- Dec 06, 2025

The Story of U.S. Mineral Fuels and Oils Exports: From the Shale Boom to a Sustainable Transition

The United States sends a lot of mineral oils and fuels to other countries. These are hydrocarbons, which include crude oil, refined petroleum products, liquefied gases, and other items.

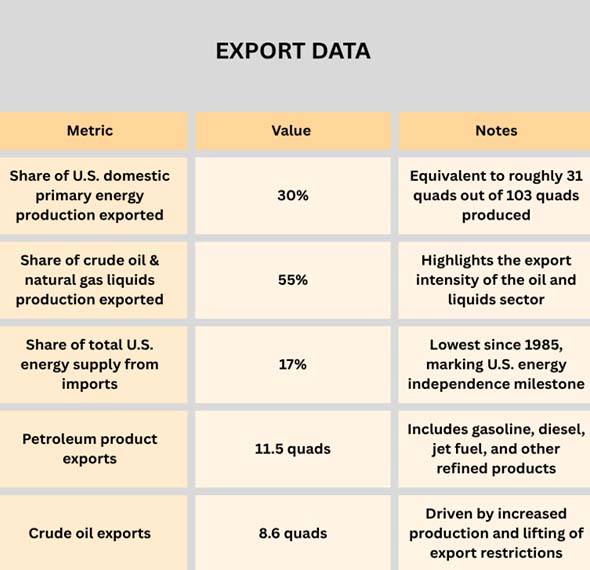

The country sent about 30% of the energy it made at home to other countries in 2024. A lot of it was fossil fuels, such crude oil and other oil products. For decades, this country has been importing more energy than it exports. This is a major change. As per USA Import Data by Import Globals, New technology, changes in the law, and higher demand throughout the world have made the U.S. one of the top energy exporters in the world. This blog talks about how this change happened, starting with the fracking revolution and finishing with concerns about refining capacity, trade, geopolitics, and sustainability that will have an impact on the future of the sector.

1. The Shale Revolution: A Huge Increase in Production and Exports

The shale revolution is what started the tale of U.S. oil exports. As per USA Import Export Trade Data by Import Globals, new ways of horizontal drilling and hydraulic fracturing made it possible to get oil and gas from places that were hard to access before.

The government overturned a long-standing restriction on crude oil exports in 2015, which was a big deal. Without government restrictions, U.S. companies quickly increased their exports to meet growing demand around the world. By 2024, the US was sending more than half of its crude oil and natural gas plant liquids production to other countries. Import Globals' USA Import Custom Data, shows how much American energy has become a part of the world's markets.

The change also made the country less reliant on goods from other countries. This transformed the energy environment from one where people were weak to one where they were strong and independent.

2. Global Market Flows and Geopolitics

The United States and Mexico

As per USA Import Trade Analysis by Import Globals, the USMCA made it easier for the two countries to trade energy, so Mexico is still one of the biggest buyers of U.S. mineral fuels and petroleum products. This relationship is good for both sides, but it is especially important for strategy because it optimizes across borders and makes logistics easier for everyone.

The two continents are Asia and Europe

When Russia attacked Ukraine, Europe requested the US to get additional oil and gas from other countries. The U.S. sent a lot more commodities to Europe, especially to Spain, the UK, and the Netherlands. As per USA Export Data by Import Globals, these countries are particularly significant for sending goods to other EU countries.

On the other side, exports to China went down in 2024 because people were worried about trade and there wasn't as much demand. This shows how weak the political and economic ties are between the two biggest economies.

3. The Risks and things that could go Wrong when you Trade

Things are getting better, but the infrastructure still needs to be fixed. Some ports, pipelines, and export terminals are filling up. When the weather is bad, transportation is problematic, or the laws on the Gulf Coast are severe, it can be harder to move stuff out of the country. Another significant issue is the lack of knowledge regarding the necessary actions for business, such as the proper payment of taxes and the prevention of legal issues. As per USA Importer Data by Import Globals, changes in global alliances, market volatility, and political events that affect trade flows make the U.S. energy company have to evolve all the time.

4. The U.S. can refine oil and send Petrochemical Commodities to other Countries

As per USA Import Trade Statistics by Import Globals, the strength of U.S. oil exports goes beyond only crude oil. The main reason for this is that American refineries are very big and work very well, especially in the Gulf Coast region.

Refineries in Texas, Louisiana, and other coastal states are particularly profitable because they have a lot of local feedstock, contemporary refining machinery, and big export ports. By 2010, the U.S. has gone from being a net importer of refined oil to a net exporter. By 2014, it was the country that sent out the most refined commodities.

