- Jan 02, 2026

Trade Patterns and Export Strengths in High-Income European Economies

High-income European economies tend to "win" in global commerce by exporting high-value, high-compliance, and high-precision goods and services that are hard to copy fast.

Their strengths come from having a lot of industries (such as engineering, chemicals, and pharmaceuticals), world-class logistics, solid institutions, and a lot of trade networks, especially in Europe and with the U.S. and Asia.

Their trade patterns also show that they all share the same reality: they rely substantially on imported energy, parts, and intermediate goods, and then they create value through advanced manufacturing, specialized services, branding, and intellectual property. As a result, these economies are usually quite open to trade, with a lot of their output coming from exports and imports. However, they are also very vulnerable to changes in global demand, currency values, and supply-chain problems.

What "High-Income" Means in Trade Language

In terms of commerce, "high-income" European economies usually have five things in common:

High Export Complexity: As per Europe Import Data by Import Globals, items including pharmaceuticals, precision machinery, medical devices, semiconductors, advanced chemicals, and specialized engineering tools.

Strong Services Sector: Finance, insurance, ICT, IP royalties, professional services, and transportation and logistics.

Dense Regional Integration: As per Europe Export Data by Import Globals, for EU countries, commerce within Europe is often the biggest part of their products trade. High standards and compliance: quality, traceability, and following the rules become ways to be ahead of the competition.

Specialization on a Large Scale: As per Europe Import Export Trade Data by Import Globals, even small countries are leaders in narrow global markets, such as naval equipment, pharma clusters, and wind supply chains.

The "European Trade Backbone" is made up of Integration and Specialization

A lot of trade between EU countries (including Germany, the Netherlands, Ireland, Denmark, and Sweden) is "regional," which means it happens because of production networks that span borders. As per Europe Import Custom Data by Import Globals, parts and semi-finished commodities may cross several countries before they are ready to be exported. This structure makes things bigger and more efficient, but it also implies that intermediate shipments might "inflate" trade numbers.

Non-EU high-income economies, especially Switzerland and Norway, are still very connected to European markets through bilateral agreements, standards alignment, and supply chains. At the same time, they each have their own strengths: As per Europe Import Trade Analysis by Import Globals, Switzerland in pharmaceuticals and chemicals and high-value goods, and Norway in energy and seafood as well as maritime capabilities.

Export Strength Patterns that Keep Coming UP

1) The Story is Mostly about High-Value Manufacturing

In these economies, the export categories that tend to be the most stable are:

- Chemicals and drugs

- Precision tools and machines for industry

- Medical tools and gadgets that are used for certain purposes

- Car parts and sophisticated parts

- Green and energy technology, notably in the Nordics

These Sectors have one Thing in Common: As per Europe Exporter Data by Import Globals, they rely on deep knowledge, capital investment, and regulated supply chains, which makes them less likely to be hurt by low-cost competitors.

2) Services are the "Silent Multiplier."

- Even when the main data is on products, services are what make things work:

- Logistics and transportation (especially in the Netherlands)

- Finance, insurance, and professional services

- ICT services and trade done over the internet

- IP/licensing and R&D-linked revenues (especially in Ireland in global frameworks)

As trade around the world becomes more digital, high-income countries are more likely to "bundle" services into goods exports, such as maintenance contracts, software, compliance, design, and after-sales ecosystems.

3) There is a Lot of Openness, Which is both a Good and a Bad Thing

As per Europe Importer Data by Import Globals, these economies usually have a lot of trade (exports plus imports), which helps the economy thrive but also makes it more vulnerable to:

- Slowdowns throughout the world

- Shocks in energy prices

- Changes in currency

- Trade barriers based on geopolitics

- Case Focus: Switzerland's Export Engine (a Real-Life Illustration of Specialization)

As per Europe Import Export Global Data by Import Globals, Switzerland is a clear example of a country that specializes in commerce with high-income countries. In 2024, Switzerland exported CHF 282.9 billion worth of goods and services and imported CHF 222.3 billion worth of goods and services. This left a trade surplus of CHF 60.6 billion. The chemical/pharmaceutical and life sciences complex is the main part of Swiss exports, making up a large part of the total.

