- Dec 04, 2025

When the U.S.-EU Auto Tariff Deal Went Into Effect

The pact is also based on a larger "Framework on Reciprocal, Fair, and Balanced Trade" between the U.S. and the EU. As per Europe Export Data by Import Globals, this framework says that the U.S. will charge either the MFN tax or the 15 percent reciprocal rate, whichever is higher, on products that come from the EU. At the same time, the EU has promised to get rid of tariffs on numerous U.S. industrial goods and make big investments and energy promises.

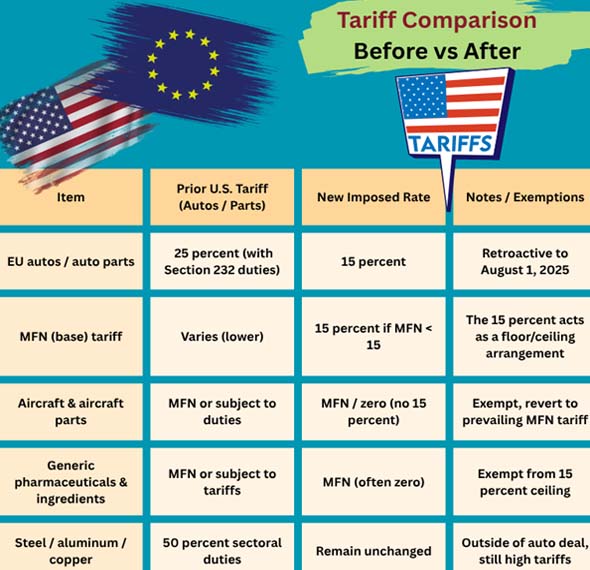

The deal lowers U.S. tariffs on EU cars and parts to 15 percent, starting on August 1. As per USA Import Data by Import Globals, a lot of EU automobiles and parts used to have to pay a higher combined tariff rate that included Section 232 national security levies. In a lot of situations, this totaled up to 25%.

Now, covered EU autos and car parts have a 15% "ceiling.". This implies that if the current Most Favored Nation (MFN) tariff is lower or if there are additional overlapping duties, the total should not go over 15 percent. The new 15 percent tariff does not apply to several types of goods, such as airplanes and aviation components, and generic drugs. Instead, these goods go back to MFN prices or zero.

Why This Matters: What It Means

1. Good News for car Producers in Europe

European car companies have been having a hard time with high U.S. import taxes for a long time. It is easier to plan and set pricing now that the 15 percent charge has been legally confirmed. As per Europe Import Export Trade Data by Import Globals, EU officials claim that this change should save €500–600 million a month in tariff charges starting in August.

Also, the financial market reacted well: shares of German car companies like Volkswagen, BMW, Mercedes-Benz, and Porsche went up after the news of the tariff decrease.

2. Still Higher than Before Trump

Even if 15 percent is better than the rates that were in place before, it is still far more than the tariffs that were in place before Trump, which were generally in the low single digits. So, even with help, EU exporters will have to pay more to compete in the U.S. market.

3. Exemptions and Carve-Outs

As per USA Import Custom Data by Import Globals, the deal sets a 15 percent limit, although other types of transactions are not subject to it. Some of these exceptions are:

- Planes and parts for planes (zero-for-zero, going back to MFN)

- Generic drugs and what goes into them

- Some natural resources, metals, and important raw materials

- Parts that are electronic and mechanical that are used in making Aeronautical Products

As per Europe Import Trade Analysis by Import Globals, the goal of the exclusions is to keep the USA supply chains safe and avoid damaging important sectors.

4. The U.S. "Ceiling" Structure and Leverage

The U.S. strategy under this deal is different. Instead of stacking various duties (MFN + Section 232 + reciprocal), the 15 percent rate is meant to be a "ceiling" so that overlapping tariffs don't make things worse. Import Globals' USA Export Data says that the US can opt to enforce or cancel parts of the accord depending on how successfully the EU follows its pledges to trade and invest.

5. More General Strategic Promises

This compromise on car tariffs is just one aspect of a bigger trade agreement between the U.S. and the EU. The EU has pledged to: By 2028, put $600 billion into the U.S. economy.

Buy $750 Billion worth of U.S. Energy Goods

Agree to recognize each other's standards, rules of origin, and work together to lower non-tariff obstacles.

According to Import Globals' USA Importer Data, these policies are aimed at making the economies of Europe and North America more integrated, not only in the automotive business.

