- Apr 28, 2025

USA Crude Oil Market and General Trade Insights

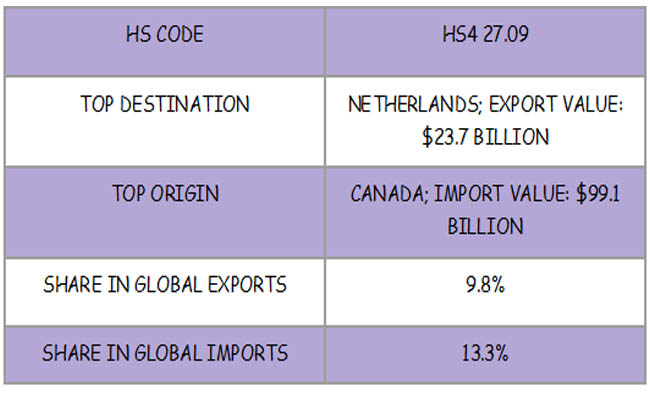

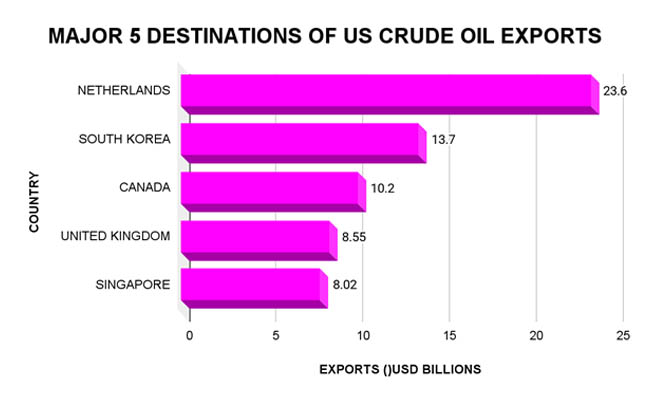

In 2024, the United States exported $118B of Crude Oil. Crude Oil is the 2nd most exported product in the United States. In 2024, U.S. crude oil exports exceeded an annual average of 4.1 million barrels per day (b/d). It has beaten the previous record of 2023 and reached a new record. The leading destinations of the USA's crude oil exports are Europe and the Asia and Oceania region.

According to the USA export import global trade data provided by Import Globals, the US global crude oil production was 13.4 million barrels per day in 2024 as compared to 12.9 million barrels per day in 2023. The main drivers for this growth are the boosted output from the Permian Basin and the Federal Offshore Gulf of Mexico.

Us Crude Oil Export and Import Overview

As per the USA Import Export Trade Analysis, there is an export expansion following the lifting of the ban on crude oil exports in 2015. In 2023, crude oil exports increased by 13% compared to the previous year. The USA Import Data from Import Globals suggests, the net imports of US crude oil are expected to drop by 20% to 1.9 million barrels per day in 2025. This will be the lowest since 1971, and this will further lead to downsized refinery demand and expanded domestic production. In terms of market dynamics, the US produces light and sweet crude oil. While domestic refineries cultivate heavier grades of crude oil. This mismatch led to the incentivizing of the US crude oil exports to such regions. The forecast trends reports of USA export data provided by Import Globals suggest that USA crude oil production will continue to expand with an average of 13.5 million b/d in 2025.