As per Europe Import Trade Statistics by Import Globals, Swiss trade data also shows that there are big flows of precious metals and gemstones, as well as strong niches in manufacturing and precise equipment.

This is how the high-income playbook works: Focus on categories where quality, regulation, and innovation provide you price power, and keep it safe by doing R&D all the time and having access to global markets. As per Europe Import Shipment Data by Import Globals, a trade balance doesn't signify "good" or "bad" when there is a surplus or a deficit.

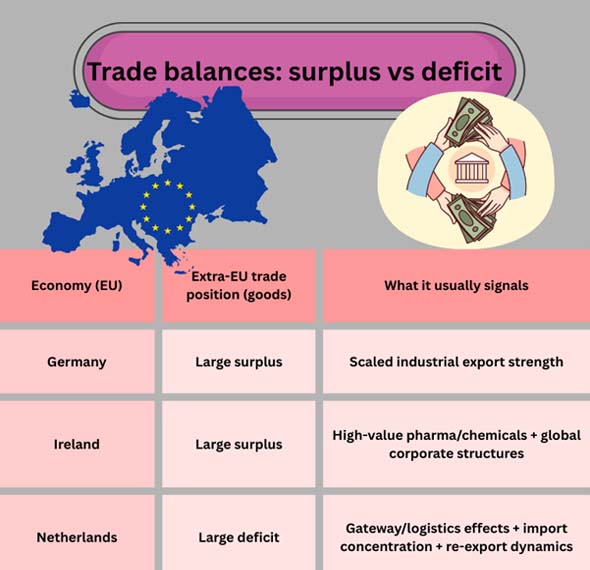

People commonly get trade balances wrong. A surplus can mean that a country is good at exporting goods, while a deficit can mean that the country is a logistical hub or an import gateway (for example, big import flows that feed re-exports) or that people in the country are buying a lot of goods.

Export Strengths: Where the Next Wave of Growth is Expected to Happen

High-income European exporters are focusing more and more on four main areas:

Health and Longevity Economy: pharmaceuticals, biotechnology, medical technology, diagnostics, health data, and controlled supply chains. Wind supply chains, grid technology, energy-efficient equipment, and infrastructure that is close to hydrogen are all part of industrial decarbonization.

As per Europe Import Export Trade Analysis by Import Globals, Advanced manufacturing and automation include high-end parts, robotics, precision tools, sensors, industrial software, and more.

Trusted Trade: traceability, compliance with sustainability standards, product passports, and consistent reporting—all of which turn rules into benefits.

The End

High-income European economies don't compete by being the cheapest; they compete by being the most reliable, the most advanced, and the toughest to replace. Their trading patterns show that they are very integrated (particularly in Europe), quite specialized, and that they are starting to export more goods and services. Over the next ten years, the economies that keep investing in new ideas, keep their markets open, and adjust their export strengths to the new realities of climate policy, digital trade, and changing geopolitics are likely to prevail. Import Globals is a leading data provider of Europe Import Export Trade Data.

FAQs

Que. What parts of high-income European economies are the biggest drivers of exports?

Ans. Pharmaceuticals and chemicals, machinery and industrial equipment, medical gadgets and precise instruments, and (in some countries) automobile and green energy technologies.

Que. Why do some wealthy European nations have trade deficits?

Ans. Deficits aren't always "bad." They can be a sign that a country is an import gateway or logistical hub (with imports feeding re-exports), that people in the country are buying a lot of things, or that the country relies on energy imports.

Que. Is commerce between European countries more significant than trade with other countries?

Ans. Intra-EU commerce is very important for many EU economies since supply chains cross borders and parts move around several times before they are exported.

Que. What is the largest threat to these export models?

Ans. Global demand slowdowns, energy price shocks, supply chain problems, regulatory fragmentation, and trade restrictions in important areas like technology, pharmaceuticals, and energy.

Que. Where to get detailed Europe Export Import Global Trade Data?

Ans. Visit www.importglobals.com.