There are, however, some things that refinement can't do. Hurricanes and other bad weather can stop work, and when the refineries aren't ready to process the correct kinds of crude oil, it can lower production. Rules about the environment, including limitations on emissions and requirements for low-sulfur fuel, make things harder and more expensive to run.

As per USA Import Shipment Data by Import Globals, the corporation still does well at refining, even though it has certain problems. Selling refined fuels instead of crude oil gives the U.S. more value and keeps it ahead of its competitors in the global market.

5. Things that affect the environment and sustainability

The risk of Change and the Carbon Footprint

Fossil fuel exports are good for the economy, but they also make people worry about climate change and the long-term implications of fossil fuels. As per USA Import Export Trade Analysis by Import Globals, people all throughout the world are becoming more interested in carbon intensity, even if the country that uses the fuel keeps track of the emissions. The U.S. might have trouble keeping its promise to lower global emissions under international climate agreements if it sells more oil and refined products.

Assets could get Stranded

In the future, fossil fuels may not be as significant if we put a price on carbon, switch to renewable energy, and take steps to protect the environment for the long term. According to Import Globals' USA Export Import Global Trade Data, investments in terminals, pipelines, and rigs could lose all of their value if the market moves faster than expected. As per USA Import Export Global Data by Import Globals, finding the right balance between short-term rewards and long-term stability is the hardest thing for investors and politicians to do.

Effects and Policy Alignment at Home

As per USA Import Export Trade Data by Import Globals, the U.S. is energy independent since it imports the least amount of energy since 1985. But this also makes many wonder: Should a government that sells a lot of fossil fuels to other countries keep putting incentives for clean energy at the top of its own list? How can we make sure that good exports don't stop us from trying to cut down on carbon emissions at home?

Putting money from exports into renewable energy, carbon capture, and better energy infrastructure all at once could be the answer. This would make sure that becoming energy independent means being a leader in energy for a long time.

6. Future Prospects and the Consequences of Strategic Development Stabilization:

Exports have been growing quickly for years, but that trend is going to stop. In 2024, a lot of records were made, but the rate of growth slowed to about 1% each year. This means that businesses may need to build more infrastructure and explore for new markets in order to continue successful in the future.

To be competitive in exports, it will be especially important to create new pipelines, LNG plants, and deepwater ports. How strong the infrastructure is, especially against hurricanes and cyber attacks, will decide how reliable things will be in the future. To make up for changes in demand, the U.S. is focusing more on new markets in Asia, Africa, and Latin America. It will still be a big destination to do business in Europe.

Changing Climate Policy: Exporters who invest in low-carbon fuels, hydrogen, and carbon-capture technologies early on will be better off as countries change their carbon border regulations and make environmental rules tighter. When the price of crude oil swings up and down, sending out more processed goods and petrochemicals worth a lot of money will help keep profits and margins high.

If the U.S. can adapt to changes in energy systems that use less carbon, it will be able to keep a part of the international market for mineral fuels in the long run. One of the biggest shifts in the history of energy is that the US is now one of the biggest exporters of oils and mineral fuels in the world. The fracking boom and America's dominance in world trade have transformed how energy markets work all around the world.

But having a lot of choices also means having a lot of responsibilities. The next ten years will be affected by geopolitical interdependence, environmental limits, and problems with sustainability. So, we can't just look at how much money the U.S. makes or how much energy it exports to evaluate how well it does. It also needs to be measured by how effectively the company can handle a world that utilizes less carbon.

The country will have to prove in the next few years that it can keep its lead in energy production while also working toward a future for the world's energy that is more balanced and long-lasting. Import Globals is a leading data provider of USA Import Export Trade Data.

FAQs

Que. How much of the crude oil that the U.S. makes goes to other countries?

Ans. In 2024, the U.S. sent around 55% of the crude oil and natural gas liquids it made to other countries, either as crude oil or refined petroleum products.

Que. Is the U.S. now a net exporter of energy?

Ans. Of course. In 2024, imports made up around 17% of all the energy used in the U.S. This was the smallest share since 1985, which means that the U.S. is moving closer to being able to make its own energy.

Que. Where does most of the oil and gas that the US exports go?

Ans. Spain, the UK, Mexico, the Netherlands, and other European countries are some of the most popular places to visit. The markets in Asia and Latin America are also becoming more important.

Que. What are the major risks to the U.S. fossil fuel export business?

Ans. A reduction in worldwide demand due to the switch to renewable energy, possible carbon taxes, problems with infrastructure, and environmental rules that could influence long-term earnings are some of the biggest dangers.

Que. Where can you obtain detailed USA Export Data?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.