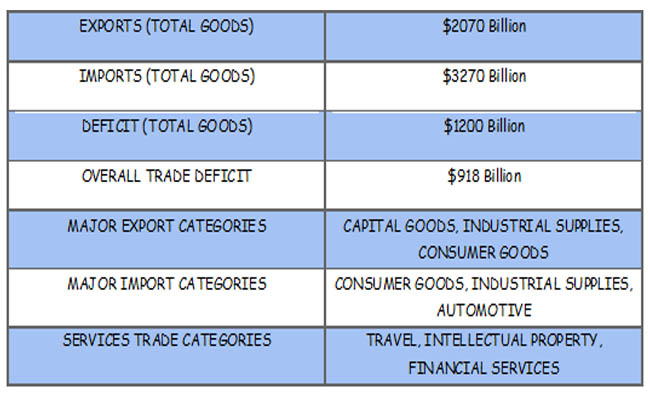

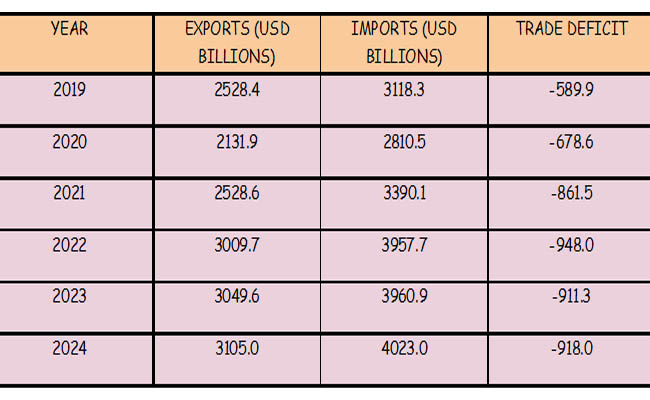

Us General Trade Overview

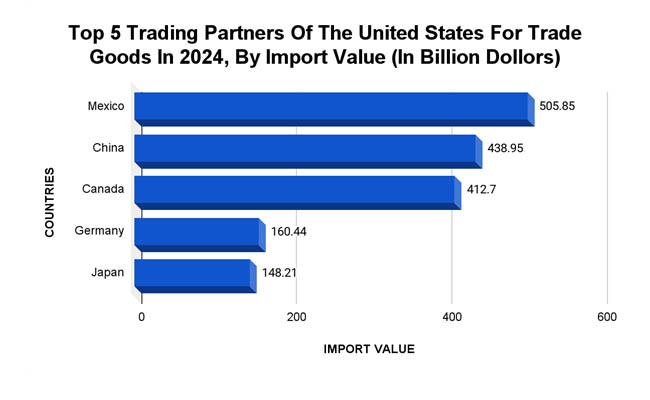

Discover USA Crude Oil Importers: Trading Partners

The Import Globals USA Export Data shows that the U.S. exported about 357,000 barrels per day of crude to India as compared to 221,000 barrels per day last year. This has hit 2 2-year high in exports of US crude oil to India. India is the world's third-biggest oil importer and consumer. In 2023, India increased its crude oil imports from Russia due to reduced prices following the sanctions. Lately, due to the narrowing of price discounts from Russia, the USA's crude oil exports have surged by 32% in 2024. Consequently, this has led to a 55,000-b/d increase in U.S. crude oil exports to India.

Due to the inclusion of West Texas Intermediate (WTI) crude oil in the European crude oil benchmark and a ban on seaborne crude oil imports from Russia, US crude oil exports to Europe have grown immensely. A report by Import Globals for the USA Export Import Global Trade Data shows that the US crude oil exports to Europe saw a surge of 6%, i.e., 1.93 million b/d in 2024.

The US has exported an average of 825,000 b/d of crude oil to the Netherlands. However, there is a drop in crude oil exports to Spain, France, and Italy. There is also a spike in exports to Germany, the UK, and the Netherlands.

Since China has increased its crude oil imports from Malaysia and Russia, this has led to the decline of US crude oil imports. The USA Import Export Trade Analysis by Import Globals suggests that the US crude oil exports to China have dropped by 53% to 217,000 b/d.

