- Jul 18, 2025

Understanding Indonesia’s Import Landscape: Trends, Trade Partners, and Strategic Implications

With its varied industrial base and quickly expanding consumer market, Indonesia, the largest economy in Southeast Asia, is essential to international trade.

According To Indonesia Import Data From Import Globals, economic expansion, infrastructure development, and changing trade relations have all contributed to major changes in Indonesia's import patterns during the last few years. It is critical to comprehend these trends since they not only show the nation's strategic position in the global supply chain but also its demand for energy, machinery, and basic raw materials.

Changes in the global economy, interruptions in the supply chain, and initiatives to diversify trading partners and sources of essential products have all influenced Indonesia's import environment between 2020 and 2024. The rising imports of agricultural products, machinery, electronics, and mineral fuels throughout this time have highlighted Indonesia's aspirations to modernize its industry and improve energy security, according to Indonesia Export Data by Import Globals. To shed light on Indonesia's economic trajectory, this blog examines the country's import statistics, main product categories, important trading partners, and the strategic ramifications of these changing trends.

An Overview Of the General Economy

Agriculture, manufacturing, mining, and services are all part of its varied economic basis. According to Indonesia Import Export Trade Data From Import Globals, the country's economy has grown steadily over the last ten years, thanks to investments in infrastructure, domestic consumption, and a youthful, growing labor force. Additionally, the nation has an abundance of natural resources, including minerals, coal, palm oil, and rubber, all of which greatly boost its export earnings and general economic stability.

The government has made economic diversification a top priority because, despite its progress, Indonesia still faces issues including income disparity, infrastructure deficiencies, and reliance on commodity exports. Indonesia is actively pursuing industrialization, digital economy initiatives, and developing trade relations globally in order to address this, according to Indonesia Import Custom Data From Import Globals. Indonesia is positioned as a prominent actor in the world economy due to its advantageous placement along important maritime trade routes, which also increases its significance in regional and international trade.

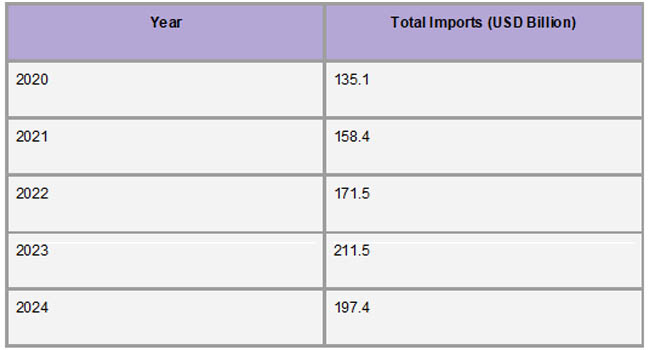

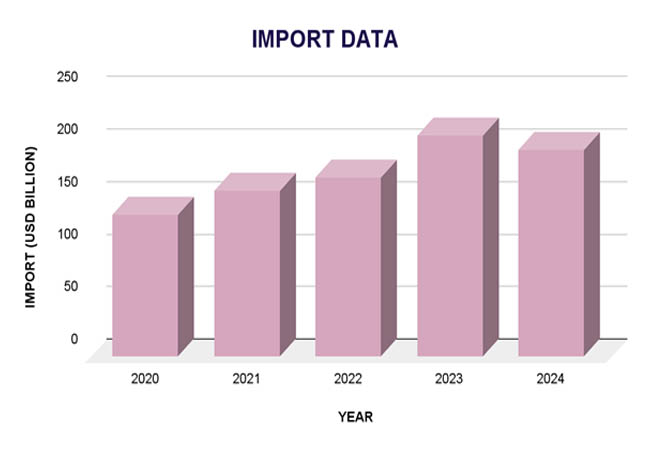

Import Data

Between 2020 and 2024, Indonesia's import market grew significantly. The nation imported items worth about $135.1 billion in 2020. This amount rose by 17.3% to $158.4 billion in 2021. With imports hitting $171.5 billion in 2022 and $211.5 billion in 2023, the rising trend persisted. 2024 preliminary figures show a minor drop to $197.4 billion. This variation can be ascribed to some factors, such as domestic demand, currency exchange rates, and worldwide economic conditions, according to Import Globals' Indonesia Import Trade Analysis.

