- Jan 03, 2026

How Energy Prices Change the Trade Balances of European Countries

Europe's import cost can skyrocket even if the continent buys the same amount of physical energy (or even less) when the prices of oil, gas, and electricity go up a lot.

As per Europe Import Data by Import Globals, that swing has a direct effect on trade balances, typically turning surpluses into deficits and making inflation, industrial stress, and currency pressures worse. When prices go down, the mechanism works in the opposite way: import values drop quicker than volumes, and trade balances can quickly get better.

Europe has shown this dynamic in the real world very clearly in the previous few years. According to Europe Export Data by Import Globals, the energy shock that got worse in 2022 raised the cost of energy imports so much that it changed the European Union's trade stance in a big way. The prices that went down later helped bring back trade surpluses, which shows how closely Europe's trade balance is related to global energy markets.

Why Energy Prices are so Important: Trade Balance

The trade balance of a country is the difference between its exports and imports. For Europe, energy imports are usually the element of the equation that changes the most and is most vulnerable to price changes. Europe sells a lot of valuable produced goods, such chemicals, vehicles, and machinery. However, it buys a lot of its fossil fuels. When energy prices go up, imports cost more (even if you don't buy additional energy).

Costs of inputs go up, which can make it harder for energy-intensive firms to compete in exports. When costs go up, people may not want to buy as much, which can also affect imports of non-energy goods.

The Terms of Trade go Worse: Europe has to sell more to pay for the same amount of energy. As per Europe Import Export Trade Data by Import Globals, when energy prices drop, the cost of imports goes down, the terms of trade get better, and trade balances often get better, often very quickly.

The EU's "Energy Price Shock" and the Swing in the Trade Balance

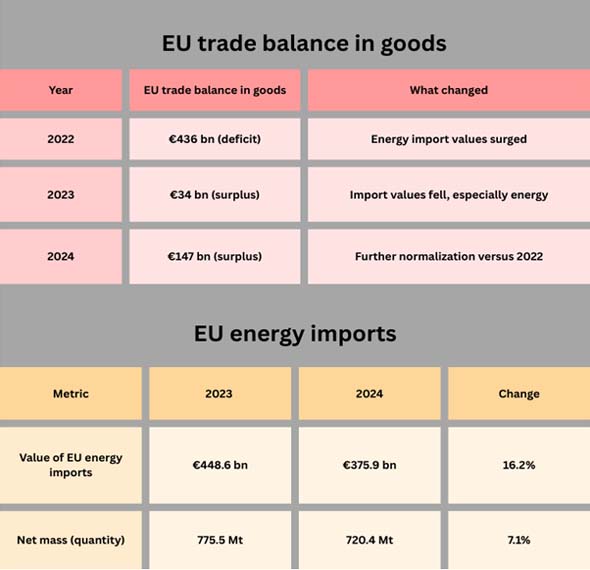

The EU's trade balance in goods before and after the 2022 energy shock is the best example. In 2022, the EU had a big trade imbalance in goods, and Eurostat says that this was because of rising energy prices that made energy imports very expensive. As energy prices went down in 2023 and 2024, the EU's goods trade balance went back into the black.

The "Same Fuel, Bigger Bill" Problem: Import Value vs. Import Volume

One important thing to know is that trade figures are generally written down in terms of value. Energy is a great example of why that matters. In 2024, the EU brought in 720.4 million tonnes of energy goods worth €375.9 billion. Both the value and the mass declined compared to 2023, but the value fell faster, which makes sense because prices fell.

Gas Prices: Why Natural Gas Has a Big Impact on Trade

Based on Europe Import Custom Data by Import Globals, Natural gas has a big effect because it is the main source of energy and industrial heat in many European economies. During the crisis, European gas benchmarks hit record highs and then dropped a lot. Even when prices are "lower," they may still be higher than they were before the crisis, which will make the trade balance worse than it was in previous years.

High gas Prices Change trade Balances in a Number of Eays

Cost of Direct Import: Gasoline and LNG prices go up.As per Europe Import Trade Analysis by Import Globals, link between gas prices and electricity prices: gas often determines the marginal power price, which raises the cost of electricity at the wholesale level.Shock to competitiveness: exporters that use a lot of energy have higher unit costs than their competitors in areas where energy is cheaper.

Changes in Demand: Households and businesses cut back on spending in other areas, which changes the demand for non-energy imports. In short, gas prices are not just about energy; they are also about the economy as a whole.

