- Oct 05, 2025

MRF Tyres: India Quiet Export Powerhouse Rolling Across Continents

Madras Rubber Factory, or MRF as it is now called, was established in 1946 as a tiny balloon-making company in Chennai and has since expanded to become India's largest tire producer, with yearly sales exceeding 24,000 crore. Because of the brand's reputation for toughness, affordability, and quality, exports have gradually become a big contributor to its growth narrative, even if domestic sales still make up the majority of its business.

As per Africa Import Data by Import Globals, Many people are unaware that, although MRF's durable tires are common on Indian roads, they also travel thousands of kilometers across seas, leaving their imprint on racetracks, farms, mines, and highways from Africa to Southeast Asia and the Middle East.

From Dominance at Home to Global Presence

It took time for MRF to establish its global presence. Decades ago, it made its initial attempt at exporting after identifying nearby Asian nations as possible buyers for its tires. Over time, the business made investments in state-of-the-art production facilities, state-of-the-art research and development facilities, and racing alliances that enhanced its reputation outside. MRF now supplies tires to over 90 countries, and its goods are reliable in areas with roads that are similar to those in India, including dusty highways, rugged country roads, and harsh weather.

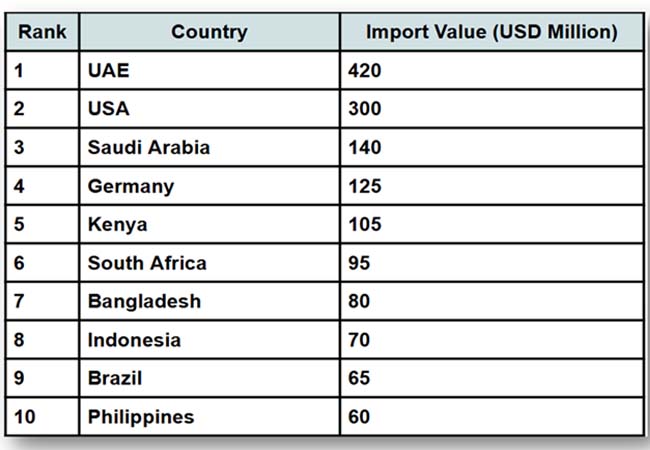

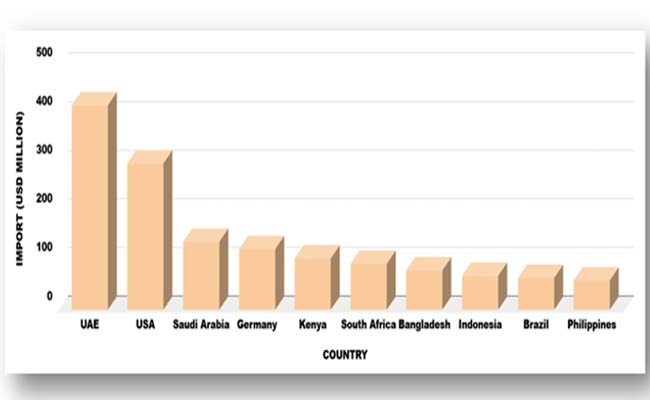

Top Importing Countries

As per Asia Export Data by Import Globals, Southeast Asia, Africa, and the Middle East are some of MRF's most lucrative international markets. MRF's truck, bus, motorbike, and agricultural tires have made a name for themselves in nations like the United Arab Emirates, Saudi Arabia, Oman, Kenya, South Africa, Indonesia, and Malaysia by outperforming and outperforming high-end international brands.

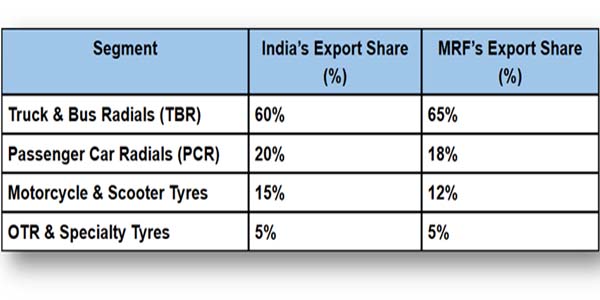

Segment-Wise Exports: India and MRF

Global Export Outcomes: How Much Does MRF Ship Abroad?

