- Jul 22, 2025

The UK–vietnam Pharmaceutical Trade Deal: A Strategic Boost for Global Pharma

More than simply better access for pharmaceutical businesses, the 2025 signing of a new pharmaceutical trade deal between the UK and Vietnam signaled a strategic change in the UK's post-Brexit trade strategy. As per Vietnam import data by Import Globals, the agreement fills gaps in healthcare delivery for Vietnam's rapidly expanding population by providing easier access to state-of-the-art medical treatments and immunizations.

This blog examines the terms of the agreement, the benefits to each party, the figures that influenced it, the consequences for the UK's life sciences industry, and how it represents general patterns in targeted trade agreements.

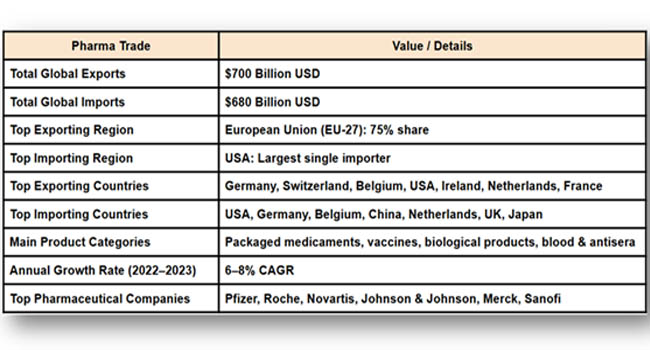

Global Pharmaceutical Trade

The Origin of the Agreement

After Brexit, the UK government, keen to expand its international trade presence, has shifted more and more toward sector-focused accords rather than waiting years for intricate free-trade agreements to come to fruition. This arrangement was reached at the most recent round of bilateral economic discussions in Hanoi between British officials and their Vietnamese counterparts, according to Vietnam Export Data from Import Globals.

For years, British pharmaceutical firms faced lengthy registration processes in Vietnam, typically taking up to 24 months for a new treatment or vaccine to overcome local regulatory barriers. Even if a medicine has already cleared the European Medicines Agency (EMA) or the UK's own MHRA, many approvals still require duplicate clinical trial data or extensive local testing. Many of those obstacles are eliminated by this new agreement. Vietnam will now legally accept approvals from the MHRA and a few other reliable foreign bodies, which will expedite the delivery of UK medications to Vietnamese clinics, pharmacies, and hospitals.

Why Vietnam is a key target for UK Pharma

Vietnam's pharmaceutical industry is becoming a major force in Asia. The demand for contemporary medications has grown significantly over the last ten years due to factors including the country's growing middle class, growing urbanization, and increased government spending on healthcare.

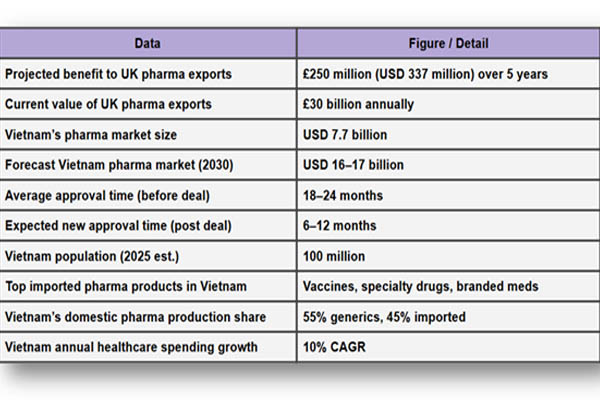

According to the Vietnam Import Export Trade Data by Import Globals, the pharmaceutical sector in the nation was valued at around USD 7.7 billion in 2023 and is expected to more than double to USD 16–17 billion by 2030. The demand for branded, high-end medications from developed countries is still high because local manufacturers mostly concentrate on generic medications.

The Vietnamese government is also facing pressure to update its healthcare system. A post-pandemic drive for vaccination programs, aging populations, and chronic illnesses has all contributed to the country's population of about 100 million. This leads to a ready market for cutting-edge therapies, sophisticated vaccinations, and specialized medications, many of which are created in UK labs, for British life sciences businesses.

What the Data Show: An Examination of the Anticipated Effect

Over the next five years, the UK's life sciences industry may get an additional £250 million in income from this deal alone, according to the country's Department for Business and Trade. Although that amount may not seem like much in comparison to the UK pharmaceutical sector as a whole, as per Vietnam Import Custom Data by Import Globals, which is valued at between £80 and £90 billion a year, it is important because it creates a fresh avenue for growth for niche and mid-sized businesses that frequently find it difficult to enter the Asian market.

