.

It's interesting to note that to support its enormous refining industry, China has started to import certain rare earth concentrates, particularly from Myanmar. China refines almost 90% of the world's rare earths, making it the essential link in the global REE chain, according to Export Data by Import Globals.

Major Rare Earth Exporters

Top Rare Earth Importers

Top Rare Earth Importers

Trade disputes and strategic risks

When China suspended deliveries to Japan in 2010 amid a diplomatic disagreement over maritime issues, the world was made acutely aware of how strategically important rare earths are. The action led to a World Trade Organization dispute, shocks to the global supply chain, and a reexamination of reliance by nations such as the US, EU, and Japan.

In 2024, China once more tightened its export regulations. As per Importer Data by Import Globals, companies must get licenses to export heavy rare earths like dysprosium and terbium, which are essential for heat-resistant magnets, under new regulations that go into effect in April 2024. Prices skyrocketed worldwide as a result of these new limitations, forcing consumers to look for alternatives.

In the meantime, as per United States Import Trade Statistics by Import Globals, the US has reinstated duties; starting in 2026, a 25% duty on rare earth magnets produced in China will be in place. In order to increase its capability for producing magnets domestically, India, which possesses the fifth-largest deposits in the world, halted some of its rare earth exports in 2023.

How Global Supply Is Diversifying

Countries are rushing to create robust supply networks in response to supply threats. More than $400 million has been provided by the US government to assist MP Materials in increasing its refining and magnet manufacturing domestically (WSJ). In Australia and Texas, businesses like as Lynas are constructing processing facilities. Other US initiatives, such as Energy Fuels and Aclara, are attempting to recover rare earth elements (REEs) from coal waste or reopen abandoned mines.

As per Import Shipment Data by Import Globals, the Critical Raw Materials Act was introduced by the European Union to reduce dependency on China by at least 65% by 2030. To assure future supply, it has made agreements with countries in Africa, Australia, and Canada. To increase indigenous magnet manufacturing capacity, India has established a production-linked incentive package of Rs 1,345 crore (about USD 160 million).

Another option is recycling; scientists are working on methods to separate neodymium and other important elements from wind turbine blades, e-waste, and outdated magnets.

Market Trends and Forecasts for Rare Earths

The shift to green energy is driving a sharp increase in the demand for rare earths worldwide. The IEA estimates that by 2040, the demand for neodymium, praseodymium, dysprosium, and terbium might increase three to seven times due to electric cars and wind turbines alone.

According to Import Export Trade Analysis by Import Globals, the worldwide rare earth market is expected to expand at a compound annual growth rate (CAGR) of 10% from its estimated USD 4–5 billion in 2024 to roughly USD 10 billion by 2034.

Social and Environmental Issues

Rare earth mining and refinement can have detrimental effects on the ecosystem. Toxic and radioactive waste are frequently produced during the separation process. China has long allowed uncontrolled mining and "illegal mines" that discharged trash into rivers and agricultural land, but recent crackdowns and more stringent environmental regulations have cleaned up portions of the sector.

As per Global Export Import Trade Data by Import Globals, countries aiming to increase their own output must strike a balance between community impacts, appropriate environmental policies, and supply security.

Conclusion

Despite being unseen, rare earth metals are at the center of the global technological competition. It is more important than ever to provide a consistent supply of these vital components as countries strive for modern defense systems, renewable energy, and electric transportation.

The rare earth market is unstable and strategically important due to China's ongoing dominance, geopolitical concerns, and environmental issues. As Per Global Import Export Data, Governments and businesses throughout the world are spending billions on new mines, recycling, cleaner refining techniques, and multinational collaborations in an effort to escape supply chain chokepoints.

Whoever controls rare earth metals ultimately controls the engines and magnets that will drive the next wave of international trade and technological advancement.

If you are looking for detailed and up-to-date Export Data, You Can Contact Import Globals.

FAQs

Que. What are rare earth metals used for?

Ans. Rare earths are used in smartphones, electric vehicles, wind turbines, military tech, and electronics because they have unique magnetic and heat-resistant properties.

Que. Which country is the largest producer of rare earth metals?

Ans. China is the world’s largest producer and refiner, mining about 70% and processing nearly 90% of the global supply.

Que. Why is the world worried about the rare earth supply?

Ans. Most countries depend on China for supply and refining. Any export bans, trade conflicts, or environmental restrictions can disrupt the global tech and energy industries.

Que. How much rare earth does the US import?

Ans. The US imports nearly all the rare earths it uses, about 74% comes from China, according to the latest USGS data.

Que. Can rare earths be recycled?

Ans. Yes. Recycling old electronics and magnets can help recover neodymium and other REEs, but large-scale recycling is still developing.

Que. Where can you obtain detailed Rare Earth Metals IMPORT DATA?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.