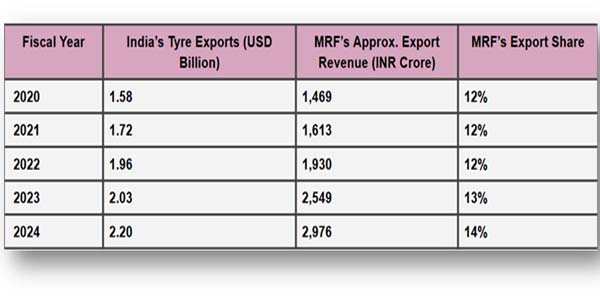

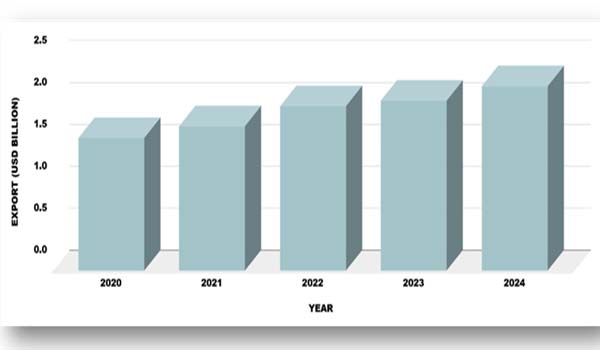

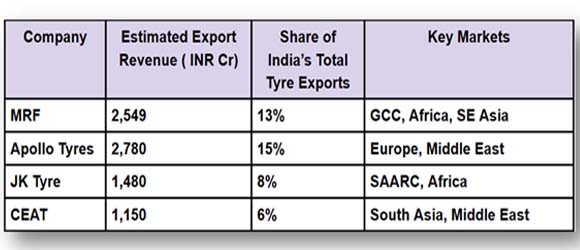

Although MRF does not publicly disclose exact export numbers per nation, its yearly reports and industry estimates provide a clear picture. The Automotive Tyre Manufacturers' Association (ATMA) estimates that MRF earned about 2,500 crore in export income last year, or 12–14% of the USD 2 billion in tires that India shipped in FY 2023.

Although as per India Import Export Trade Data by Import Globals, exports now provide for 10–12% of MRF's overall income, their strategic worth is far greater since overseas markets enable MRF to reduce the risk associated with domestic cycles, maintain consistent capacity utilization at its factories, and establish a global reputation.

Here is a snapshot based on MRF's disclosed financials and industry statistics to show how this has increased in previous years:

How Does MRF Export Work?

The firm has a diverse export portfolio tailored to the demands of new and developing markets. Truck and bus radial (TBR) tires, which make up the majority of India's tire exports, are among its best-selling products abroad. In the Middle East and Africa, where transport vehicles travel great distances in inclement weather, MRF's TBR line is especially well-liked.

Additionally, a sizable portion of exports are motorcycle and scooter tires, particularly to Southeast Asian and African nations where two-wheelers continue to be the major means of mobility. As per Africa Import Custom Data by Import Globals, Off-the-road (OTR) tires for mining and construction are another product that MRF offers; this market is growing as infrastructure investment increases in Africa and some regions of Asia.

The Reasons Foreign Buyers Select MRF

MRF vs. Other Top Tyre Exporters

In far-off areas, MRF attracts devoted customers for a number of reasons. First, because of the company's extensive knowledge of India's varied and difficult roads, its tires are designed to withstand harsh circumstances. As per Asia Import Trade Analysis by Import Globals, Foreign consumers in rural Asia or Africa value tires that can withstand situations that European or North American tires aren't usually made for, such as potholes, heavy vehicles, and inclement weather.