This decrease in wait times is among the most important real-world adjustments for exporters. For novel therapies and vaccines, where shelf life, patent length, and competitive advantage are closely related to time-to-market, speed to market is particularly important.

The Reasons the UK Selected a Sector-Specific Agreement

As per Vietnam Import Export Global Data, the UK's trade negotiators have encountered several obstacles in their pursuit of comprehensive, large-scale free-trade agreements. Rather, they have been concentrating more on smaller, more pragmatic transactions that target high-value sectors like digital trade, financial services, and medicines.

As per Vietnam Import Trade Analysis by Import Globals, this agreement shows how the UK can "move fast on high-growth sectors without getting stuck in wider disputes," said Trade Minister Douglas Alexander during the announcement. One of Britain's leading export industries is the pharmaceutical sector. The United Kingdom shipped over £30 billion worth of pharmaceutical items worldwide in 2024 alone.

This agreement is realistic for Vietnam. It guarantees Vietnamese patients faster access to cutting-edge therapies, some of which are not produced locally, and lessens the administrative load on its regulatory bodies.

Strategic Context and Wider Trade

Despite being a success story, the pharmaceutical trade agreement is set against the backdrop of more intricate trade tensions between the two nations. Notably, as per Vietnam Export Import Global Trade Data, due to worries about unfair competition and dumping, the UK recently set stricter limitations on steel imports from Vietnam.

This demonstrates that whereas specific sector agreements are advantageous, other trade conflicts are not always resolved by them. But both sides seem eager to keep matters separate, concentrating on areas that benefit everyone, like green technology and life sciences, while resolving disagreements in more controversial fields, like heavy industries.

Later this year, as per Vietnam Export Data by Import Globals, the UK-Vietnam Joint Economic and Trade Committee will meet in London to formally evaluate the deal. During the meeting, officials will also talk about infrastructure, finance, and renewable energy collaboration.

Implications for the UK Life Sciences Industry

As per Vietnam Import Export Trade Analysis, the life sciences industry in the UK has long been acknowledged as a leader in research and development worldwide. However, it has been under pressure from changes in domestic policy in recent years, such as discussions over the NHS's structure and prescription prices.

The Vietnam contract and other trade-focused development prospects provide British pharmaceutical companies, particularly small and medium-sized biotech enterprises, a viable means of diversifying their sources of income. It also fits in with the UK's new Industrial Strategy, which places a strong emphasis on innovation and high-tech exports.

According to Vietnam Import Data by Import Globals, implementation will be the true test. On paper, faster registration seems promising, but it's unclear if Vietnam's Ministry of Health has the bandwidth and ability to handle a large volume of applications in a short amount of time. In a similar vein, UK exporters will need to adjust to local marketing specifications, distribution networks, and post-purchase assistance.

Prospects for the Future

If this methodology is effective, the UK may be able to apply it to other developing Southeast Asian markets where there is a growing need for novel medications but regulatory procedures have historically produced obstacles.

Similar discussions are being considered with nations including Thailand, Malaysia, and the Philippines. According to Vietnam Import Trade Statistics by Import Globals, Britain's agility after Brexit rests on striking these "mini deals," which allow exporters to realize genuine value without having to endure years of political stalemate.

Conclusion

The UK-Vietnam pharmaceutical trade pact is notable for its speed and concentration in a global trade context where large-scale free-trade agreements often stagnate for years. It illustrates how eliminating a single, crucial obstacle, protracted medication approvals, can result in instant advantages for both parties.

It offers quicker patient access to contemporary therapies for Vietnam. It offers the UK a straightforward path to strengthen one of its most lucrative export markets. Both administrations will be closely monitored in the upcoming months to see how they implement these pledges in real-world initiatives. Import Globals is a leading data provider of Vietnam import export trade data. Subscribe to Import Globals to get more details on global trade!

FAQs

Que. What is the UK–Vietnam pharmaceutical trade deal about?

Ans. It’s an agreement to remove regulatory barriers and speed up approvals for UK medicines and vaccines entering the Vietnamese market.

Que. How much is this deal expected to benefit the UK?

Ans. It’s projected to generate around £250 million (~USD 337 million) for the UK’s life sciences sector over five years.

Que. Why is Vietnam important for UK pharma?

Ans. Vietnam’s growing healthcare market is set to more than double by 2030, making it an attractive destination for high-quality medicines.

Que. What changes for drug approvals?

Ans. Vietnam will now recognize UK and other trusted regulator approvals, reducing approval times from up to 2 years to as little as 6–12 months.

Que. Where can you obtain detailed Vietnam Import Shipment Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.