- Issues, Criticism, and Risks

- Not sure about EU Legislation

To make the tax decrease on EU automobiles happen, EU member states need to approve laws. Parliaments might change how fast or fully the benefits are paid out by postponing, modifying, or rejecting them. According to Import Globals' Europe Import Trade Statistics, some EU MPs have even suggested they had "doubts" about the accord and could wish to change it.

Sectoral Tariffs Are Still in Place

This deal on car tariffs doesn't change the U.S levies on metals like steel and aluminum or other charges that only apply to certain sectors. So, under other tariffs, cars or car parts having a lot of metal in them may still have to pay hefty customs on the metal part.

Differences in Competition (other Countries)

Other countries or groups may be able to negotiate better conditions or lower taxes on imports from the EU, which would give them an edge against EU exporters. For example, the U.K. and the U.S. made an agreement previously that set a 10% tax on cars (although with a quota limit).

Cost Pass-Through and Prices for Consumers in the U.S.

According to Europe Import Shipment Data by Import Globals, a 15 percent tariff is still a big expense, even if it's reduced. Automakers and suppliers may respond by taking on certain expenses, changing their supply chains, or passing costs on to U.S. customers. This might boost prices or limit demand for volume.

Risk of Politics and Compliance

As per USA Exporter Data by Import Globals, because the arrangement is carried out by the U.S. executive branch (for example, by changing tariff schedules), future governments might change or cancel elements of it. Also, if the EU doesn't keep its promises on investments, energy purchases, or removing tariffs, the U.S. may be able to reimpose or raise duties.

- What the Auto Industry Will Keep an Eye On

- Rebalancing the Supply Chain

To get the best duty exposure, car producers may change where they get parts and raw materials from EU, U.S., or third-country sources.

New Plant and Investment Strategy

Some car companies could enhance domestic production or assembly activities in the U.S. to lower their exposure to imports.

Pricing Strategy and Positioning in the Market

EU brands that want to sell in the U.S. may need to rethink their margins, models, or packaging options to make up for the extra costs.

Bringing rules and standards into Line

As per Europe Import Export Trade Analysis by Import Globals, the agreement's guarantee of mutual acceptance of standards or easier conformity tests might make it easier to get over non-tariff obstacles like safety and emissions certificates.

Watching for compliance and ways to settle Disputes

Companies will keep an eye on how tightly exclusions, rules of origin, and content criteria are followed or challenged.

In Conclusion

The official start of a 15 percent U.S. tax on EU cars and parts is a big step forward in trade between the U.S. and the EU. It gives European carmakers some respite and makes things more predictable, but it also keeps costs higher than they have been in the past. The carve-outs for aviation and pharmaceutical items, the ceiling structure, and the larger strategic promises made by both sides all show that this pact is as much about vehicles as it is about geopolitics and economic realignment.

In the next months, how swiftly EU legislatures approve the pact, how companies change their supply chains, and whether future U.S.

administrations stick to it will all affect whether it is a long-term gain or just a short-term break. Import Globals is a leading data provider of Europe Import Export Trade Data.

FAQs

Que. Why do people call the 15 percent tariff a "ceiling" instead of just a flat rate?

Ans. Because the deal says that overlapping tariffs (MFN + Section 232 / reciprocal) should not raise the total tax over 15 percent, in practice, 15 percent is the most that may be charged for protected auto items, even if the base tariffs or specific parts would imply a higher rate.

Que. When does the 15% rate kick in?

Ans. The tariff rate is retroactive to August 1, 2025, even though it didn't officially go into effect until September 2025. That implies that EU vehicle exporters who qualify can ask for refunds or changes to the tariffs they paid since that date.

Que. Does the 15 percent tax affect all European goods?

Ans. No. The vehicle deal is only about cars and car parts. Some other EU commodities may also be subject to the same reciprocal tariff system; however, there are some exceptions. Specifically, airplanes and aviation parts, generic drugs, and some raw materials or parts are not subject to tariffs and go back to MFN or zero tariffs.

Que. Is it possible for a future U.S. government to undo this deal?

Ans. Yes. Because executive orders and modifications to U.S. tariff schedules are used to make the tariff changes, a future administration might revise, cancel, or add to the tariffs, especially if the EU doesn't keep its promises.

Que. Where can you obtain detailed USA?

Ans. Visit www.importglobals.com or email info@importglobals.com for more information on up-to-date data.