Second, MRF keeps its prices competitive. India is one of the biggest producers of natural rubber; therefore, MRF can provide cheaper rates than many of its international competitors without sacrificing quality, thanks to local sourcing and cost savings.

Third, as per Asia Import Export Global Data, MRF's worldwide brand image has been subtly but significantly enhanced by its motorsport relationships. MRF's reputation for performance tires is reinforced by sponsorships of events such as the Asia Pacific Rally Championship and Formula car racing circuits, a message that is highly appealing to distributors and customers overseas.

Crucially, MRF has important international certifications, including DOT (US), GCC (Gulf), and E-mark (Europe), which enable it to enter regulated markets where performance compliance and safety are non-negotiable.

MRF vs. Global Tyre Majors: Up against the Giants

Despite its solid foundation, as per MRF Exporter Data by Import Globals, MRF competes in a very competitive global market that is controlled by industry titans like Pirelli, Continental, Goodyear, Michelin, and Bridgestone. Each year, these companies spend billions of dollars on worldwide supply networks, branding, and research.

In order to maintain its position, MRF concentrates on markets where its blend of dependability, affordability, and durability provides a competitive edge, particularly in nations where consumers are very sensitive to pricing and where harsher road conditions necessitate the use of more durable tires.

Obstacles on the Export Path

But there are challenges along the way. Since rubber costs make up about half of tire production costs, price volatility in natural rubber is a persistent worry. Margin effects may also be impacted by tariffs and trade restrictions in the destination nations.

A further new issue is the worldwide drive for sustainability. As per USA Import Data by Import Globals, Customers are requesting tires with reduced rolling resistance, eco-friendly materials, and reduced carbon footprints, particularly in North America and Europe. Continuous R&D investment is necessary to meet these expectations, which raises prices for more volume-driven businesses like MRF.

How MRF Is Going to Grow Even More

As per Europe Import Trade Statistics by Import Globals, MRF is strengthening its position by upgrading research and development for EV-compatible tires, expanding its radial tyre production capabilities at factories in Tamil Nadu, and looking at new markets in Eastern Europe and Latin America.

In the next five years, MRF wants to increase its export revenue share to around 15% of overall income, according to its most recent annual reports. According to Import Globals, MRF's exports should increase by 8–10% annually, driven by the continent of Africa's stable replacement market demand as well as the expanding mining and construction industries that require OTR tires.

Additionally, as per India Export Import Global Trade Data by Import Globals, the RoDTEP plan and other government subsidies for tire exports from India assist producers in staying competitive in the face of competition from Thailand, Indonesia, and China.

In conclusion

It's amazing how MRF, which began as a little balloon business, has grown to become the biggest tire brand in India and a new exporter worldwide. Its exports continue to be driven by its emphasis on quality, innovation, and a knowledge of challenging markets across continents.

As per MRF Import Shipment Data, MRF's modest but steady march on the global trade map is likely to acquire much more traction as emerging nations continue to expand cities, ports, and highways, and as long as there is a strong need for long-lasting, reasonably priced tires.

Import Globals is a leading data provider of MRF Import Export Trade Data. Subscribe to Import Globals to get more details on global trade!

FAQs

Que. Which countries are MRF’s main export markets?

Ans. MRF exports mainly to the Middle East (UAE, Saudi Arabia), Africa (Kenya, South Africa), and Southeast Asia (Indonesia, Malaysia).

Que. What share of MRF’s revenue comes from exports?

Ans. Exports make up about 10–12% of its total annual revenue.

Que. Which product contributes the most to MRF’s exports?

Ans. Truck and Bus Radial (TBR) tyres are MRF’s top-selling export product.

Que. How does MRF maintain international quality standards?

Ans. MRF tyres meet E-mark, DOT, and GCC certifications, required by Europe, the US, and the Gulf markets, respectively.

Que. What are MRF’s future export plans?

Ans. MRF aims to expand exports to new regions like Latin America, develop EV-ready tyres, and raise exports to 15% of its revenue in five years.

Que. Where can you obtain detailed MRF Import Export Trade Analysis?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.