Oil Prices: A Constant Cause of Europe's Import Bill

As per Europe Exporter Data by Import Globals, Crude and refined petroleum imports are a constant driver of Europe's trade balance because oil is still the biggest source of energy in the continent. Because Europe uses so much oil, even small fluctuations in oil prices can have a big effect on the value of imports.

Eurostat says that in 2024, the amount and value of imported petroleum oils fell. This shows how the price and the number of commodities together affect the bill for imports. When oil prices go up, Europe's trade balance normally grows worse. This is unless there are surpluses in other areas, like chemicals and equipment, that can make up for the loss.

Effects on Countries: Economies with Surpluses vs Economies with Deficits. Energy prices don't have the same effect on every European economy. The effect relies on-

- How much fossil fuel a country buys (energy import reliance)

- Structure of industry (percentage of energy-intensive industries)

- Export mix (the ability to make up for energy shortages with high-value exports)

- Energy output in the country (including nuclear, renewables, or gas from the country)

Surplus manufacturing economies, which generally export a lot of machinery, automobiles, or chemicals, can nevertheless see their trade position get worse if the price of energy imports goes up too much. According to Europe Importer Data by Import Globals, Economies with a lot of imports or deficits may see their deficits grow even more.

Eurostat adds that at the EU level, surpluses in machinery, automobiles, and chemicals are usually higher than deficits in energy. But the energy shock in 2022 was so big that it erased these structural surpluses.

The Euro Area's Current Account Link

As per Europe Import Trade Statistics by Import Globals, there is a strong connection between the trade balances of products and the larger current account, which includes money and services coming in and going out. When the cost of importing energy to Europe goes up a lot, it can lower the external balance. A terms-of-trade shock is what this is. The current account can improve as energy prices fall, but it normally takes a while for contracts and hedging to conclude. This is important because the current account affects; capital flows, changes in currency, and macro stability in times of crisis.

Industrial Competitiveness: Energy Prices as a Trade Factor

Energy costs affect trade balances in two ways: by raising the cost of imports and by making European exports less competitive. As per Europe Import Shipment Data by Import Globals, when the prices of gas and electricity go up, industries that use a lot of energy, such as metals, chemicals, fertilizers, ceramics, glass, and some industrial sectors, see their margins shrink. That can lower production and exports, or move production to other countries, both of which can hurt the trade balance. European institutions have pointed out that even after wholesale prices stabilized, energy costs for businesses and consumers stayed high compared to before the crisis. They also said that the EU's industrial gas and electricity prices can stay much higher than those of its main trading partners, which is a concern for competitiveness.

Why Trade Balances Got Better When Prices Went Down

It's easy to sum up how Europe got better when the shock peaked:

- Energy prices fell from their crisis highs, which lowered the value of imports.

- Demand changed through conservation, substitution, and efficiency.

- Supply became more varied (more LNG, different sources, and better storage management).

As per Europe Import Export Trade Analysis by Import Globals, policy changes made things less volatile and made people more ready. The effect was that energy stopped being more important than the extra money that Europe made from its non-energy exports.

Final Thoughts

Because Europe gets a lot of the fuels that power its economy from other countries, energy costs change the trade balances in Europe. As per Europe Export Import Global Trade Data by Import Globals, when prices go up, import values go up, the terms of trade go worse, and even excellent export performance might be overshadowed, much like what happened in 2022. When prices go down, the import bill goes down quicker than the number of goods imported, and trade balances can swing back into surplus, as they did in 2023 and 2024.

Anyone who is keeping an eye on Europe's external position—investors, exporters, or policymakers—should pay as much attention to energy prices as they do to exports. Energy isn't just a background factor in Europe; it's often the main one. Import Globals is a leading data provider of Europe Import Export Trade Data.

FAQs

Que. What caused Europe's trade balance to get so bad in 2022?

Ans. Because high energy costs made energy imports far more valuable, enough to outweigh other trade surpluses.

Que. Is it possible for the trade balance to get better even if Europe still buys a lot of energy?

Ans. Yes. If prices go down, the value of imports can go down a lot even if the amount stays the same.

Que. What energy source is most important for Europe's trade balance: gas or oil?

Ans. They are both important. Oil is usually the biggest in terms of volume and value, but gas can have a bigger impact because it is linked to electricity and industrial prices.

Que. Do energy prices affect both imports and exports?

Ans. They effect both: rising energy prices raise production costs and can make businesses less competitive, which can lower exports, especially for industries that use a lot of energy.

Que. Where to get detailed Europe Import Export Global Data?

Ans. Visit www.importglobals.com.