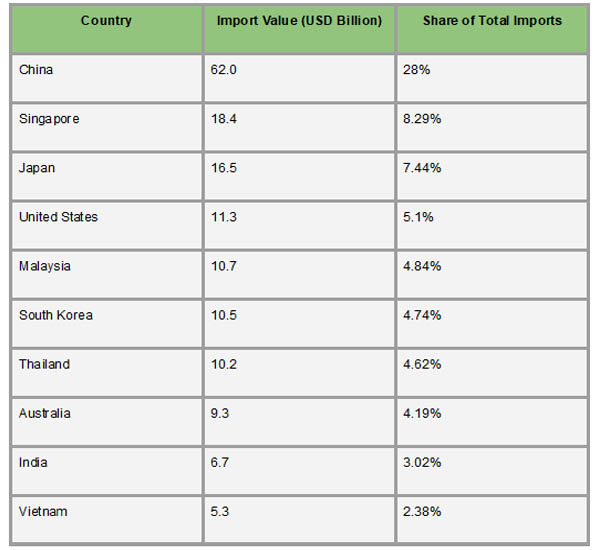

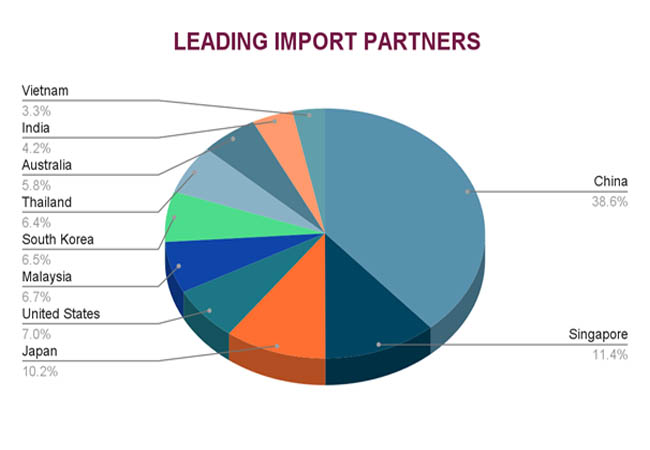

Although Indonesia imports a wide range of goods, some of the main categories are cars, iron and steel, machinery, electrical equipment, and mineral fuels. The greatest percentage in 2023 was 18.9% for mineral fuels, followed by 13.2% for machinery and mechanical appliances, and 11.1% for electrical machinery and equipment. In terms of trading partners, China continues to be Indonesia's biggest import supplier, accounting for almost 28% of total imports, or $62.88 billion. Other important partners include Singapore, Japan, the United States, and Malaysia, according to Indonesia Export Data From Import Globals. Strategic economic collaborations and regional trade agreements serve as the foundation for these relationships.