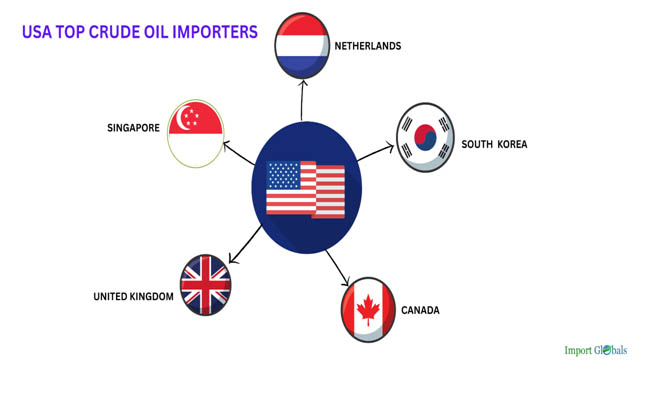

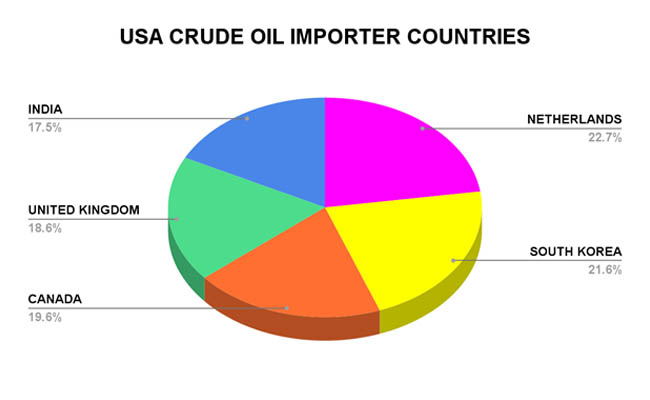

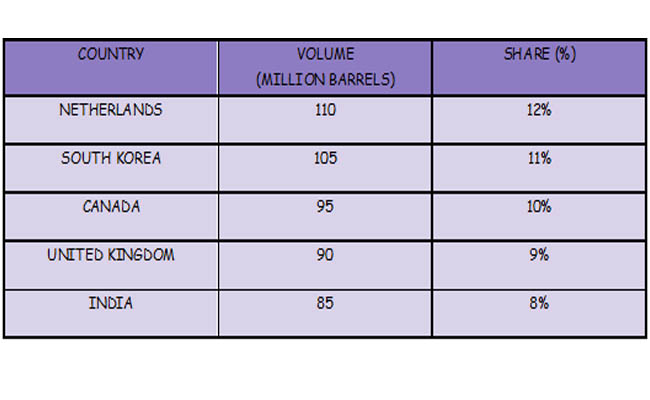

Usa 5 Leading Crude Oil Importer Countries

Netherlands - The country has imported more crude oil from the US than any other country. Additionally, it is the core refinery and distributor hub in Europe. It facilitates the flow of crude oil to other European nations.

South Korea - This country has advanced refining capacity and is considered a significant strategic location in Asia for regional distribution and domestic consumption.

Canada - The country is a major crude oil producer but it produces heavier crude oil versions. That's why it imports light and sweet crude oil from the USA to blend with its manufactured oil.

United Kingdom - The region has a significant crude oil refining infrastructure and trading hub.

India - India's rising crude oil demands have led to increased USA crude oil imports.

Usa Leading Crude Oil Manufacturer Regions

Usa Leading Crude Oil Manufacturer Regions

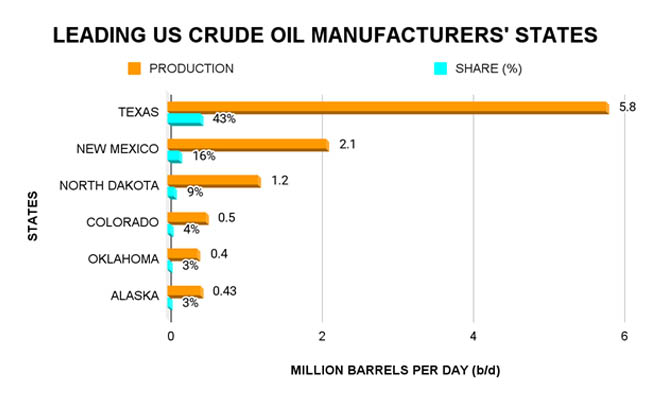

Texas: It is the largest crude oil producer in the US. Texas has consequential infrastructure and a huge refinery capacity. Moreover, it is the dominant crude oil manufacturing state due to the prolific Permian Basin.

New Mexico: One of the rapidly growing contributor regions to the US crude oil export. This region also gets advantages from Permian Basin resources.

North Dakota: This region produces crude oil from the Bakken Shale formation.

Colorado: This region produces crude oil for the US export from the Niobrara Shale formation. Colorado gets its resources from the Denver-Julesburg Basin for its crude oil manufacturing.

Oklahoma: This region is known for its long-standing period in crude oil production. For production, this region procures its resources from the Anadarko Basin.

Alaska: A key player region in crude oil production. It is a stable region and operates on the North Slope.

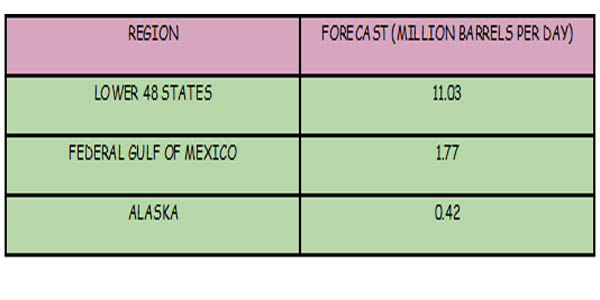

As per the USA Trade Data provided by Import Globals, the U.S. Lower 48 (L48) crude oil production for the Appalachia, Bakken, Eagle Ford, Haynesville, and Permian regions is the most prolific crude oil production region. These regions account for almost two-thirds of total U.S. crude oil production.

The Permian region in western Texas and southeastern New Mexico produced more crude oil than any other region. The USA Import Shipment Data by Import Globals shows that these two regions solely contributed to 48% of the total U.S. crude oil production.

Forecast Trend of Regional Contributions to Us Crude Oil Production

Understanding Russia’s Role in Crude Oil Trade Dynamics

India has been reliant on Middle Eastern oil for many years. Now, due to a shift in crude oil market dynamics, it is diversifying its crude oil sources. OPEC production has further restrained crude oil production, and this has further led to a decline in Middle East crude oil exports. This is the prime reason for India to secure crude oil supplies from other regions.

Due to the Russia-Ukraine War and subsequent Western sanctions, Russia has reduced its crude oil prices. This led India to buy crude oil from Russia. These developments have impacted the USA-India crude oil trade relationships.

The further tighter sanctions on Russian oil producers and shipping companies by the US have led Indian refiners to seek alternative crude oil sources. Moreover, Indian oil refiners have a preference for light and sweet crude oil such as the West Texas Intermediate (WTI) quality grade. As per the USA export data by Import Globals, approximately 80% of US crude oil exported to India was of WTI. These trade dynamics led the USA to hike 33% in crude oil exports to India.

CONCLUSION

According to the USA Import Export Trade Data, the sudden 33% increment in USA crude oil exports to India in 2024 reflects a wider trend of diversification in energy imports. The US has been consistently maintaining its top position as the global leading crude oil producer and exporter. Moreover, the forecast reports provided by the Import Globals suggest that the USA will be a strategic key player in crude oil manufacturing and exports.

If you are looking for detailed and up-to-date USA Export Data, you can contact IMPORT GLOBALS. Visit www.importglobals.com or email info@importglobals.com for more information.

FAQs

Que. What caused the 33% increase in US oil shipments to India?

Ans. The increase is a result of India looking for alternatives to Russian oil, while the US provides premium WTI crude at affordable costs.

Que. What is India's import of US oil?

Ans. India purchased 357,000 barrels of US crude oil per day in 2024, up from 221,000 the previous year.

Que. WTI crude oil: What is it?

Ans. Indian refiners choose WTI (West Texas Intermediate), a light, sweet crude oil, because of its high quality and simplicity of processing.

Que. How has commerce between the US and India been affected by the world oil market?

Ans. India diversified its crude sources by increasing its imports from the US as a result of the sanctions on Russian oil and changing market conditions.

Que. What effects has the world oil market had on trade between the US and India?

Ans. India diversified its crude sources by increasing its imports from the US as a result of the sanctions on Russian oil and changing market conditions.

Que. How will US oil exports to India fare in the future?

Ans. Given the growing demand for premium US crude and India's ongoing oil source diversification, US shipments are predicted to stay robust.

Que. Where to obtain detailed USA Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date USA Export Data.