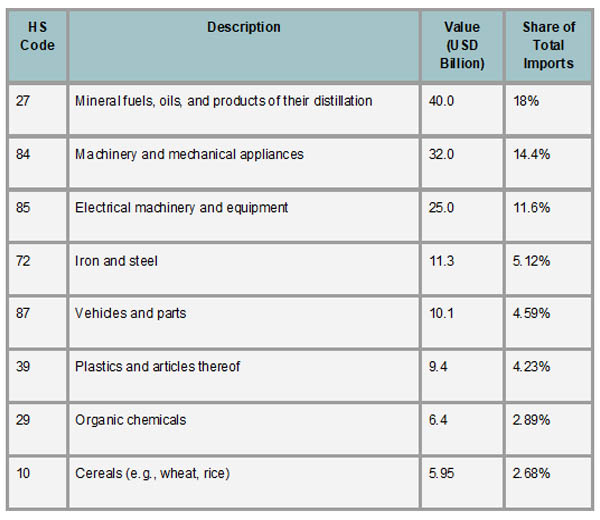

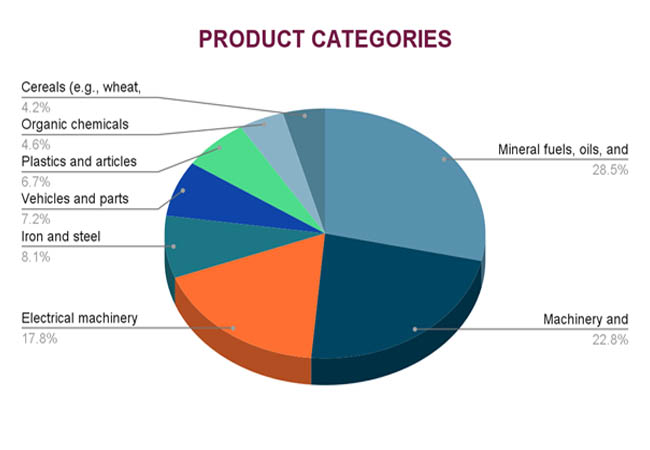

Major Import Product Categories

Here is an analysis of Indonesia’s imported products:

Mineral Oils, Fuels, and Products of Distillation (HS Code 27): As per Indonesia Import Data by Import Globals, with an import value of $40.12 billion, or 18.1% of overall imports, this category was in the lead. It consists of natural gas, refined petroleum products, and crude oil, all of which are necessary for the nation's industrial operations and energy requirements.

Equipment, Boilers, Nuclear Reactors (HS Code 84): This sector's $32.16 billion in imports accounted for 14.5% of all imports. This category includes electrical and industrial machinery, as well as components of these, which are essential to Indonesia's infrastructure and manufacturing growth.

Electrical, Electronic Equipment (HS Code 85): As per Indonesia Import Trade Statistics by Import Globals, with an import value of $25.78 billion (11.6% share), this category includes items such as computers, telecommunications equipment, and consumer electronics, reflecting the growing demand for technological advancements in Indonesia.

Iron and Steel (HS Code 72): Imports amounted to $11.38 billion, making up 5.1% of total imports. This category is vital for construction, automotive, and other heavy industries.

Vehicles Other Than Railway, Tramway (HS Code 87): At $10.2 billion (4.6% share), this category includes automobiles, parts, and accessories, highlighting the demand for transportation infrastructure and consumer vehicles.

Plastics and Articles Thereof (HS Code 39): Imports were valued at $9.4 billion, representing 4.2% of total imports. This category covers a wide range of plastic products used in various industries, including packaging, construction, and consumer goods.

Organic Chemicals (HS Code 29): With an import value of $6.42 billion (2.9% share), this category includes chemicals used in pharmaceuticals, agriculture, and manufacturing processes.

Cereals (HS Code 10): Imports totaled $5.95 billion, accounting for 2.7% of total imports. This category primarily includes wheat and rice, essential for food security and consumption

Articles of Iron or Steel (HS Code 73): At $4.35 billion (1.96% share), this category includes products like pipes, tubes, and fittings, important for construction and industrial applications.

Residues, Wastes of Food Industry, Animal Fodder (HS Code 23): Imports were valued at $4.31 billion, representing 1.94% of total imports. This category includes by-products from food processing used in animal feed and other applications.

Leading Import Partners

A small number of important trading partners controlled the majority of Indonesia's imports in 2023, which reflected the country's strategic economic ties and dependencies. China became Indonesia's largest import partner, contributing over 28.5% of its total imports, which are worth about $62.88 billion. This significant trade volume highlights how crucial China is to Indonesia's industrial and manufacturing sectors by providing necessary items, including electronics, machinery, and raw materials. With 8.3% ($18.4 billion) and 7.4% ($16.5 billion) of Indonesia's imports, respectively, Singapore and Japan came in second and third, as important partners. These nations supply a variety of goods, ranging from sophisticated machinery and automotive components to refined petroleum and chemicals, according to Indonesia Import Shipments Data From Import Globals, underscoring the diverse nature of Indonesia's import requirements.

In addition to these top three, the United States, Malaysia, South Korea, and Thailand were also significant import partners, accounting for 4% to 5% of Indonesia's overall imports. For example, the United States contributed about 5.1% ($11.3 billion), providing a variety of goods related to agriculture, machinery, and technology. Thailand's exports to Indonesia comprised processed foods and automobiles, and components, while South Korea and Malaysia supplied essential inputs for Indonesia's electronics and automotive sectors. According to Import Globals' Indonesia Import Export Trade Analysis, these varied trade partnerships serve Indonesia's immediate production and consumption needs while also being strategically important for the country's overall economic growth and integration into international supply chains.

Strategic Implications

Indonesia's changing import situation has important strategic ramifications for its geopolitical and economic standing. Concerns about economic dependency are raised by the growing reliance on nations like China for essential imports like electronics and machinery, which is a reflection of growing trade ties. As part of larger trade talks, Indonesia is increasing imports from the United States, particularly crude oil and LPG, to diversify its energy supplies and reduce such risks. In addition to ensuring a more balanced trade portfolio, fortifying ties with regional players such as South Korea, Japan, and India also helps Indonesia's infrastructural and industrial development. These import policies are in line with government objectives to improve energy security, modernize industries, and fortify the resilience of global trade, according to Indonesia Export Import Global Trade Data by Import Globals.

Forecast Trend: Indonesia’s Future Prospect

A cautious but steady trajectory is indicated by Indonesia's import outlook for 2025 and 2026, which is impacted by both strategic domestic initiatives and international economic conditions. Indonesia's imports are expected to reach about $189.5 billion in 2025, a slight rise from prior years, according to Import Globals on Indonesia Import Export Global Data. With the help of the nation's initiatives to diversify its import sources and fortify trade alliances, this rise is projected to last until 2026. Notably, Indonesia intends to import a sizable amount of its petroleum from Singapore to the US, which might result in an approximate $10 billion increase in US energy imports. This strategic move aims to balance trade relations and mitigate potential tariffs on Indonesian exports. Additionally, Indonesia is considering importing 1 million metric tons of rice from India in 2025 to ensure food security amid anticipated domestic production shortfalls. These initiatives underscore Indonesia's proactive approach to managing its import portfolio in response to evolving economic and geopolitical dynamics.

Conclusion

In conclusion, Indonesia’s import trends from 2020 to 2024 reflect a nation actively adapting to global economic shifts while strategically strengthening its domestic capabilities. The country's diversified import portfolio, ranging from energy and industrial machinery to food staples, underscores its dual focus on economic modernization and resource security. As Indonesia navigates evolving trade dynamics with major partners like China, the U.S., and regional neighbors, its policy decisions, such as increasing energy imports from the U.S. and securing food supplies from India, highlight a forward-looking approach. These efforts are poised to not only stabilize the nation's supply chains but also enhance its resilience in an increasingly interconnected global economy.

If you are looking for detailed and up-to-date Indonesia Import Data, You Can Contact Import Globals.

FAQs

Que. What are Indonesia's top imported products?

Ans. Indonesia's major imports include mineral fuels, machinery, electrical equipment, iron and steel, and vehicles.

Que. Which countries are Indonesia's primary import partners?

Ans. China, Singapore, Japan, the United States, and Malaysia are among Indonesia's top import partners.

Que. How is Indonesia diversifying its energy imports?

Ans. Indonesia plans to increase imports of crude oil and LPG from the U.S. by approximately $10 billion to reduce reliance on traditional suppliers.

Que. What is the forecast for Indonesia's imports in 2025?

Ans. Imports are expected to grow in 2025, driven by industrial expansion and infrastructure development, with a projected GDP growth of 5.1%.

Que. Where can to obtain detailed Indonesia Import Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date Indonesia Import Data.